Surprise House Price Rise Proof that UK Financial Conditions are Easing, Defying the Bank of England

- Written by: Gary Howes

One of the UK's largest mortgage lenders reported a surprise rise in UK house prices, defying expectations that a sharp downturn was now well underway.

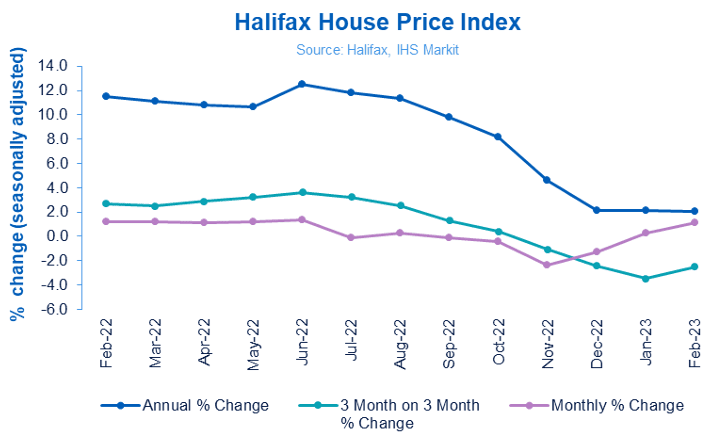

Halifax reported a second monthly increase of 1.1% month-on-month gain in February, making for a third annual increase of 2.1%.

In response to the data, economists warn that the rise in prices could be a blip ahead of a resumption in declines as UK house prices remained overvalued and the Bank of England would have to accept more rate hikes are needed.

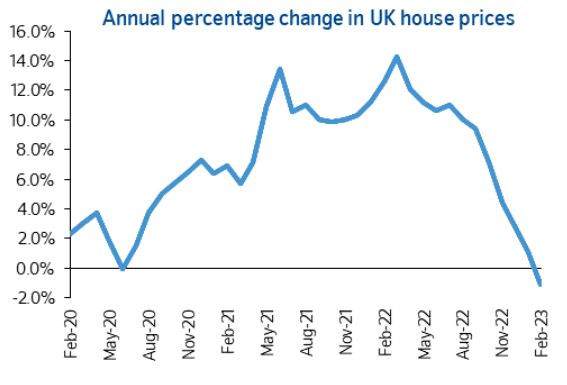

The Halifax numbers contrast with the findings of another major UK mortgage lender, Nationwide, which reported a sixth consecutive month-on-month fall in house prices in February.

Halifax said the improvement is due to recent reductions in mortgage rates, improving consumer confidence, and a continuing resilience in the labour market.

Above: Nationwide's measure does not show the same uptick as reported by Halifax.

The findings will complicate matters for the Bank of England, where rate-setters appear intent to pause the rate hiking cycle to allow the impact of previous rate hikes to be felt.

The data appears to validate the warnings of Bank of England MPC member Catherine Mann that the financial conditions in the UK have actually loosened. In a recent speech, she cited the fall in mortgage rates as evidence.

If she is right, then the Bank cannot afford to end its hiking cycle in March.

Halifax says that in cash terms, house prices are down around £8,500 (-2.9%) on the August 2022 peak but remain almost £9,000 above the average prices seen at the start of 2022 and are still above pre-pandemic levels.

"The substantial recovery in Halifax house prices in February added weight to the view that we will see a stand off between buyers and sellers that causes transactions to slump, but minimal price falls," says Andrew Wishart, Senior Economist, at Capital Economics.

However, Wishart says such an outcome "would be a historical anomaly, which is why our forecast is for a more traditional housing downturn with prices falling much further."

Capital Economics says at current prices and mortgage rates, houses are still extremely overvalued.

Based on Halifax's average house price, the cost of a typical mortgage was 58% of the average pay in January, whereas levels of over 45% have generally been consistent with falling prices in the past, according to Capital Economics.

"The positive surprise in the Halifax house price data was in keeping with the wider economic data. But that could be taken as evidence that interest rates need to go higher. A stabilisation, or even increase, in mortgage rates in response means that any respite from price falls will be temporary," says Wishart.