UK Economy Resilience Not Enough for Budget Giveaways Says Oxford Economics

- Written by: James Skinner

"We doubt the Chancellor will respond to the improved short-term outlook by delivering any substantial "giveaways" in the Budget on March 15. For one, Jeremy Hunt still faces some near-term fiscal constraints " - Oxford Economics.

Image © Adobe Images

A range of indicators suggests the UK economy has performed better than been feared just a few short months ago and there are some reasons for thinking the outlook is not quite as bleak as it was but all of this still leaves HM Treasury beset by fiscal challenges, according to Oxford Economics.

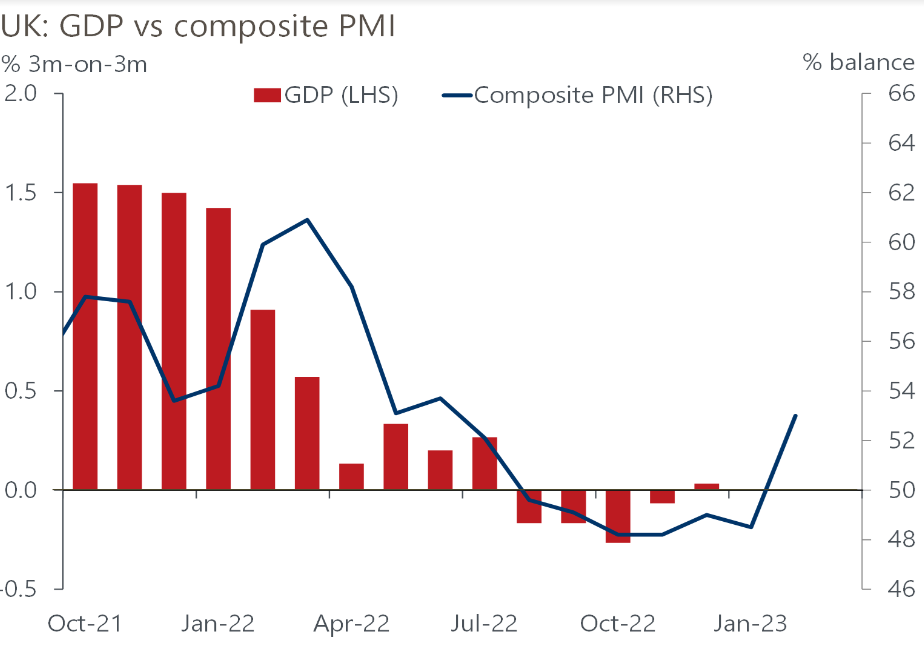

Growth evaporated in the final quarter but the economy did not contract as had been widely expected at times in the lead- up to February's publication of data covering that period while tax receipts have been stronger and there may even be a partial recovery of long-lost business investment underway.

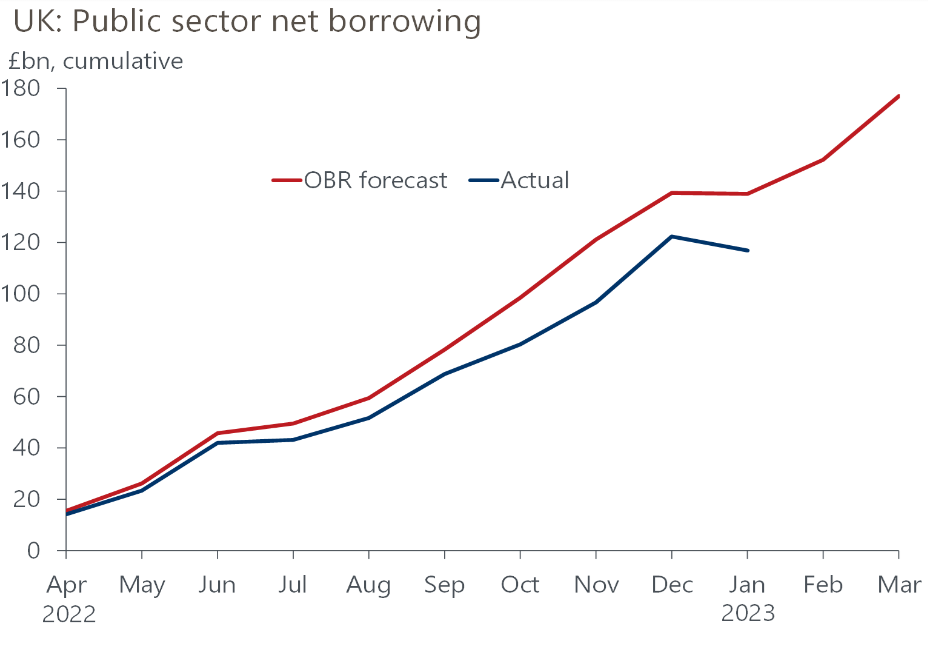

"The impact of high inflation on the cost of servicing index-linked government debt and outlays on energy support schemes meant the consensus prediction was for a deficit this year," says Andrew Goodwin, chief UK economist at Oxford Economics, in reference to public finance figures out this week.

"In practice, tax receipts exceeded public spending by £5.4bn, smaller than January 2022's surplus of £12.5bn but much bigger than the OBR's forecast of £0.4bn. A surge in tax revenues from self-assessment (up 33% y/y, and 20% above the OBR forecast) played a big role in this," Goodwin adds.

Source: Oxford Economics.

The partial rub for optimists is that higher tax receipts were exclusively the result of 2021's strong economic performance so had nothing to do with last year - though last was another good year in GDP terms - and there a reasons for why the economy could yet shrink somewhat in the months ahead.

"Based on past form, and if February's gains were to extend into March, the PMIs would be consistent with GDP expanding in Q1. However, we're doubtful this will happen and still think there's a good chance that output will fall slightly over the first half of this year," Goodwin says.

"December's drop in GDP presents a poor launchpad for growth in Q1, while continued widespread industrial action over the last few weeks will weigh on activity. And Q2 will have an extra bank holiday, and so one fewer working day, to celebrate the King's coronation," he adds.

However, and every bit as importantly, the public finances still remain in an unsustainable position after decades over which successive UK governments have run regular budget deficits, which have lifted debt as a share of GDP significantly in the years since the 2008 financial crisis.

"Less expensive energy could have some positive supply-side effects and inactivity has been dropping. On top of this, some of the recent strength in tax receipts may be structural, reflecting an economy bigger and/or more "tax-rich" than thought," Goodwin says.

"However, we doubt the Chancellor will respond to the improved short-term outlook by delivering any substantial "giveaways" in the Budget on March 15. For one, Jeremy Hunt still faces some near-term fiscal constraints, including finding £10bn+ to continue the long-running freeze on fuel duty, pay for further support for businesses with energy bills after April and, as is likely, boost pay rises for public sector workers," he adds.

All of this is a big part of why the chancellor may still feel compelled to look for expenditures to cut wherever they can be found when preparing next month's budget, while many forms of expenditure cuts would likely be accounted for through reductions of GDP.

To the extent that any identified savings do reduce GDP, they would likely act as a constraint on the performance of the overall economy this year and in subsequent periods even if the outlook has improved somewhat with the declines in oil and gas prices seen over recent months.

"Moreover, that the government has adopted a five-year horizon for its fiscal targets means near-term fiscal improvements are of less relevance to decisions around permanent tax or spending changes. Margins against those targets were wafer-thin in November's Autumn Statement, and may get thinner if press reports that the OBR will downgrade its medium-term growth forecasts are accurate," Goodwin writes in a Friday research briefing. he adds.