European Gas Prices Forecast to Fall to 35/MWh Amidst "Overstocking" Prospects: Morgan Stanley

- Written by: Gary Howes

Image © Adobe Images

European wholesale gas prices have fallen to their lowest levels since August 2021 and a leading Wall Street investment bank says further declines are possible.

Research from Morgan Stanley finds wholesale gas prices could be set to fall further as a strong pipeline of Liquefied Natural Gas (LNG) supplies could see Europe overstocking on gas during the summer.

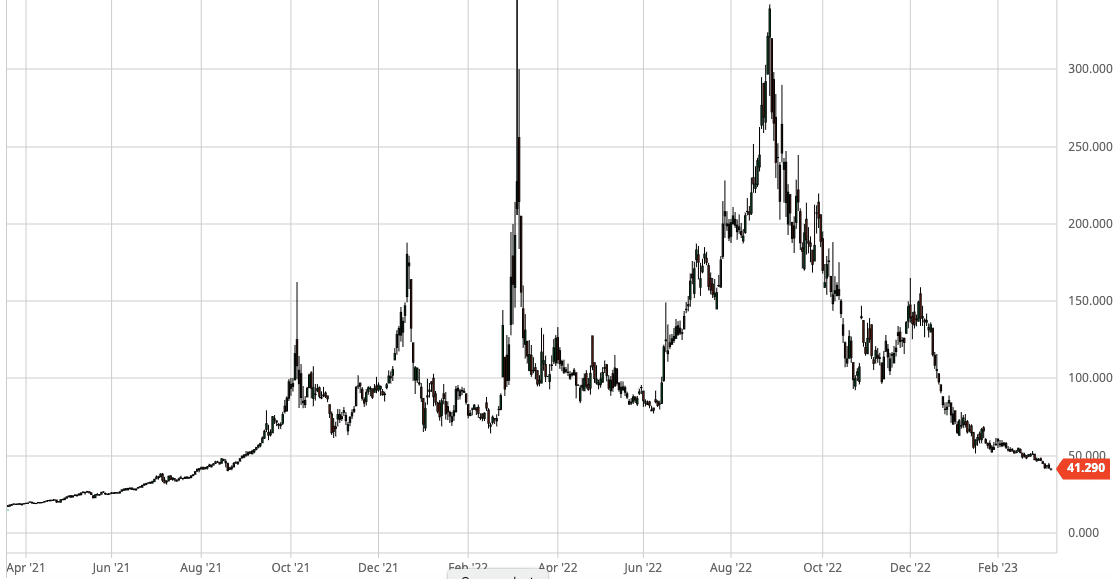

The findings come as the benchmark Title Transfer Facility (TTF) contract for April delivery falls to 41.29/MWh on March 09, the lowest level for the month-ahead contract seen since August 20, 2021.

Above: TTF for delivery in April 2023. Source: Barchart.

The declines come amidst lower demand across Europe and increased non-Russian supply. The prospect of a summer spike in gas prices as European countries look to restock storage levels is meanwhile greatly reduced as Europe enters the restocking season with above-average storage levels.

In fact, Europe could find itself swimming in gas.

"Low demand and high LNG imports continue to risk over-stocking this summer," says Martijn Rats, an economist at Morgan Stanley.

Morgan Stanley says fas consumption in the European perimeter came in 14% below the 5-year seasonal average in February and weather did not play a big role in the end: weather-adjusted demand was also 14% below seasonal norms, in line with January.

Rats says despite lower gas prices, data showed little sign of an improvement in industrial gas consumption.

But while households and businesses showed no significantly increased appetite for gas, demand for power generation remains relatively strong.

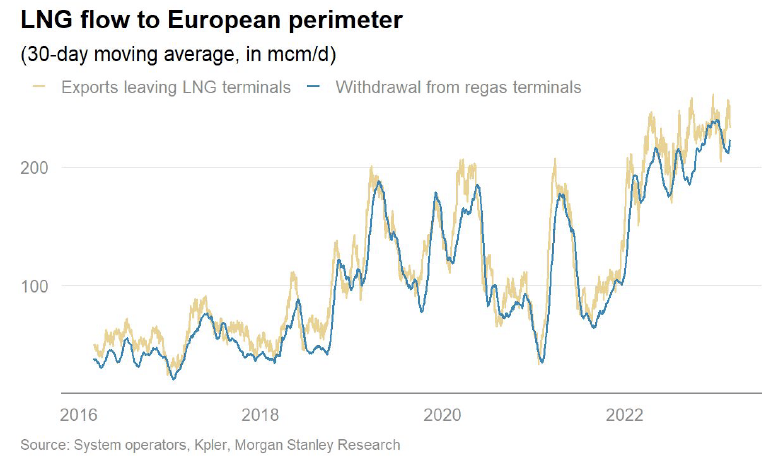

LNG imports meanwhile "remain very strong and show little sign of slowdown," says Morgan Stanley.

Above: "LNG flow to Europe remains strong; 237 mcm/d of new LNG left liquefaction terminals in Feb heading for our European perimeter" - Morgan Stanley.

LNG is created by transforming natural gas into a liquid state, by cooling it to -161oC (-259F), reducing it to 1/600th of its original un-liquified volume and to half the weight of water. This means Europe has been able to diversify gas procurement away from Russia to countries in North America, South America, Africa and Australia.

The data shows withdrawals from LNG regasification terminals across Europe increased again in February to reach 224 mcm/d, which Morgan Stanley says is in line with its forecast and only modestly below the all-time high of 236 mcm/d set in December.

"For context, this was typically ~100 mcm/d pre-war. There is little sign of slowdown," says Rats.

He says liquefaction terminals around the world shipped on average ~237 mcm/d of new LNG towards Europe during February, which will arrive in the coming weeks.

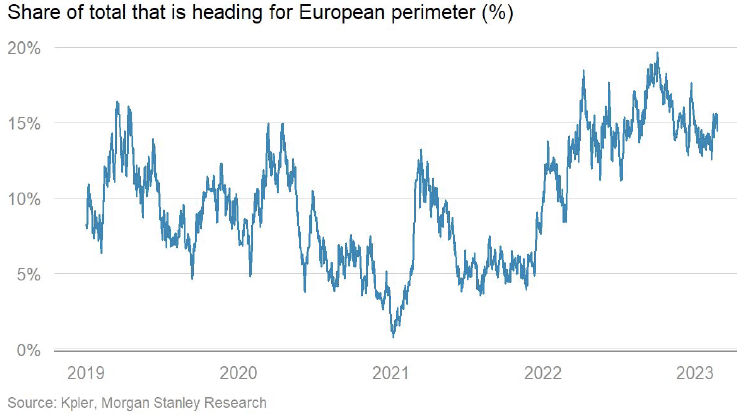

Above: "The share of global LNG that is steaming towards Europe is staying high" - Morgan Stanley.

In addition, "there is also currently ~2.7 mt of LNG steaming towards our European perimeter, a level that typically correlates with LNG imports continuing at ~230 mcm/d. Approximately 18% of LNG imports came from Russia in February, broadly stable on prior months," says Rats.

Morgan Stanley forecasts downside to TTF to €35/MWh "in order to boost demand or, more likely, divert some LNG cargoes away from Europe."