Germany Risks "Slightly More than Just a Technical Recession" says Deutsche Bank

- Written by: Gary Howes

Image © Alfred Yaghobzadeh, European Commission Audiovisual Services

Germany's estimate of economic growth in the final quarter was revised lower last week and the country's largest lender, Deutsche Bank, is forecasting a further contraction in the opening quarter of this year that would make for "slightly more than just a technical recession."

Initially, it had been assumed that Europe's largest economy dodged a contraction when in January Destatis announced a 1.9% growth rate for the year that had included an imputed estimate of final quarter output, although other data released on January 30 and February 24 told a different story.

"Probably the weakness in December hard data (IP falling by 3.1% mom and retail sales slumping by 4.9%) was even stronger than assumed by the Stats Office before," says Stefan Schneider, chief economist at Deutsche Bank.

"The weak overall Q4 GDP number was corroborated by the development of the demand components, with all domestic components – except for government consumption (+0.6% qoq) and inventories (+0.3pp) – shrinking," Schneider and colleagues write in a Friday briefing.

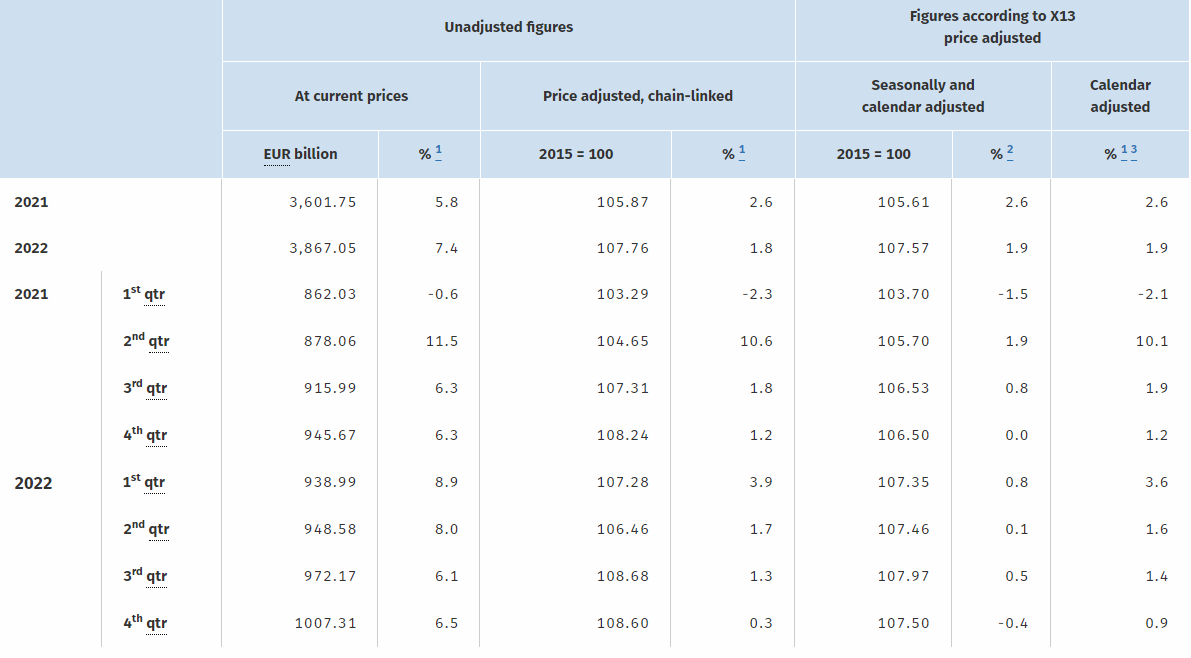

Destatis said last week that final quarter output likely fell by -0.4% following a downward revision from the -0.2% estimated on January 30 and after output from all parts of the economy retrenched in response to elevated prices and falling real terms incomes.

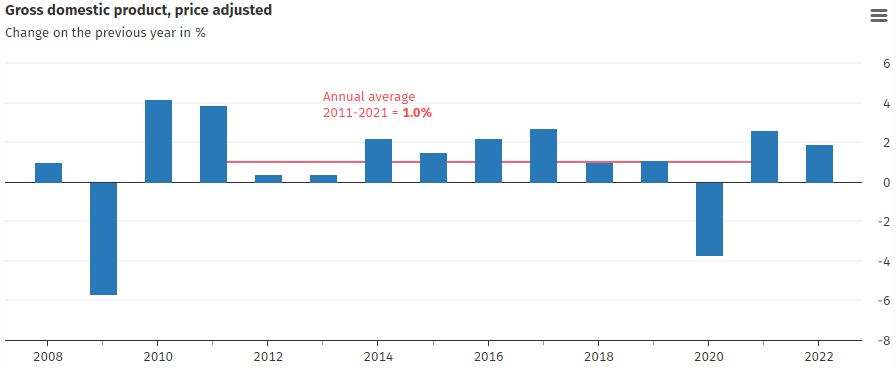

Source: Destatis.

Declining private household consumption may also have been a partial driver of a 1.1% fall in imports during quarter, which was smaller than the 1% decline in exports and means that net trade made a small contribution to the economy late last year.

Estimates of economic output for the December quarter are often revised due to delays in the reporting of information but last quarter's weakness could also have implications for the likely pace of growth in the current quarter too.

"The improvement of sentiment indicators which started during Q4 has continued in Q1, albeit at a slower rate. Still, the December weakness of hard data provides a low starting level for Q1, so that we expect GDP to see another ¼% qoq decline," Schneider says.

"If we leave our quarterly forecast profile unchanged the weaker Q4 2022 would give us -0.1% for 2023," he adds.

While the economy risks contracting again this quarter, the Deutsche Bank team forecasts a breakeven performance for 2023 overall.

Source: Destatis.

A forecast of unchanged GDP growth for the year implies a rebound in GDP over the coming quarters, which is something that may have become more likely with recent declines in wholesale energy prices.

Lower energy prices might ease household concerns about the economy and outlook for their real terms incomes, potentially leaving them more willing to spend.

Some economists doubt this will be the case, however, and worry that any 2023 recovery will be short-lived.

"The second consecutive drop in the Ifo’s current assessment component, a falling PMI manufacturing and, as reflected in this morning’s data, weak consumer confidence and a willingness to spend close to historical lows, all confirm our view that the German economy will contract once again in the first quarter," says Carsten Brzeski, global head of macro at ING.

"Looking beyond the first quarter, the latest improvement in soft data suggests that the German and eurozone economies are in the middle of a typical cyclical recovery, while we fear that we are actually in the middle of a structural transition. If we are right, any rebound this year will be softer and more short-lived than many expect, and subdued growth rather than a strong rebound remains the base case," Brzeski warns.