"U.S. core inflation is at 2%" When Parred with Europe - ING's Smith

- Written by: James Smith, Developed Markets Economist at ING

Image © Adobe Images

Here’s something that might surprise you: US core inflation is at 2% and has been since last July.

That might sound like a parallel universe. Certainly, it goes against everything we’ve heard about US inflation so far this year.

But here’s the thing, official data published in the U.S. shows that if you calculate inflation in the same way we do here in Europe, then that is exactly what is happening.

Before getting too carried away, I should say that this is not the price gauge the Fed is watching. And markets can’t be blamed for not doing so either.

It’s a reminder, though, that the way we measure inflation matters – a lot. The U.S. famously puts a much greater weight on housing than we do in Europe. And that helps to explain why the more mainstream CPI data puts core inflation up at 3.6%.

Even then, the numbers don’t always add up. James Knightley reckons next week’s PCE deflator – the Fed's preferred inflation gauge – should look a little less worrisome than those CPI figures a couple of weeks back. Much of the discrepancy can be traced back to car insurance, which you’d think shouldn't be keeping policymakers up at night.

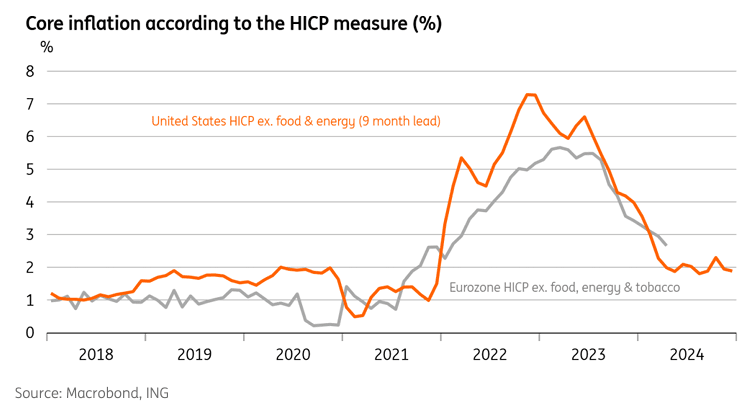

Anyway, if U.S. inflation really is more benign than we’ve come to believe, then that can only be good news for Europe. Take the stat we mentioned right at the start. That “harmonised” measure of U.S. core inflation has been a decent predictor of the eurozone data a few months down the road. Have a look at our chart of the week below.

It’s a relationship that holds when you look at individual categories, too. Things like food and consumer goods are still contributing more to inflation in Europe than in the U.S. – particularly here in the UK - and America’s experience suggests that’s unlikely to be the case for long.

So when central banks here in Europe tell us there is nothing to fear from the recent resurgence in the U.S. data, maybe they’ve got a point. Still, life’s rarely that straightforward. Services inflation is not helping the case for rate cuts here in Britain.

And as Bert Colijn (Senior Economist at ING) explains, a surprise pick-up in eurozone negotiated wage growth is a headache for the ECB, too. We’ll get fresh inflation data for the eurozone next week.

The lesson for markets is two-fold. If US inflation really is less worrisome, then the Fed has nothing to fear from rate cuts. Remember, James Knightley (ING's Chief International Economist in New York) is betting on three rate cuts this year from September.

That’s more than markets currently expect. And if eurozone inflation really is that similar to the U.S., then it’s hard to see the ECB going its own way on rate cuts for long. Just like the U.S., our team expects three cuts in the eurozone over the course of 2024.