German Inflation Slides, Brings September Rate Cut Into Focus

- Written by: Sam Coventry

Image © Adobe Images

A fall in German inflation will boost the odds that the European Central Bank (ECB) will cut interest rates again in September.

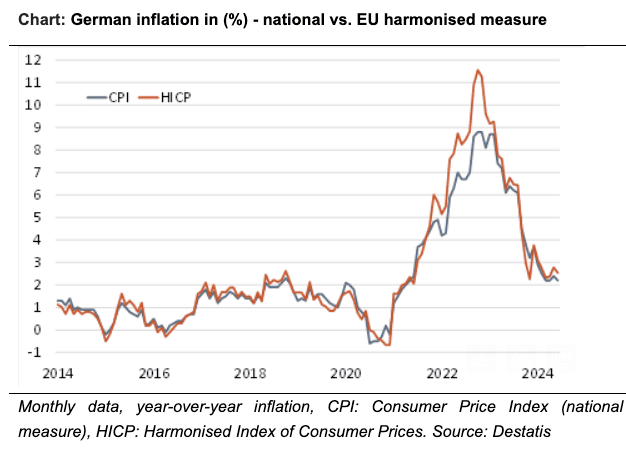

German headline CPI inflation fell 2.2% year-on-year in June from 2.4% in May said Destatis, missing the consensus estimate of 2.3%. This was after the month-on-month comparison remained stuck at 0.1% for a second consecutive month, missing expectations for a rise to 0.2%.

"The fall in inflation in Germany, the largest economy in the Eurozone, alongside lower inflation prints in France and Spain, will encourage the ECB to go ahead with its next interest rate cut in September," says Felix Schmidt, an economist at Berenberg.

Last May's subsidisation of public transport meant transportation bumped up headline inflation in May 2025 (this is called a base effect). With this statistical effect out of the comparisons, inflation is mainly back to where it was in March and April.

"A slight drop in German headline inflation in June keeps the door open for another ECB rate cut in September, even though inflation remains too sticky at slightly too high a level," says Carsten Brzeski, Global Head of Macro at ING Bank.

Indeed, although inflation is falling, it is doing so slowly, and some ECB Governing Council members will be cautious about the speed at which interest rates are lowered.

"The case for a series of rate cuts is much less obvious. The big difference between the current situation and previous periods of rate-cut cycles is that past cycles were mainly triggered by either a recession or a crisis. Fortunately, none of these is currently threatening the eurozone economy," says Brzeski.

July seems too soon for the ECB to cut rates, and in September, the ECB's economists will also release new forecasts. Softer inflation forecasts will give the Governing Council the cover to deliver another cut.

Looking ahead, economists at Berenberg expect a September cut to be followed by a pause for the remainder of the year as fresh base effects temporarily lift inflation again in late 2024. The central bank is then expected to cut interest rates twice, taking the deposit rate to 3% by mid-2025.

"The risk to our forecasts is tilted towards a faster pace of cuts with a further move in December 2024," says Schmidt.