Income Tax Would Fall by Over £5K For Some With Reform UK's 'Moon Shot' Proposals

- Written by: Gary Howes

Above: File image of Reform UK leader Nigel Farage. Image: Gage Skidmore.

Reform UK has announced it would offer a tax cut in excess of £5000 for those earning more than £75000, but financial analysts say how it will be funded is unclear.

The party said it would increase tax thresholds if it won. "However, the specifics of how that would be funded lacks detail, leaving voters to wonder about the financial feasibility of such promises," says Rachael Griffin, tax and financial planning expert at Quilter.

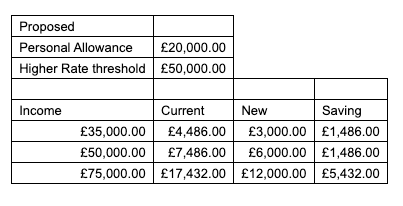

Reform would raise the Personal Allowance to £20,000.00 and the Higher Rate threshold to £50,000.00. This means those in the £35K earnings bracket would save £1,486.00. Those in the 50K bracket would save a similar amount, but those on £75K would take home an extra £5,432.00.

"The party is offering a feast of ‘red meat’ policies that are likely to energise right-wing supporters," says Griffin. "As with many tweaks to the tax system while this policy would lift lots of people out of having to pay income tax, it also means that those on higher-than-average salaries pay much less in tax too."

Quilter says a lower tax environment can stimulate economic growth, but measures like these can take time to feed through and on the face of it these kinds of pledges can look like a giveaway to the wealthier.

"Given the current economic environment, the optics of handing someone with a salary of £75,000 a nearly £5,500 per year saving while those on the average salary only save £1,486 might be difficult for many to stomach," says Griffin.

For such policy measures to succeed, Reform would inevitably have to cut spending to convince financial markets the UK's finances would be on a stable trajectory.

"These kinds of tax giveaways are not easy to fund and such a radical shake up would cost the government billions at a time when the public purse strings are stretched. As is often the case manifesto pledges among the smaller political parties are designed to ignite public debate rather than have a chance of being realistically implemented," says Griffin.

"Whether these tax pledges will prove to put pressure on the Tory and Labour policies remains to be seen, but they’re certainly poised to shake up the conversation on Britain’s fiscal future," she adds.