Bank of England Tipped to Cut Faster than Markets Currently Expect by ex-MPC Saunders

- Written by: Gary Howes

Above: File image of Michael Saunders when on the MPC. Image copyright Pound Sterling Live, courtesy of Parliament.tv

A former member of the Bank of England's Monetary Policy Committee has said interest rate cuts will come faster than markets are currently expecting.

"Fiscal tightening and the reduced impact of the cashflow channel argue for a fairly rapid return to a neutral monetary stance, to prevent inflation falling below target over time," says Saunders in note written for clients of Oxford Economics.

The call comes as markets bet on a slow pace of interest rate cuts from the Bank as UK inflationary pressures remain elevated and are expected to rise again into year-end.

Bank of England Governor Andrew Bailey said in a recent speech at the Jackson Hole Symposium that it is "too early to declare victory" over inflation, verifying market expectations that it would skip another rate cut in September.

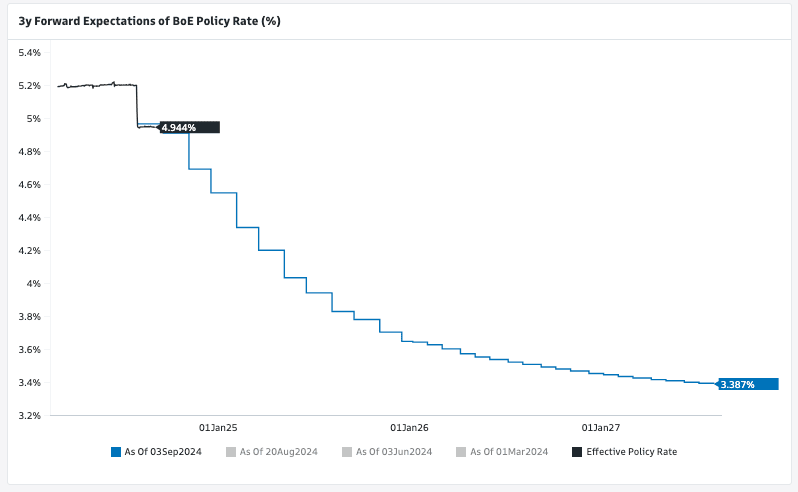

Money markets show investors are expecting Bank Rate to fall to 3.75% by the end of 2025 and stay around 3.5% thereafter.

Above: Market-implied expectations for the future of Bank Rate.

This would mark a slow rate cutting cycle by historical standards, with Saunders noting a typical cutting cycle would be close to completion in the first nine months.

But Saunders says, "interest rates may eventually fall further than the market path if the upcoming Budget delivers credible plans for sizeable multi-year fiscal tightening."

Chancellor Rachel Reeves is expected to raise taxes and detail where money will be saved, meaning government spending will restrain growth going forward, giving the Bank of England the opportunity to interest rates as economic growth begins to disappoint.

Furthermore, the impact of the recent rate hiking cycle will continue to be felt for months to come as long-term mortgage deals continue to roll over.

This suggests the Bank can cut rates and many households will still feel the constraints of higher mortgage payments as they come off ultra-low deals.

"Interest rates may eventually fall further than the market path," says Saunders. The market path refers to the current expectations ingrained in financial market assets, such as interest rate products and the Pound.