Eurozone Inflation Falls, Next ECB Rate Cut Tipped for September

- Written by: Sam Coventry

Image © Adobe Images

Eurozone inflation fell in June and kept alive expectations that the European Central Bank (ECB) would be in a position to cut interest rates again in September.

Headline inflation fell to 2.5% year-on-year in June from 2.6% in May, according to Eurostat, meeting market expectations. Core inflation fell from 2.9% to 2.8%.

Although inflation is falling, some members of the ECB will feel it is falling too slowly and cutting interest rates in July would be premature.

Particularly so given the Eurozone's strong labour market. Eurostat also said today that unemployment in the Eurozone fell to 6.4% in June from 6.5% in May. This will keep upward pressure on wages which can prevent a rapid decline in inflation.

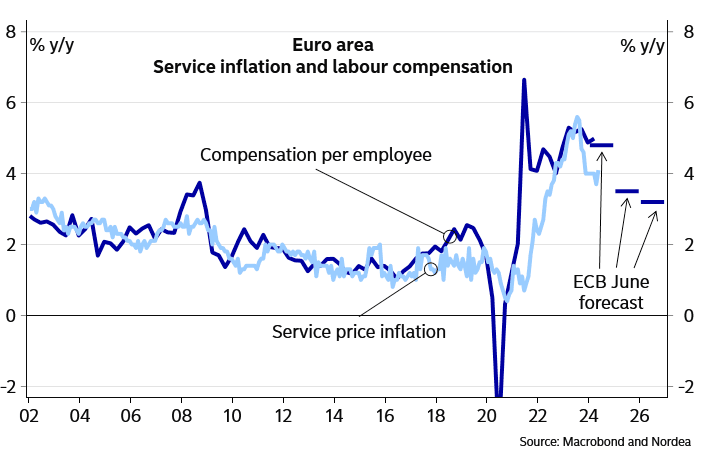

Looking at the main components of the latest inflation release reveals the services sector remains a key driver of price growth at 4.1%, which was unchanged from May.

"Services inflation is key to rate cuts" - Nordea Bank.

"The fact that services inflation, which is most sensitive to domestic economic conditions, has remained high this year strengthens the case for caution at the ECB," says Jack Allen-Reynolds, Deputy Chief Euro-zone Economist at Capital Economics. "June’s inflation data will reinforce policymakers’ inclination to move very cautiously."

Speaking at the ECB's conference in Sintra, Portugal, ECB President Christine Lagarde said the ECB has time to gather data to be certain that inflation is on the right path, but at the same time has to be mindful that taking time with rates at restrictive levels comes with an economic cost.

"We believe in rate cuts at the Sep and Dec meetings, but that will require that the ECB’s baseline inflation projection is confirmed by incoming data. Today’s inflation print is the first of three that will be available before the Sep meeting," says Anders Svendsen, Chief Analyst at Nordea Bank.