"Green Shoots": UK Retail Sales in Upside Surprise

- Written by: Gary Howes

Image © Adobe Images

Consumers continue to spend despite elevated inflation levels with new data revealing an increase in the volumes sold in UK stores amidst improving consumer confidence.

UK retail sales were up 1.2% in the month to February said the ONS, an acceleration from January's 0.9% and ahead of analyst estimates for 0.2%.

Sales contracted 3.5% in the year to February, but this was less severe than January's -5.2% and analyst expectations for -4.7%.

The increase was driven by strong growth in non-food stores (0.9%) and food stores (0.3%).

"The UK consumer appears to be spending their wage increases, despite uncertainty over the economic outlook. Growth in clothing was strong which supports our view that the consumer still has some catch up spending to do after the pandemic," says Emma Mogford, manager of the Premier Miton Monthly Income Fund.

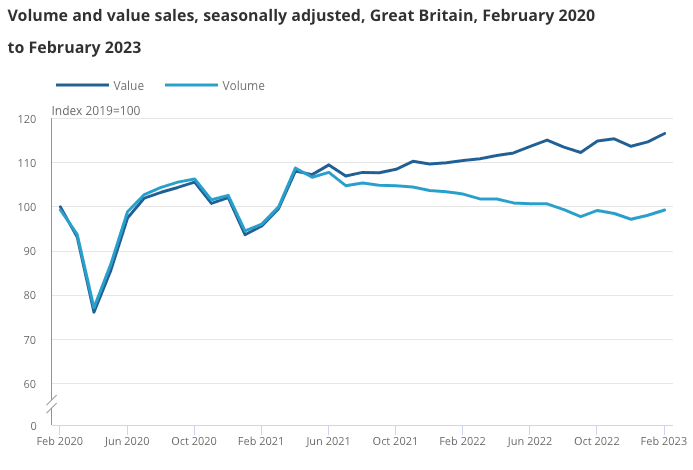

Image source: ONS.

Lisa Hooker, Industry Leader for Consumer Markets at PwC says retail benefitted from a number of factors including:

» a soft comparative trading performance the previous year when poor weather affected sales;

» a shift from out-of-home leisure to eating and drinking in home;

» and generally improved consumer confidence

"We are not only seeing an improvement in grocery, but there also appear to be green shoots in other categories, with small month-on-month improvements in volumes for fashion retailers and other specialty retailers, albeit sales of household goods remained weak," says Hooker.

The figures come a day after the Bank of England raised interest rates to counter rising inflation amidst signs the economy was performing better than previously expected.

The retail sales figures underpin this theme.

"With both growth and inflation having surprised to the upside, we do not believe that data will have weakened enough for the BoE to pause its hiking cycle at the May meeting," says Jens Nærvig Pedersen, Director of FX and Rates Strategy at Danske Bank.

"The outlook for retail sales has improved since the Budget, when the government scrapped planned increases in both the Energy Price Guarantee and fuel duty. These U-turns have averted a 1.0% hit to households’ disposable incomes in Q2," says Gabriella Dickens, Senior UK Economist at Pantheon Macroeconomics.

She says many households also will see further relief in April when benefits, including the state pension, rise by 10.1%, and the National Living Wage increases by 9.7%

Nevertheless, Dickens says it might be too soon to say the retail sector is in the midst of a recovery with consumer confidence remaining near historically suppressed levels.

Other headwinds include elevated mortgage rates and an uptick in redundancies, as recorded at the Insolvency Service and frozen tax thresholds that mean pay increases will leave many paying more by way of tax.