China's Big Interest Rate Cut Won't Be Enough To Boost Property Market: Economist

- Written by: Gary Howes

The People's Bank of China (PBoC) has announced its biggest interest rate cut since 2019, but the move won't be enough to swing sentiment and reboot the country's property market, according to analysts.

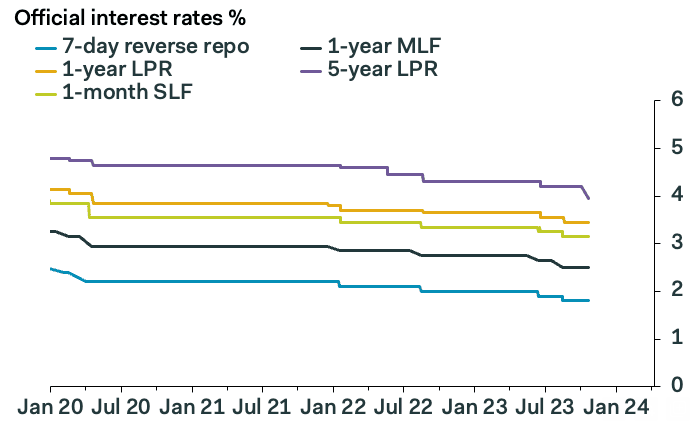

Chinese equity markets and Chinese proxies, such as the Australian Dollar, gave a nonchalant reaction to news the PBOC cut the benchmark five-year loan prime rate (LPR), the peg for most mortgages, by 25bps to 3.95%.

This is the first cut since June 2023 and is larger than the market expected. In fact, this is the largest reduction of the 5-year since the PBoC reformed the LPR-setting mechanism in 2019.

"Reducing this 5-year reference rate is another step of Chinese authorities to support the ailing property market, which also weighs on overall economic activity. Today’s action could support demand for long-term corporate loans as well. For now, there is not really an euphoric reaction on Chinese markets," says Mathias Van der Jeugt, an economist at KBC Markets.

Image © Adobe Images

The Chinese economy has underperformed expectations since the country removed all Covid restrictions, with the domestic property market coming under significant pressure amidst an oversupply of new-build properties.

The resultant downturn in the construction sector has meanwhile weighed on commodity prices and the currencies of major trading partners, such as Australia. "The larger than expected cut to China’s benchmark for mortgage rates did not alleviate concerns about the property sector. Iron ore futures fell more than 3% to a three‑month low," says Carol Kong, a markets strategist at Commonwealth Bank of Australia.

The central bank kept the one-year LPR, the peg for most household and corporate loans, unchanged at 3.45%.

"The asymmetric rate cut, with the one-year LPR unchanged at 3.45%, is clearly intended to support the property market," says Duncan Wrigley, Chief China Economist at Pantheon Macroeconomics.

Wrigley estimates the average mortgage rate for first-homes should now fall by roughly another 25bp, having already fallen 5bp q/q to 3.97% in Q4.

Chart courtesy of Pantheon Macroeconomics.

"Mortgage rates are set by bank branches, according to city-level guidance tailored to local market conditions. The national floor rate for first-home mortgages in most cities is the five-year LPR minus 20bp, now 3.75%; and for second home-mortgages, 4.15%," says Wrigley.

But, he explains, the floor guidance doesn't apply to cities with three straight months of declining new home prices both month-to-month and year-over-year.

It is estimated about 37% of the 343 cities of prefecture level may cut local mortgage rates to below the floor or even cancel the floor rate altogether.

Some 101 cities set a local mortgage rate floor below the national guidance in December, and 26 others had removed the local minimum rate, according to the PBoC's fourth quarter monetary policy implementation report.

"Today’s rate cut signals policymakers are getting serious about supporting the property market, but probably isn’t enough to ensure a rapid turnaround in sentiment and sales," says Wrigley.

The market's tepid reaction to the development suggests local and international investors agree.

"More measures will likely be needed, especially in lower-tier cities with high levels of unsold housing inventories. A slow, grinding recovery remains the most likely scenario," adds Wrigley.