Germany Has Entered Three-Quarters-Long Recession: Nomura

- Written by: Sam Coventry

Image © Adobe Images

Germany has entered a three-quarters-long recession, say economists at Nomura.

They expect German GDP to decline by 0.4pp over this period. But there is a more worrying prediction: that the economy will then recover into a period of stagnation, owing to structural, not cyclical, factors.

When economies shrink because of cyclical factors, the rebound can often be quite sharp, and lost output is soon recovered as a result.

Nomura lists the structural problems:

(i) greater exposure to a weakening China with its own structural headwinds

(ii) more pronounced exposure to a global manufacturing downswing, as well as increased competition from China and a shift to electric vehicles

(iii) deteriorating demographics, with the biggest expected rise in dependency ratios among the G7 in the next decade and a shrinking population.

"All of these factors suggest little is required in the way of cyclical weakening in Germany to produce a recession – and perhaps less of a slowing than is necessary for other countries without similar structural problems," says Andrzej Szczepaniak, an economist at Nomura.

Germany's economy has been hit particularly hard by the sharp rise in gas prices since Russia's invasion of Ukraine, owing to the country's strong manufacturing and industrial base.

The loss of output in this critical sector of the economy has spread to other sectors via suppressed consumer confidence. After all, if you work for a German manufacturer, the ongoing struggles your sector faces will make you more cautious in your habits.

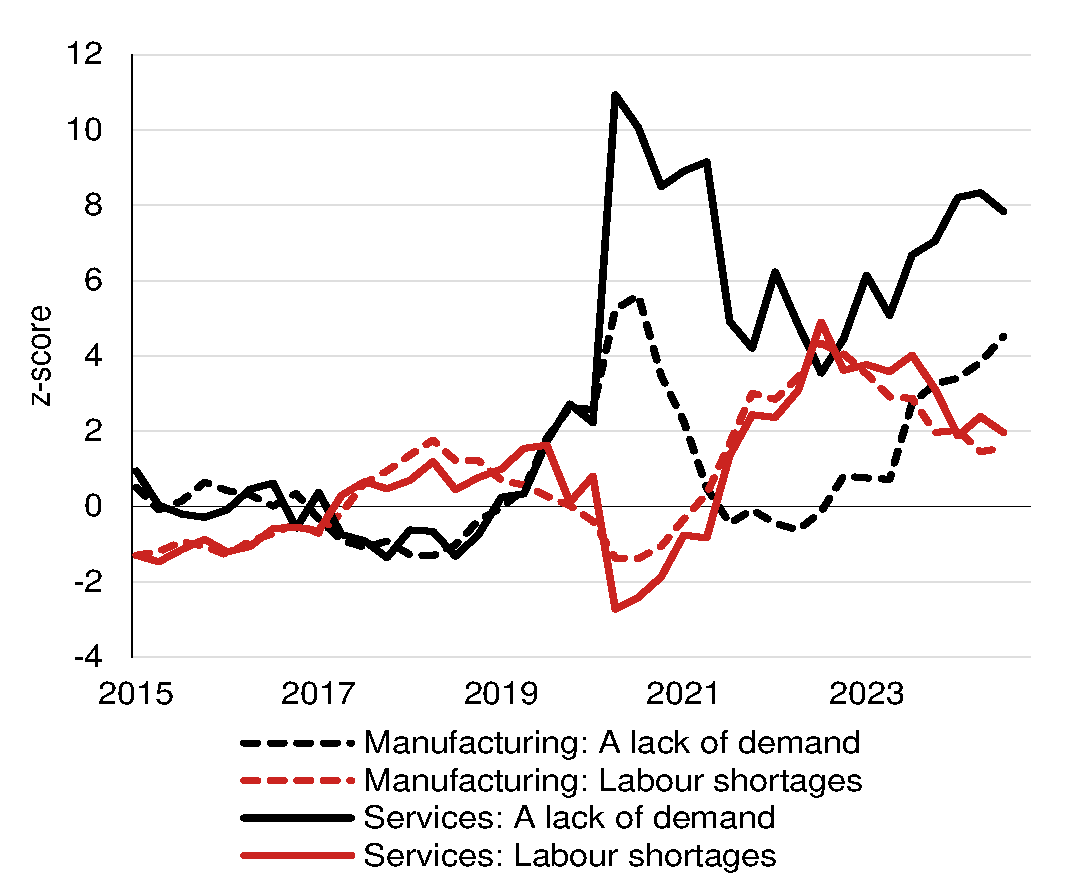

Above: "Consumer demand is noticeably deteriorating" - Nomura.

"We had expected a consumer-led recovery. However, this now appears unlikely to materialise. Subcomponents in consumer surveys related to consumption have barely improved since the height of the European gas crisis. In part, this could be because households have less available cash than before the pandemic," says Szczepaniak.

Additionally, the unemployment rate in Germany has risen more than peers, and some 200k more people than usual are on short-time work schemes (government subsidised wages). Nomura says this number only set to increase, an additional sign of a weak labour market.

"Finally, a fiscal contraction in 2025 relative to 2024 is likely due to Germany’s fragile and weak government," adds Szczepaniak.

Nomura forecasts German GDP of -0.2% in 2024 and just 0.1% in 2025.