Budget 2023: Recession Ruled Out by OBR, Hunt Looks to Boost Productivity

- Written by: Gary Howes

The Chancellor of the Exchequer Jeremy Hunt, accompanied by his ministerial team and watched by his wife and children, leaves 11 Downing Street on his way to deliver the budget. Picture by Simon Walker / No 10 Downing Street.

The UK economy won't fall into recession in 2023, inflation will fall sharply and employers can look forward to a boost as more people are encouraged to return to work.

These are the headline takeaways from the 2023 budget presented to Parliament by Chancellor Jeremy Hunt on Wednesday.

Hunt announced an additional £22BN would flow into the economy over the next three years in what can be termed a moderately expansive budget, although none of this would come from headline-grabbing tax cuts.

Instead, the focus was placed firmly on improving the productive capacity of the economy via the creation of investment zones and allowing companies to fully deduct investment spending from their tax bill.

Hunt announced the introduction of "full expensing" for the next three years, which would allow companies to deduct from tax every pound spent on plant and equipment investments.

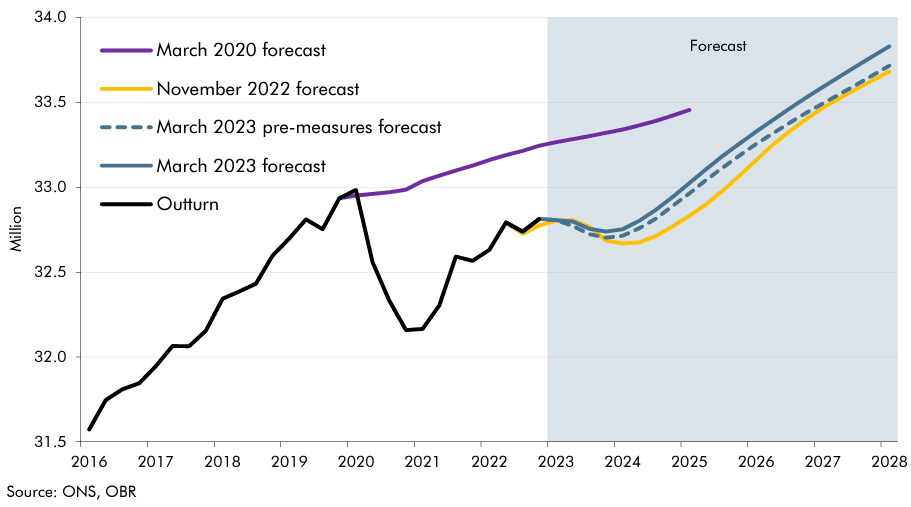

The supply of labour was another priority as it was announced childcare would be massively expanded, potentially allowing hundreds of thousands of women to get back into work, increase their hours and pursue careers that might have otherwise been put on hold by the cost of bringing up young children.

"At present, the UK’s high childcare costs probably have significant adverse effects on female participation and workplace progression, thereby limiting overall labour supply and productivity," says Michael Saunders, Senior Policy Advisor at Oxford Economics and former Bank of England MPC member.

Saunders says aggregate UK labour supply (total hours available for work) would rise by slightly more than 1% if the UK's participation rate and full-time employment share among women aged 30-50 years matched the EU average.

"If they matched the average levels in France, Denmark, Sweden and Norway, aggregate UK labour supply would rise by slightly over 3%, adding significantly to potential output," he adds.

However, businesses will nevertheless face an increased tax burden as the headline corporation tax rate is set to rise from April.

"Much of the focus was placed on reforms to increase both productivity growth and the productive capacity of the economy rather than radical changes to tax and spending," says Simon Harvey, Head of Research at Monex.

Improved Economic Trajectory

The OBR meanwhile said the UK would avoid falling into a technical recession, previously it had predicted GDP to fall by 1.4% over the course of 2023, and Inflation would more than halve as it falls from 10.7% in Q4 2022 to 2.9% by end of 2023.

"Jeremy Hunt wasted no chances in pulling the biggest rabbit from his hat, brandishing the forecast from the Office for Budget Responsibility that the UK will swerve a recession this year. Things were already looking up, with consumer and business confidence rising, and spending proving much more resilient," says Susannah Streeter, head of money and markets at Hargreaves Lansdown.

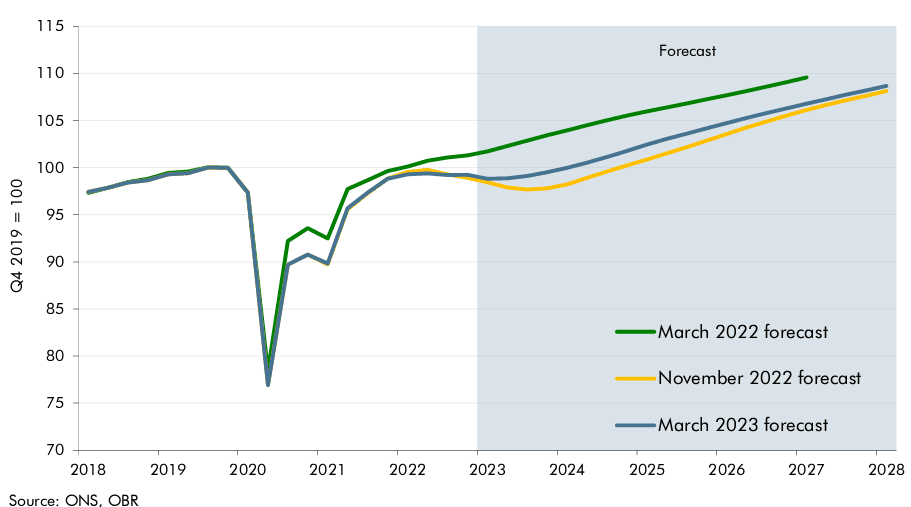

Above: Real GDP growth forecasts from the OBR.

The fall in inflation will be aided by the government's decision to freeze the Energy Price Guarantee, ensuring the typical household energy bills will remain at £2,500 a year.

"Headline inflation is likely to be roughly one percentage point lower across the remainder of 2022 by our reckoning. Indeed it’s likely to end the year at 2%, on our current forecasts," says James Smith, Developed Markets Economist at ING Bank.

Fuel duty was also frozen alongside that levied on pints served in the pub, ensuring no uplift to inflation from these components of the price basket.

Debt as a percentage of GDP would fall:

» 92.4% of GDP in 2023-2024

» 93.7% in 2024-25

» 94.6% in 2025-26

» 94.8% in 2026-27

» 94.6% in 2027-28

GDP growth outlook:

» 0.2% decline in 2023

» 1.8% increase in 2024

» 2.5% increase in 2025

» 2.1% increase in 2026

» 1.9% increase in 2027

The developments make for a material upgrade to the UK's economic outlook, which should bolster sentiment towards the Pound.

Currency markets are however more focussed on external factors, most notably Wednesday's collapse in Eurozone bank stocks which have seen the Euro fall sharply.

Above: Employment forecasts from the OBR.