UK to see Record Levels of Debt Supply in the Coming Year

- Written by: Gary Howes

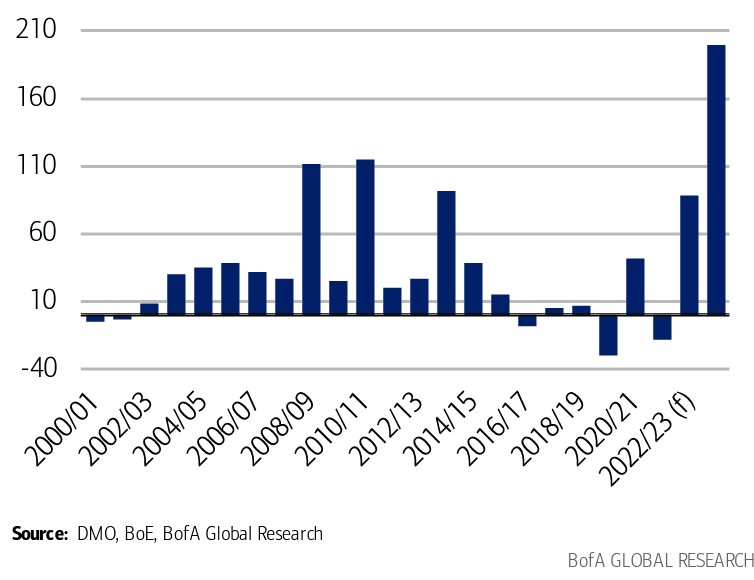

Above: Gilt net supply to private investors, £bn. "More than double the amount to be sold in 2022/23" - Bank of America.

The UK government and Bank of England will supply a record level of debt to private markets in the coming financial year, which starts on Monday.

The UK Debt Management Office (DMO) says it will issue £241BN worth of bonds (Gilts) in the new fiscal year which is £71BN higher than this year's £170BN.

The Bank of England's quantitative tightening programme will meanwhile continue, meaning the authority will sell back the bonds it purchased using the quantitative easing programme (Asset Purchase Facility, or APF) of recent years.

Bank of America estimates Gilt issuance from the DMO and BoE will combine to create a year of record supply.

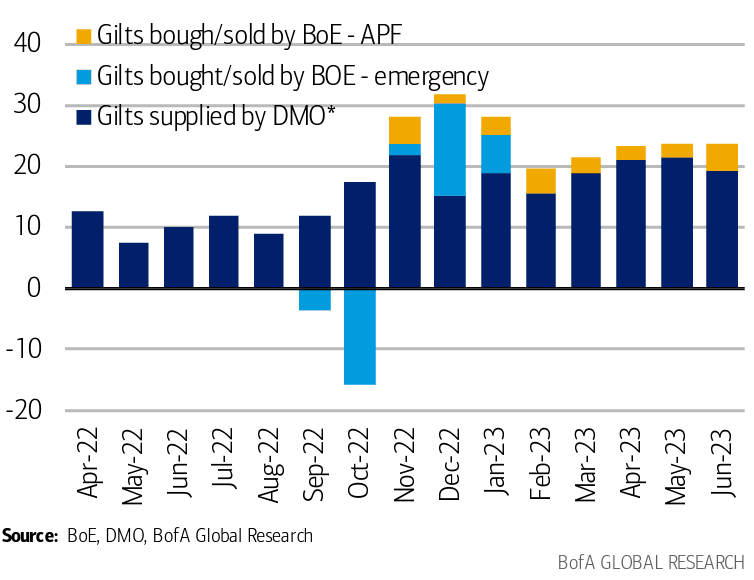

They calculate supply will rise by less than £2BN in Q2 2023.

"However, drawing conclusions from this quarterly number would be misleading as they would mask that the Q1 2023 total was inflated by a £6bn unwind of the emergency Gilt holdings by the APF. All of which were unwound at the very start of January," says Agne Stengeryte, Rates Strategist at Bank of America Global Research.

Above: Gilt supply by the DMO and BoE per month, £bn (cash). "We expect a steady increase from February 2023" - Bank of America.

Stengeryte's estimates suggest that monthly Gilt issuance from the DMO and BoE will rise every month from February to June.

The DMO issuance of Gilts will increase by around £8bn in the second quarter of 2023, from around £54BN in the first quarter to nearly £62BN in Q2 2023.

The amount of Gilts sold by the Bank of England is expected by Bank of America to remain broadly stable at £9.2BN in the second quarter of 2023, from £9.7BN in the previous quarter.