Federal Reserve Likely to Cut in September: Economists

- Written by: Gary Howes

Image © Federal Reserve

The Federal Reserve is on course to cut interest rates in September and again in December, according to economists.

The calls come after members of the Federal Reserve Open Market Committee (FOMC), the body that decides on interest rate settings, opted to keep interest rates unchanged and said they don't foresee as many interest rate cuts falling in 2024 as they did back in March.

This change signals a cautious central bank that has underestimated the strength of the U.S. economy and the persistence of inflation.

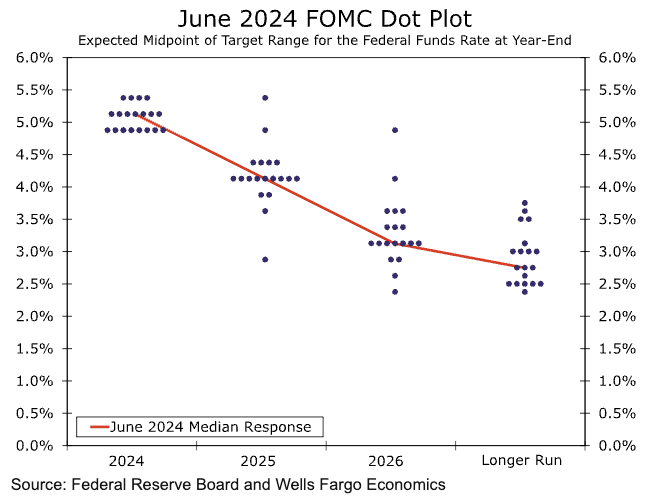

The Summary of Economic Projections shows members of the FOMC expect one 25 basis point cut this year compared to three in March. Participants now expect four cuts in 2025 as compared to three at the March meeting.

The details of the so-called dot plot chart show four participants envision no cuts, seven participants see a single cut, and the rest (eight participants) think we will see two cuts. The Fed revised up its forecast for inflation at the end of 2024 to 2.6% from 2.4% previously.

"The dots do send a strong signal that better data is needed before cuts can begin," says Christopher Hodge, an economist at Natixis. "We think we will see disinflation continue, and we maintain our call that the first cut will come in September."

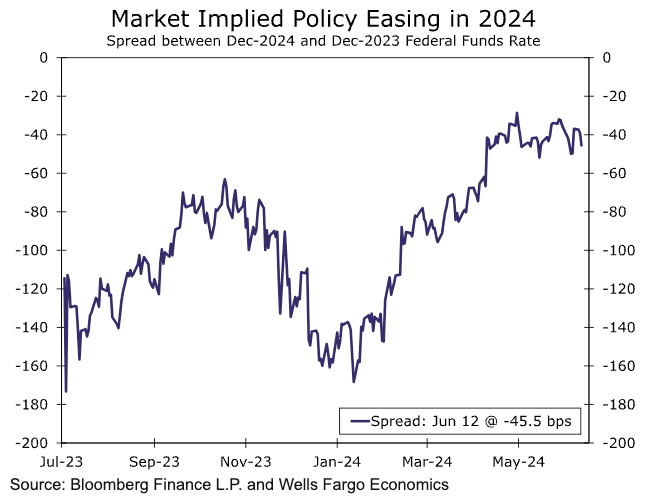

"Our base case forecast since early April has looked for a 25 bps rate cut at each of the September and December FOMC meetings. For now, our forecast remains two cuts this year and another 100 bps of easing in 2025," says Sarah House, an econmoist at Wells Fargo.

The Dollar and U.S. bond yields firmed in the wake of the event, having earlier fallen following below-consensus inflation figures.

In the press conference, Powell said Wednesday's below-consensus inflation print was an example of a good print, suggesting a couple more in this vein would greenlight a cut.

Natixis thinks an encouraging core PCE reading at the end of June and another in July will present the conditions necessary for the Fed to prepare for landing and start cutting.

Economists at UBS Global Wealth Management are confident that the trend toward slower inflation, which went into reverse in the first three months of the year, is back on track.

"In our view this should carry greater weight than the Fed’s dot plot," says Mark Haefele, Global Wealth Management Chief Investment Officer at UBS AG. "The outcome of the Fed meeting and the latest inflation data are consistent with our view that the US is headed for a soft economic landing, which will permit the Fed to cut rates by 50 basis points this year—most likely starting at the September policy meeting."

Economists at TD Securities remain optimistic that the Fed will first ease rates at its September FOMC meeting and look for core PCE inflation to gradually moderate by then to a monthly pace that is consistent with a return to the inflation target.

"We still pencil in a second rate cut for the December FOMC. Stickier-than-expected outcomes in core inflation remain the main risk to our view, with the Fed likely preferring in that event to err on the side of signalling a policy of higher for longer," says Oscar Munoz, Chief U.S. Macro Strategist at TD Securities.