European Energy Crisis Ends as Electricity Prices Return to Pre-Pandemic Levels, LNG Prices Plummet

- Written by: Sam Coventry

Image © Adobe Images

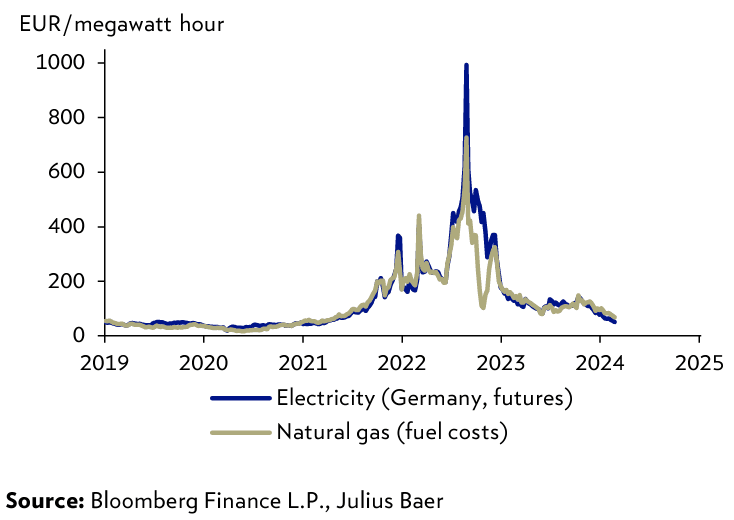

Europe's energy crisis has come to an end, with electricity prices largely reverting to pre-pandemic levels. Norbert Ruecker, Economist at Julius Baer, sheds light on the factors driving this stabilisation and offers insights into the future of the region's energy landscape.

"Energy markets have shifted from scarcity to abundance due to increased production, the rise of clean energy initiatives, and other marginal factors such as Japan's nuclear revival. This abundance, coupled with mild winter weather worldwide, has led to oversupply, further driving down prices," says Ruecker.

Additionally, internal trends within Europe have contributed to price pressures.

"Industrial activity remains subdued, while Norway's increased gas production and solid wind and solar generation have reduced the need for gas-powered plants," Ruecker explains.

As a result, thermal generation has plummeted to multi-year lows, impacting CO2 credit costs.

Despite the overall stabilisation, Ruecker highlights persistent political factors keeping CO2 costs elevated.

"CO2 costs remain above pre-pandemic levels due to political reasons, serving as the primary inflationary element in the energy transition," he emphasises.

Looking forward, Ruecker anticipates continued pressure on prices fueled by the clean energy and liquefied natural gas (LNG) boom.

He predicts heightened fluctuations between periods of abundant clean energy and shorter periods of gas dominance. "This deflationary trend is well underway," Ruecker states.

In Germany, signs of normalisation are evident as electricity tariffs for new contracts return to pre-2020 levels across all user categories. However, Ruecker warns that lower energy prices may only partially stimulate industrial demand in Europe, given global overcapacities in sectors ranging from metals to chemicals.

European energy prices have been dragged lower by falling natural gas prices thanks to lower demand linked to warmer-than-seasonal weather and a successful pivot to ex-Russia sources.

The increase in Liquified Natural Gas imports (LNG), particularly from the U.S., have aided in this supply shift, and LNG swap futures have declined sharply below $US8.5/mmbtu after peaking as high as $US18.6/mmbtu in early October.

Image courtesy of CBA.

The last time LNG prices were this low was April 2021.

"The fall in LNG swap futures mirrors the decline in European gas futures. Europe’s gas market has emerged as a key driver of LNG markets following the Ukraine war, given Europe has needed to buy additional LNG to compensate for lower gas pipeline imports from Russia," says Vivek Dhar, an economist at Commonwealth Bank.

He explains LNG is expected to account for 35‑40% of Europe’s gas supply in the 2023‑24 gas season (1 October 2023 to 30 September 2024), up from ~15% prior to the Ukraine war in the 2020‑21 gas season as net Russian gas pipeline imports are virtually absent.

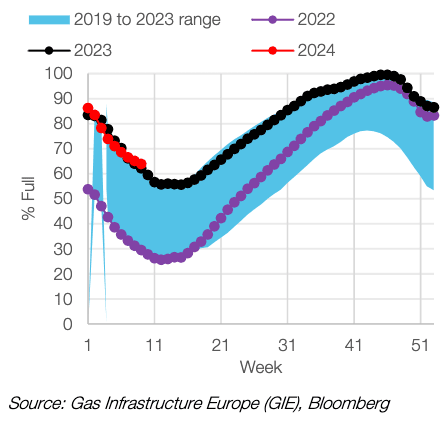

"Europe’s gas supply comfort is best demonstrated by Europe’s gas storage levels. Storage is currently tracking at ~64% of capacity, well above the 5‑year average (2019 to 2023) of ~47% for this time of year. The higher than usual gas stockpiles in Europe reflect strong LNG deliveries, but perhaps more crucially, subdued gas consumption," adds Dhar.