Bank of England Hikes to Result in 1.2 Million UK Household Insolvencies This Year says NIESR

- Written by: Gary Howes

Image © Adobe Images

By the end of 2023 more than a million households (4% of all UK households) will run out of savings as a result of higher UK interest rates according to research from the National Institute of Economic and Social Research (NIER).

The findings come on the day the Bank of England raises its base interest rate by a sizeable 50 basis points to 5.0% in a move that will underscore the recent rise in mortgage rates.

NIESR says the higher mortgage repayments will take the total proportion of insolvent households to nearly 30% (around 7.8 million).

"The rise in interest rates to 5% will push millions of households with mortgages towards the brink of insolvency. No lender would expect a household to withstand a shock of this magnitude, so the government shouldn't either. Some investment should be done in forbearance agreements, giving households and lenders the ability to create payment plans that work for each other," says Max Mosley, an economist at NIESR.

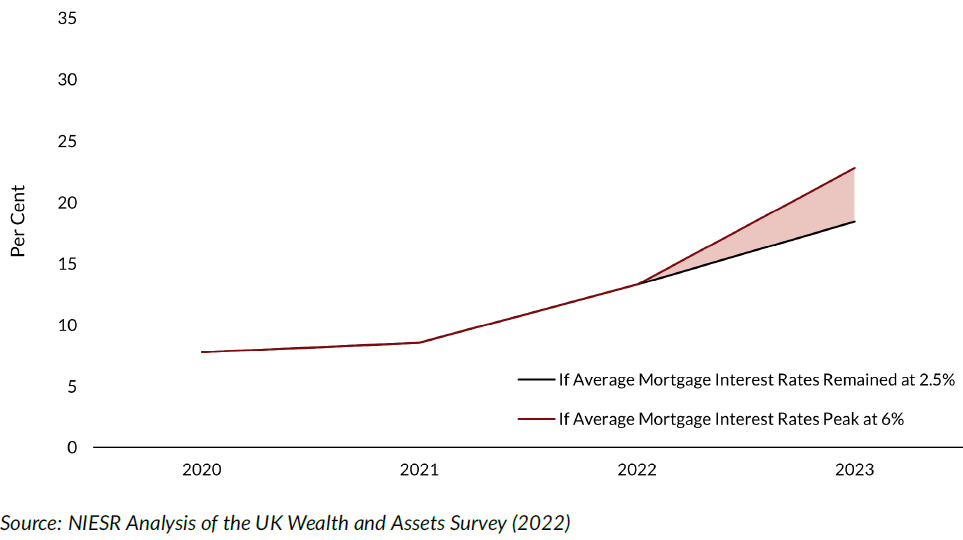

Above: Proportion of households with no savings.

The research shows a significant proportion of the population will see their savings wiped out because of the rise in interest rates and thus higher mortgage repayments which will rise by nearly 50% on average: this rise is above typical stress-tests households are subjected to when applying for a mortgage.

The largest impact will be felt in Wales and the North-East where up to 6% of households are projected to be insolvent by the end of the year as a direct result of rising mortgage repayments.

Also, the analysis finds that the rising repayments in aggregate will wipe out 0.3% of UK GDP, costing all households with mortgages a total of £12bn per year.

Fixed-rate monthly mortgage repayments will rise from around £700 to £1,000 on average: this applies to nearly 2m households when needing to remortgage.

Variable-rate monthly mortgage repayments will rise from around £450 to £700: this applies to 1.5m households on variable-rate mortgages.

"Given the findings above, we would recommend the government to consider intervening in forbearance agreements, which allow households to agree to create repayment plans based on what they can afford when they are unable to repay their debt," says Mosely.