Welcome Drop in Inflation Expectations Soured by New BCC Forecast

- Written by: Gary Howes

Image © Adobe Images

Business inflation expectations are now at their lowest in three years, but the British Chambers of Commerce have released new forecasts showing UK inflation will remain above the Bank of England's target until 2027.

The Bank of England will next cut rates in October or November, according to forwards markets, in a decision that will be backed up by its latest monthly survey of business decision makers that shows inflation expectations have fallen to their lowest since August 2021.

The Bank of England's Decision Maker Panel (DMP) is a highly influential survey that the Bank's Monetary Policy Committee relies on when formulating policy. It shows businesses expected prices to rise by 3.4% in the year ahead, down from the 3.7% forecast in the previous month.

To be sure, this is well above the 2.0% target the Bank is mandated, but it shows the direction of travel is supportive of further monetary easing.

However, businesses warned wage pressures remain at high levels, which will continue to concern the MPC and is a chief reason why the Bank will forgo a September interest rate cut.

Decision makers forecast wage growth to rise 4.1% in the year ahead, broadly unchanged over the previous three months.

Image: BCC.

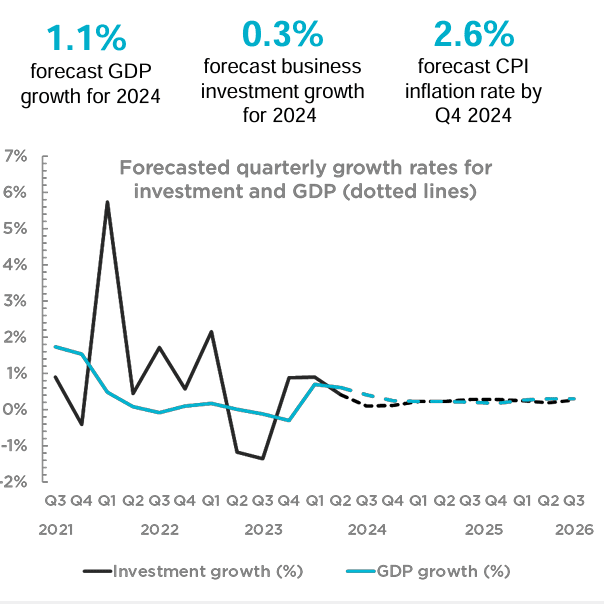

Further caution on the inflation outlook comes from the British Chambers of Commerce (BCC), who warned their latest forecasts show inflation will remain above the 2.0% target until 2027.

Inflation is predicted to hit 2.6% in 2024 before falling to 2.2% in 2025 and 2.1% in Q4 2026. The BCC says inflation will remain elevated owing to global trade uncertainties, pay growth, and rising energy costs.

The BCC's predictions are at odds with those at the Bank of England: the August 2024 Monetary Policy Report (MPR) forecasts that inflation is likely to increase to around 2.75% in the second half of the year but then fall to 1.7% in two years' time and to 1.5% in three years.

The BCC's forecasts are conditioned on the assumption that the Bank will cut rates again during Q4, although it warns the Bank will adopt a more cautious approach and make a series of 0.1pp cuts, bringing the interest rate to 4.3% by the end of 2025 and falling to 3.8% by the end of 2026.

The BCC's Quarterly Economic Forecast, winner of the 2024 FocusEconomics award for best GDP forecast, now predicts the UK economy to grow 1.1% in 2024, up from 0.8%. Growth of 1.0% is expected in 2025.

But, business investment will constrain upside potential.

"Although domestic demand should be helped by a gradual reduction in interest rates and by rises in real wages as inflation stabilises, firms will still struggle to invest. This is due to continuing global economic and political uncertainty, alongside a downbeat Government assessment of its fiscal position and warnings of tough decisions in the budget," says Vicky Pryce, Chair of the BCC Economic Advisory Council.