UK Sees Tepid GDP Rebound, But Investment Summit Could Shift the Narrative, Economists Say

- Written by: Gary Howes

Above: Chancellor Rachel Reeves. Picture by Celine Charles/ Cabinet Office.

The government must use next week's Investment Summit and upcoming budget to turn the tide on a slowing economy.

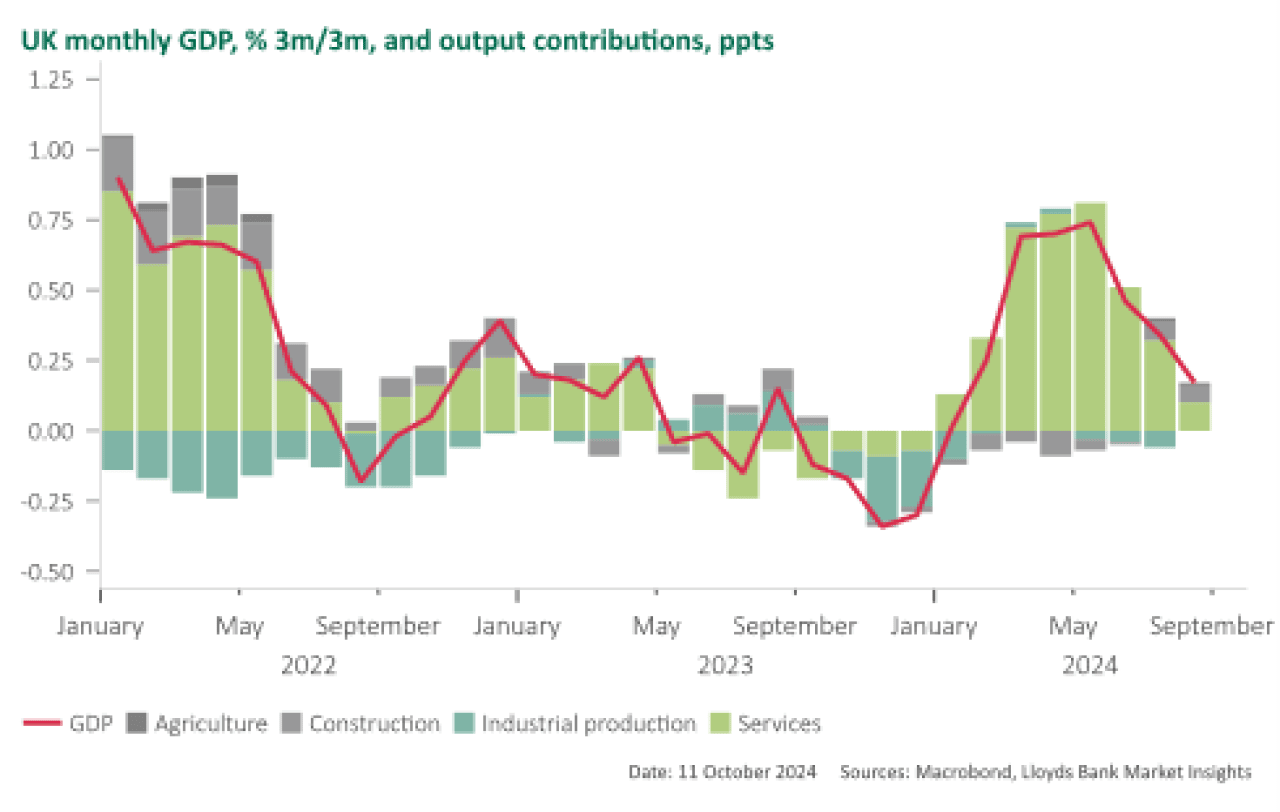

Monthly GDP rose 0.2% month-on-month in August following two months of no growth, said the ONS. It leaves real GDP on course to expand 0.3% quarter-on-quarter in Q3 2024, in line with the Bank of England's forecast.

However, revisions to Q2 GDP data meant the 0.2% 3m/3m reading for August was below the 0.5% consensus expectation, and the prior month was revised lower on this measure.

In August, services output - the dominant sector of the economy - rose 0.1% month-on-month, while industrial production and construction output partially rebounded from their falls in July.

"Today's growth figures came in slightly weaker than what we had forecasted. While the economy continues to expand, there are growing signs that momentum is tailing off compared to the strong performance observed in the first half of the year," says Hailey Low, Associate Economist at the NIESR.

Image courtesy of Lloyds Bank.

Low says the Chancellor must seize a crucial opportunity in the upcoming Budget to announce policies which foster higher investment levels and drive the UK into a sustained era of higher output growth.

"We expect quarterly growth to slow to a near standstill in 4Q24 amid lower consumer confidence and tighter fiscal policy," says a note from economists at UniCredit Bank.

Economic surveys show the economy has slowed since the summer, with consumers and businesses reporting concerns about the government's upcoming budget.

Prime Minister and Chancellor Rachel Reeves have warned that the budget will be difficult and that taxes must rise to pay for a burgeoning government spending bill.

Expansion Still Has Further To Run

The Bank of England will also be watching for signs of a slowdown and will stand ready to cut interest rates. Analysts warn the slowing economy means growth looks set to undershoot the Bank's most recent set of forecasts:

"There needs to be a solid performance reported for the September monthly GDP figure not to undershoot the MPC’s expectations for Q3 GDP," says Sam Hill, an analyst at Lloyds Bank.

"Growth slowing below the MPC’s forecast leaves a rate cut in November as a racing certainty," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics.

Services growth of just 0.1% was soft, with seven of the fourteen sub-sectors registering contractions in August.

"The combination of a patchier performance across services sub-sectors and repeated instances of monthly GDP figures being a stretch to reconcile with MPC expectations does point to the theme of momentum fading after a strong H1," says Hill.

Despite the signs of a slowdown, Wood says, "the UK’s expansion still has further to run. The housing market is responding strongly to the MPC’s rate cut already, as is construction."

UK Investment Summit Must Reset the Agenda

Pantheon Macroeconomics expects GDP growth to pick up to 0.4% q/q in Q4 as consumers trim saving a little in response to interest rate cuts, low unemployment and continued real wage growth.

"Expect the positive momentum to continue in the following months given some of the tailwinds we see in the domestic economy," says Barret Kupelian, Chief Economist at PwC.

Kupelian says the upcoming UK Investment Summit should allow the government a chance to reset the tone of the UK's potential and inspire increased investment.

The new government has complained at length about the inheritance it was left with, warning that tax cuts and difficult decisions were needed to fill a budgetary "black hole."

But Anna Leach, Chief Economist at the Institute of Directors, says the government must shift the narrative from filling today’s deficit to building tomorrow’s economy.

"That’s the key to sustainable public finances and higher living standards. The Investment Summit and Budget provide opportunities for the government to build on its manifesto commitments to drive up investment by providing further detail on the National Wealth Fund’s role in catalysing private capital and the early priorities for the industrial strategy," she says.

The UK Investment Summit is scheduled for October 14 and is intended "to bring together up to 300 industry leaders to catalyse investment in the UK."

However, concerns over the quality and organisation of the UK’s investment summit have left some senior business figures wavering over whether to fly to the event on Monday.

According to the FT, international and domestic executives have been frustrated by a lack of information from the UK government about its flagship gathering in London with some even questioning whether the event will be worthwhile.