Wage Data Confirms UK's Unique Inflation Problem

- Written by: Gary Howes

- Employment Change (mom): 23k v 7k previously (revised from -136k) April and 23k est.

- Weekly Earnings (3m %yoy): 6.5 v 6.1 (revised from 5.8) March and 6.1 est.

- Weekly Earnings ex Bonus (3m %yoy): 7.2 v 6.8 (revised from 6.7) March and 6.9 est.

- Unemployment Rate (%): 3.8 v 3.9 March and 4.0 est.

Image © Adobe Images.

"Wage growth has far too much momentum for the MPC to stop hiking Bank Rate yet," says Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics.

Tombs' comment comes after the UK reported a set of above-consensus labour market statistics suggesting the Bank of England is still some way off from cooling the economy enough to bring down inflation.

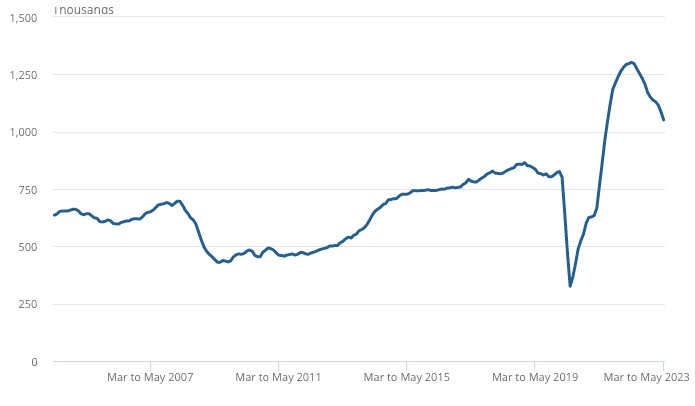

According to data from the ONS, employment rose, participation rose and the unemployment rate fell, a dynamic that left little to ponder as to why UK wages are rising at inflationary rates.

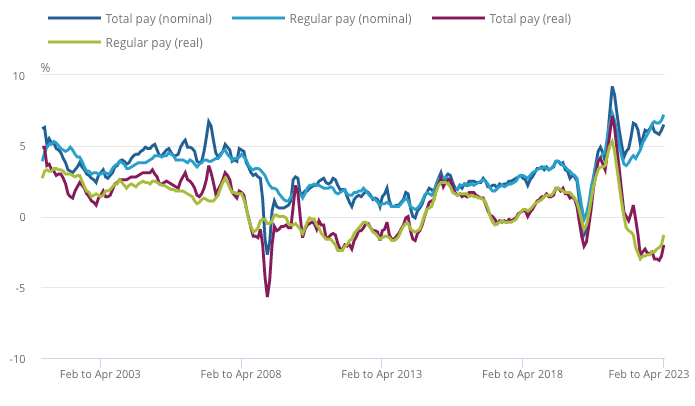

The average Earnings Index (+Bonus) showed a 6.5% increase in wages in April, surpassing expectations for 6.1% and March's 6.1%.

Excluding bonuses, the index showed a 7.2% increase in wages for April, easily passing expectations for 6.9% and March's reading of 6.8%.

"The renewed pick-up in wage growth in April will add fuel to the recent rise in gilt yields and expectations for the future path of Bank Rate, by fanning the impression that the U.K. has a unique problem with ingrained high inflation," says Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics.

Investors have sold UK bonds in response to the figures, driving up the yield these bonds pay. Bond yields are a benchmark for lending, meaning borrowing costs across the economy continue to rise sharply.

The yield on the two-year notes jumped 13 basis points to 4.77% on Tuesday, the highest since the global financial crisis in 2008 and surpassing levels reached during the turmoil that marked Liz Truss’s government.

Why would investors sell UK bonds? Simply because high inflation makes holding bonds unattractive as their value will decline over their lifespan, ensuring investors demand higher compensation for holding them via higher coupon payments (yield).

Above: Inflation-impacted real pay might have turned a corner following the recent decline.

The UK's inflationary spurt was triggered by high commodity prices that followed global Covid lockdowns and exacerbated by high energy prices following Russia's invasion of Ukraine.

Covid stimulus by the UK government and Bank of England meanwhile created significant excess savings in UK households and real pay increases in 2020-2021 that have kept demand elevated through the 'cost of living crisis'.

The inflationary impulse has now spread into everyday economic activity in the UK, including services and domestic production. It is here where price pressures risk becoming embedded.

Tombs says the evidence suggests pay awards are broad-based in nature, with those on the National Living Wage seeing increases right through to higher-paying sectors, such as financial and business services.

"This points to a high risk of ongoing momentum over the coming months," says Tombs.

Above: UK job vacancies continue to fall, yet remain elevated by historical standards.

The Bank of England is concerned that elevated wage settlements will create a wage-price spiral where wages become a driver of inflation.

Higher wages stimulate demand for goods and services while raising a business's cost base, prompting business owners to raise prices.

This in turn spurs further wage increases and a self-fulfilling inflationary 'doom loop' emerges.

The Bank of England spent much of 2022 saying inflation was likely to plummet in "the medium term", however, it is clear they and other major economists have underestimated the inflationary propensities of the modern UK economy.

Tombs nevertheless says there could be some relief on the horizon.

"The outlook for a further increase in labour market slack, the absence of any further changes in minimum wages for another 12 months, and the likelihood of a further fall in the headline rate of CPI inflation driven by lower energy prices should mean that wage growth loses momentum over the next six months," he says.

He cites the timelier measure of median pay derived from the PAYE data which rose by just 0.3% month-to-month in May, dragging down its year-over-year growth rate to 7.0%, from 7.5%.

Furthermore, the net balance of recruiters reporting that salaries are rising for new hires fell to an 25-month low in May, and now is slightly below its average in the second half of this year.

Accordingly, Pantheon Macroeconomics thinks that year-over-year growth in average weekly wages will slow to about 5.0% by the end of this year, on course for a 3.5% rate in 2024.

"We remain unconvinced, therefore, that the MPC will need to increase Bank Rate all the way to 5.5% by the end of this year, as markets expect; a 5.0% peak still looks more likely to us," says Tombs.