Bank of England to Tee Up a September Rate Cut Next Week

- Written by: Sam Coventry

Image © Adobe Stock

The Bank of England will find next week too soon to cut interest rates, says an independent economic research house, although there is no shortage of economists who think the Bank will pull the lever next week.

According to Andrew Goodwin, Chief UK Economist, Oxford Economics, the Bank will maintain the base rate at 5.25% on August 01, although he acknowledges the decision will be a close call.

"The conditions are in place for the MPC to cut, but we think they will wait until September to avoid surprising markets," says Goodwin.

He thinks the 'hawkish reaction' of markets to June's inflation data will be the decisive factor.

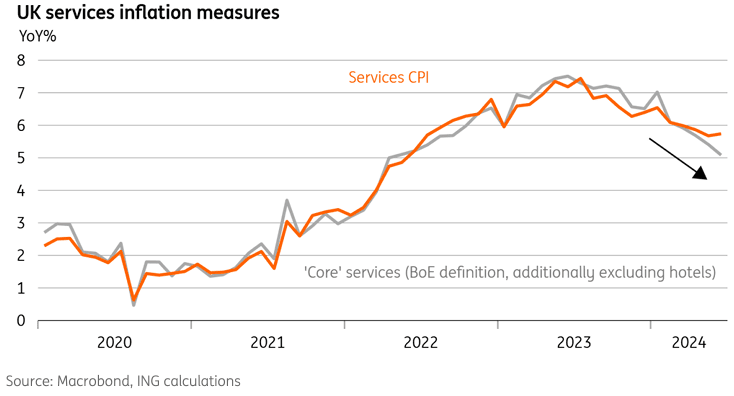

Market pricing showed investors lowered expectations to below 50% after the release of inflation figures that showed UK services inflation remains above what the Bank of England's most recent forecasts anticipated.

The Pound and gilt yields also rose in response.

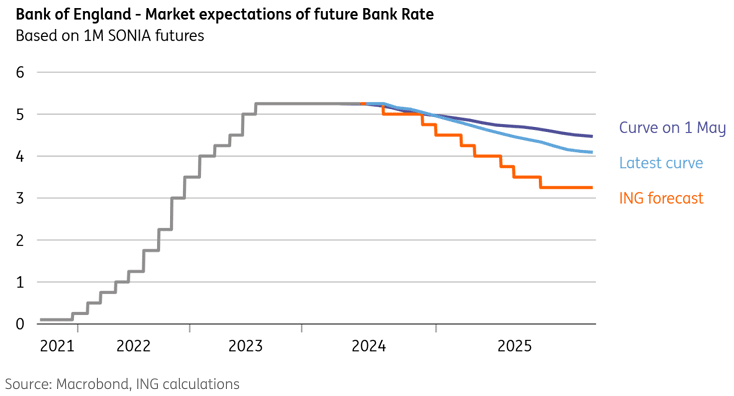

Above: ING thinks the market underestimates the degree of Bank of England rate cuts ahead.

"The fact that those members who might switch to voting for a cut, particularly the Governor, have chosen not to speak since the June meeting suggests a lack of urgency on their part," says Goodwin.

Oxford Economics thinks the Bank will use the Monetary Policy Report and press conference to tee up a September rate cut.

"The more dovish members will reiterate that they are adopting a more forward-looking approach than they have over the past couple of years, supplementing that message with a forecast that shows inflation clearly below target at the two-year horizon," says Goodwin.

Sanjay Raja, Senior Economist at Deutsche Bank, thinks the Bank won't wait until September to press the trigger.

"We expect the MPC to deliver its first rate cut of the cycle, bringing Bank Rate lower to 5%. It's a close call. But, we think, the case for a rate cut rests on a shifting reaction function within the MPC, including stronger reliance on its inflation projections, forward-looking indicators of wage and services prices, as well as firming real rates," he says.

Deutsche Bank looks for a close-fought 5-4 vote tally in favour of a cut.

The vote composition is important as it signals how fast opinion is shifting on the Monetary Policy Committee. James Smith, Developed Markets Economist at ING, says to expect a clear majority in favour of a cut of 6-3.

"The fall in market swap rates since the May projections point to modest upgrades to both growth and inflation in the medium-term, though not enough to move the dial on rate cuts," says Smith.

ING expects the Bank of England to update its forward guidance to point to further gradual rate cuts without committing to action at any particular meeting.