Bank of England To Strike 'Hawkish' Tone Thursday: Berenberg

- Written by: Gary Howes

Image © Adobe Stock

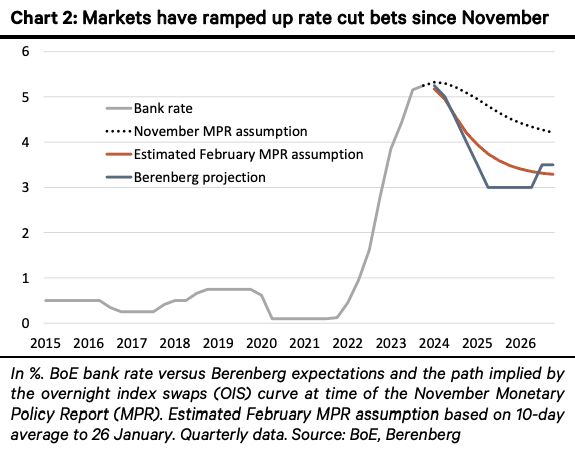

The Bank of England will strike a 'hawkish' tone on Thursday as it judges it is too soon to encourage market participants to bet on imminent rate cuts.

Although inflation is trending below the levels set out in the Bank's November forecasts, analysts at Berenberg Bank say "policymakers will continue to strike a hawkish tone".

The Bank is expected to maintain interest rates at current levels and release a new set of financial forecasts, including lower inflation projections.

It is these forecasts and the associated guidance that will likely prompt any market reaction.

"The key question is: will policymakers begin to shift even slightly away from their hawkish bias towards a more neutral stance?" asks Kallum Pickering, Senior Economist at Berenberg.

In December, the Bank's Monetary Policy Committee (MPC) maintained guidance that "further tightening" would be required if inflation remains stickier than expected.

However, most economist previews we have read show an expectation for this phrase to be dropped in an admission that a 'pivot' to looser policy was underway.

But Pickering says the uptick in inflation in December to 4.0% from 3.9% could mean "the hawks" on the MPC "may not even budge this time around."

This would prove a 'hawkish' surprise that could boost UK bond yields and the Pound.

"While split decisions are not unusual, we doubt the BoE can fully shift towards neutral guidance until all policymakers agree that rates are sufficiently high," says Pickering.

Crucial to any pivot will be evidence that UK core inflation is on course to hit 2.0%, which Berenberg doesn't think will happen until later in the year.

The path forward, as envisaged by Pickering and colleagues is as follows:

February: we may get a soft signal that the BoE is turning less hawkish.

March: further inflation progress should open the door for the hawks to drop their preference for further hikes.

May will include a fresh set of forecasts; the BoE should be able to lose its hawkish bias and signal that the monetary can turn less tight.

June: a first 25bp cut.