Pace of Deterioration in UK Government Finances Slows

- Written by: Sam Coventry

Image © Gov.uk

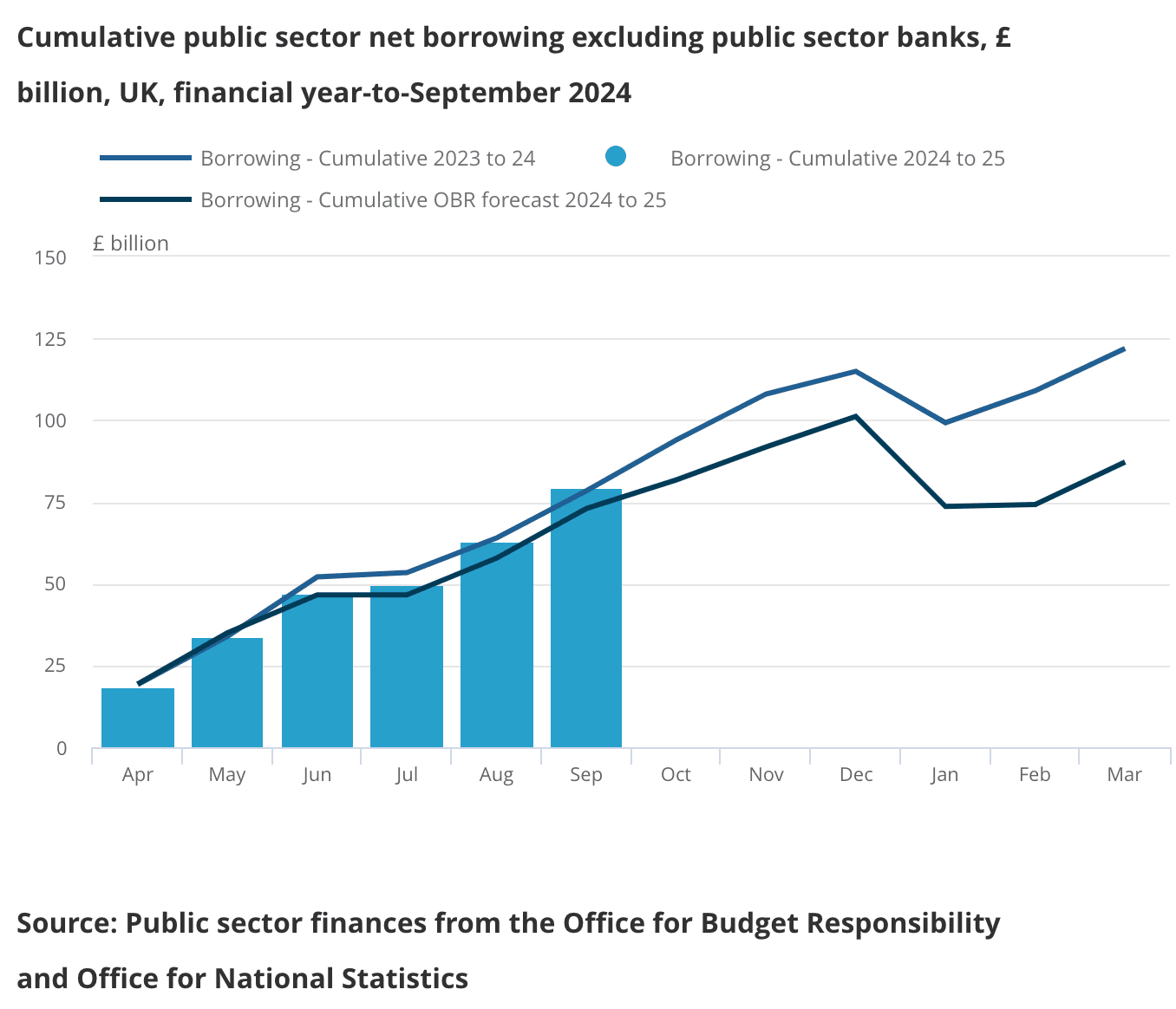

The deterioration in the UK's public finances continues, but the pace of decline has slowed.

This is according to new data from the ONS that shows the UK's budget deficit is some £6.7BN worse than the Office for Budget Responsibility (OBR) was expecting.

The UK public sector borrowed £16.6BN in September, lower than a consensus forecast of £17.5BN.

This was some £2.1BN above the deficit in September last year and pushed the year-to-date overshoot versus the most recent OBR forecasts up to £6.7BN.

The UK's debt ratio was revised lower to stand at 98.5%, down from 98.8% in August (this was due to a lift in GDP, not a decline in debt).

Central government borrowing stood at £13.2BN, undershooting the monthly OBR estimate and paring the cumulative overshoot for the financial year so far to £13.4BN from £16.2BN in August.

Economist Philip Shaw at Investec explains the main driver of the relatively benign level of borrowing overall was lower spending in two specific areas. First, net social benefits were £2bn below year-ago levels.

"This is connected with lower winter fuel payments to pensioners, partly due to the absence of one-off cost of living payments in September 2023. Second, current grants were £0.9bn lower than a year ago mainly due to a lack of payments to the EU this month," he says.

This deterioration offset increasing tax receipts from income, corporation and VAT.

"It reminds of the fiscal pressures the government is dealing with and the tough choices required to balance those with spending and investment needs," says Sam Hill, an economist at Lloyds Bank.

Investec's Shaw says these data "will certainly not alter the stance of the forthcoming Budget on Wednesday next week when Chancellor Rachel Reeves is set to unveil higher taxes."