Germany to Suffer Double-dip Recession: Deutsche Bank

- Written by: Gary Howes

Image © Adobe Stock

Germany's largest bank says the domestic economy is set to suffer a double-dip recession sparking a negative feedback loop that will weigh on activity in 2024, ensuring the UK, France, U.S. and Italy will all grow faster.

Deutsche Bank says a double-dip recession is likely with hard and soft data pointing to a GDP contraction of about 0.3% in the third quarter.

"Despite receding inflation, we expect that private consumption will only gradually come out of its rut, as consumer confidence has remained depressed," says Chief Economist Stefan Schneider.

Germany's economy saw recession in the final quarter of 2022 and the first quarter of 2023 and Deutsche Bank now expects another fall of 0.3% in the third quarter with little sign of a sharp recovery on the horizon.

"A renewed fall in GDP provides another setback to already downbeat German confidence. This negative feedback loop will likely weigh on the economy in 2024," says Schneider.

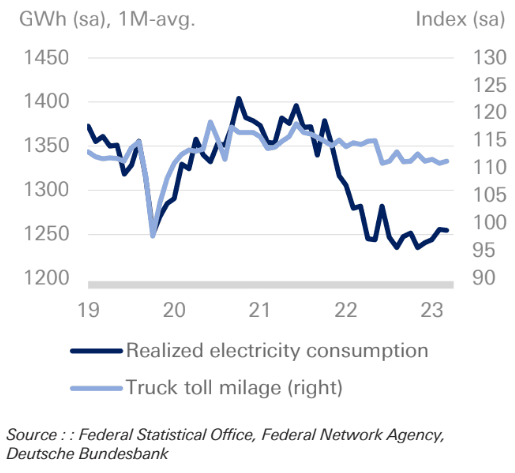

Above: "German real-time data point to weak activity in Q3" - Deutsche Bank.

But he also warns, "megatrends such as decarbonization, digitalization, and demographics, as well as signs of deglobalization, could cause structural supply bottlenecks in the 2020s and beyond. They are likely to slow potential growth in Germany towards 0.5% and keep inflation above 2%."

Deutsche Bank looks for German exports to shrink in 2023 due to weak sentiment, lower competitiveness and a lackluster recovery in China.

"In 2024, we expect only a modest recovery due to the meagre global growth and structural challenges for the German economy," says Schneider.

Germany is forecast by Deutsche Bank to record a -0.5% full-year 2023 GDP figure, with a rise of 0.3% expected in 2024.

By comparison, France looks better placed with 0.9% expansion expected in 2023 followed by 0.5% in 2024. Italy will also outperform with growth figures of 0.7% and 0.4% in these respective years.

The UK will also grow with rates of 0.3% and 0.4% expected, but all these European countries will be eclipsed by U.S. growth that looks set for 2.3% and 0.6%.