Bank of England "Not as Restrictive" as Previously Thought: Greene

- Written by: Gary Howes

Above: File image of Megan Greene. Image © Informa Connect Global Finance.

The Bank of England's Megan Greene says the interest rate policy was not as restrictive as she and her colleagues had assumed.

Greene, a member of the Monetary Policy Committee, which sets interest rates, said the Bank must proceed cautiously when cutting interest rates further.

In a speech to the North East Chambers of Commerce in Newcastle, Greene said:

"I believe the risks to activity are to the upside, which could suggest that the long-run neutral rate is higher and - all else equal - our stance of policy isn't as restrictive as we had thought."

Restrictive policy means interest rates are high enough to squeeze economic growth to the extent that inflation falls to the Bank's 2.0% target on a sustained basis. If interest rates are not high enough, the economy can continue to expand and churn out inflation.

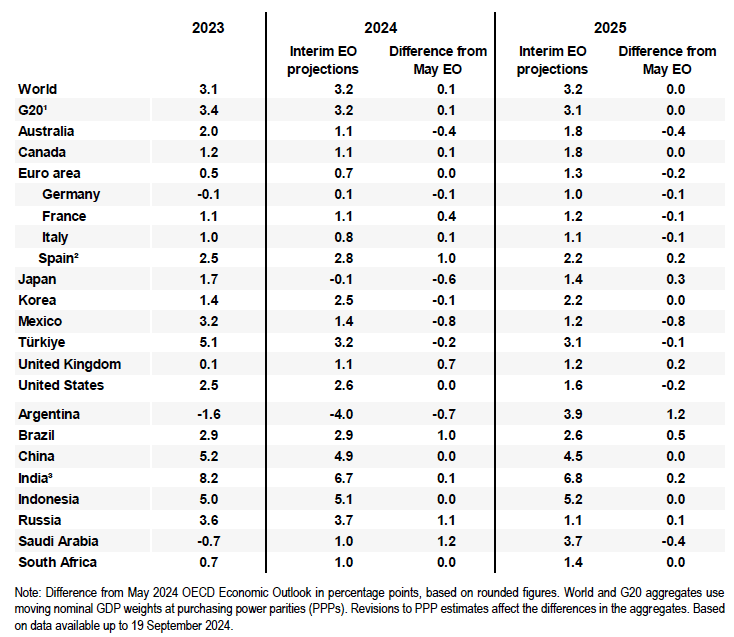

Her observations come on the same day the OECD issued a significant upgrade to its growth forecasts for the UK economy while also saying headline inflation won't fall back to the Bank's 2.0% target in 2024 and 2025.

Above: Annual GDP growth forecasts from the OECD shows the UK's significant upgrade.

Greene said she thinks her colleagues should maintain a "cautious, steady-as-she-goes" approach to cutting interest rates.

Money markets see the next interest rate cut from the Bank falling in November, but the odds of a subsequent cut in December are at 60%. There is scope for this pricing to fall given recent developments, which can further bolster the Pound.

Greene said she wants to be certain that the danger of permanent changes in price and wage setting has passed before she can support a quicker loosening in policy.

"Given this risk, I believe it is appropriate to take a gradual approach to removing restrictiveness," she said.

She notes services inflation has been "stuck" between 4-5% for the past year, which will likely prevent inflation from falling to the 2.0% target the Bank is tasked with achieveing.

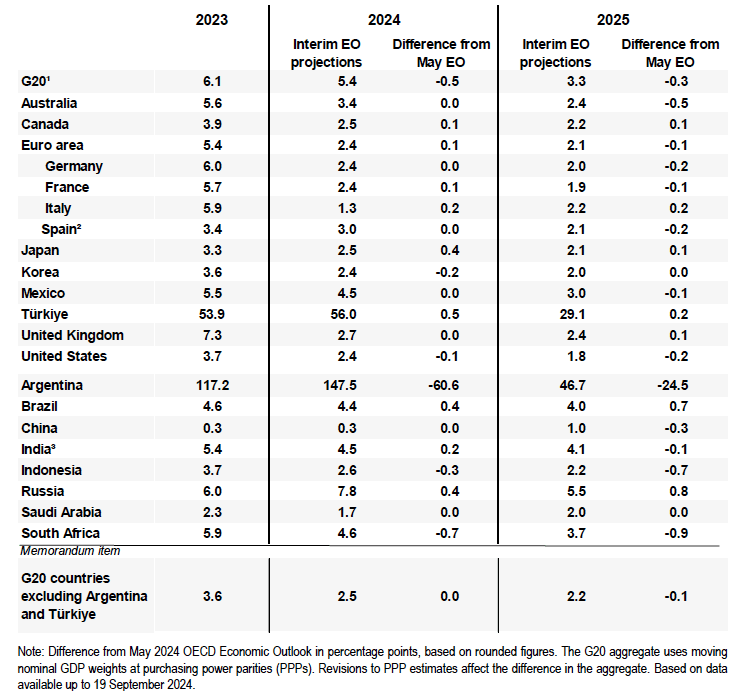

Above: The OECD's inflation forecasts.

"It’s certainly moving in the right direction but I wouldn’t get too excited," she said in a Q&A following the speech. "We’re not surprised that it’s sticky. The biggest component of services inflation is labour, so as wages come down, hopefully inflation will come down."

In its latest outlook on the world economy, the Organisation for Economic Cooperation and Development (OECD) said the UK economy was on course to expand by 1.1% this year, an upgrade of 0.7 percentage points from its last forecast in May.

The Paris-based organisation also released forecasts that suggest the UK might have an inflation problem on its hands.

New projections showed that UK inflation would be at 2.7% in 2024 and fall to 2.4% in 2025. The 2025 forecast will worry the Bank of England, which would potentially have to adopt novel explanations as to why it is cutting interest rates in a pro-cyclical environment.

The OECD noted that the prices of over half the items in the UK inflation basket were still growing at an annual rate above 3% in July 2024. That was more than the U.S., where 40% of items were above the same threshold.

The OECD said risks to higher inflation could come from continued labour-cost growth. The new Labour government has promised to further improve pay for workers on top of the 10% minimum wage increase approved by the outgoing Conservatives.

By contrast, the OECD's forecasts showed the Federal Reserve had a runway to lower rates, predicting the USA would experience inflation of 2.4% in 2024 and 1.8% next year.

Germany's inflation rate was seen at 2.4% and 2.0% respectively, while that of France was set at 2.4% and 1.9%.

For Canada, inflation was seen at 2.5% and 2.2%, and the Bank of Japan will welcome forecasts of 2.5% and 2.1%, confirming that Japan has exited the deflationary quagmire.