Making Sense of Contradictory Labour Market Data

- Written by: Sam Coventry

Image © Adobe Stock

The ONS reported on Tuesday that wages rose at a faster pace than markets expected but that unemployment is also rising. These contradictory signals have lessened the prospect of a Bank of England rate cut in June, but only slightly.

Sarah Coles, head of personal finance at Hargreaves Lansdown, says the jobs market is horribly divided, and the gaps are growing.

"On the one side are those in secure jobs, in the manufacturing and finance and business services sectors, who are sitting pretty with wages up 6.8% and March bonuses burning a hole in their pockets. On the other are the rising numbers of people losing their job, and those in the construction sector, facing pay rises of just 2.6% - way below inflation," she says.

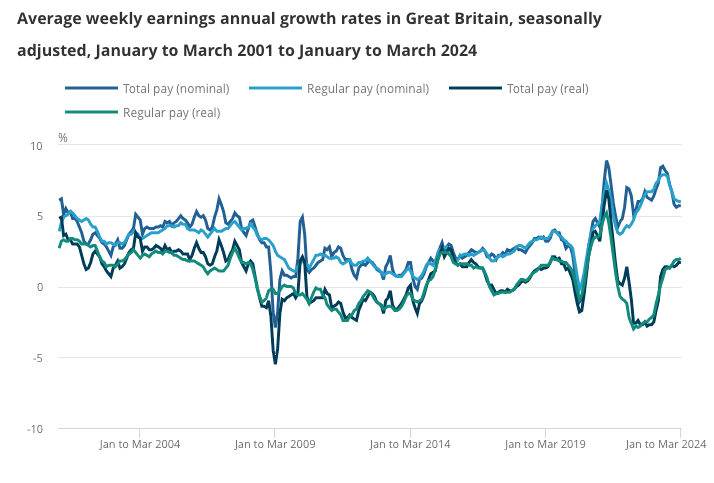

Before inflation, wages in January-March were up 6% in a year excluding bonuses and 5.7% with them. After inflation, wages rose 1.7% including bonuses and 2% excluding them. This has risen as inflation has fallen.

"Pay growth remains steamy, with bonuses in March the highest on record. This may keep policymakers at the Bank of England a bit hot under the collar. They'll be worried about the persistence of inflationary pressures," says Susannah Streeter, head of money and markets at Hargreaves Lansdown.

"The concern is that hefty wage bills may be passed on in the form of higher prices for goods and services," she adds.

However, with unemployment rising, there are also signs the labour market should keep cooling, keeping hopes for a summer interest rate cut alive, explains Streeter.

Over both the most recent quarter and the year, the unemployment rate has risen (4.3%), the employment rate has fallen (74.5%) and economic inactivity (22.1%) has increased.

Redundancies fell on the quarter by 0.9 per thousand, to 3.1 per thousand, but they’re still higher than a year earlier.

Vacancies fell for the 22nd consecutive time – in 13 of 18 industries.

Inactivity rates have also shifted higher, with the numbers of long-term sick limiting the pools of available labour.

"This does make the Bank of England decision to cut rates more tricky, and they’ll want to see more data indicating an easing of pressures, which is why an August rate cut is looking more likely. The pound rose slightly on the labour market data, against the dollar, indicating that markets see Bank moving a little more slowly on rates," says Streeter