Rise in UK Business Investment is the Biggest Piece of Good News You Might Have Missed

- Written by: Gary Howes

Above: File image of Jeremy Hunt by Simon Dawson / No 10 Downing Street. Hunt is urged to make a decision on a long-term successor to the super-deduction incentive.

Improving business investment is the biggest piece of good news you might have missed in the most recent set of GDP data, but the end of favourable tax incentives and a looming corporation tax rise means a recent recovery could prove fleeting.

The ONS revised up business investment data in its most recent set of GDP accounts, saying business investment rose 4.8% quarter-on-quarter in the final quarter of 2022.

Economists at HSBC noted, "the recovery in business investment as the best news in the Q4 GDP release."

The ONS said at the time of the release of its third-quarter GDP that business investment was still 8.1% below pre-pandemic levels .

"Now, with upward revisions to the back data and a 4.8% q-o-q increase in Q4 2022, it was more or less back to where it was pre-pandemic. Long may that last (and not be revised away!)" says Elizabeth Martins, Senior Economist at HSBC.

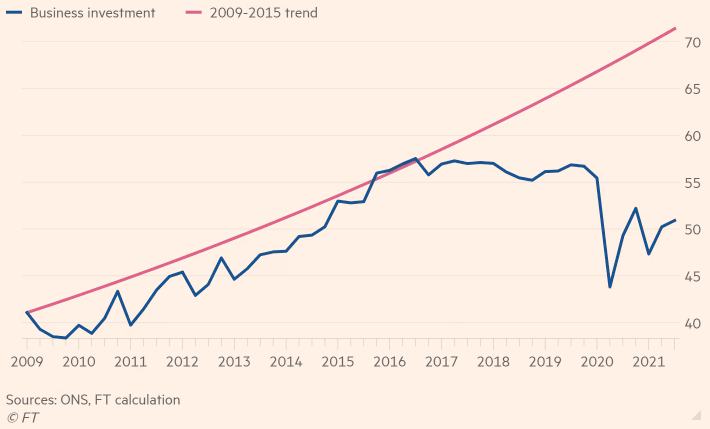

Above: "The ONS has revised up business investment" - HSBC.

Business investment is spending by private businesses on physical capital, which are long-lasting assets used to produce goods and services.

The more a business invests in physical capital, the greater the output produced by the humans that operate the capital.

Business investment is, therefore, a key driver of growth and wealth in an economy but recent years have seen the UK lag behind peers in business investment, in fact across 31 mostly wealthy nations in the OECD, the UK had the fourth-lowest business investment in 2020.

Economists say its recovery holds the key to a more robust UK economy in the 2020s.

"Low business investment is one of the main reasons economists give for poor productivity and very slow growth in living standards since the late 2000s," says David Milliken at Reuters.

The UK will therefore need to boost business investment to achieve meaningful growth, which is why the Q4 figures are welcomed by some economists.

But business leaders and economists warn the end of the Government's super-deduction could mean the fourth-quarter business investment figures were flattered by companies acting to take advantage of the break before it ends.

Andrew Goodwin, Chief UK Economist at Oxford Economics, says the 4.8% increase in business investment was potentially "aided by firms seeking to benefit from the super-deduction tax incentive which ends this April".

The government's super-deduction programme allows companies investing in qualifying new plant and machinery assets to claim a 130% super-deduction capital allowance on qualifying plant and machinery investments and a 50% first-year allowance for qualifying special rate assets.

Above: UK business investment has underperformed the trend. Chart: £BN in 2019 value (taking into account an ONS error). Image courtesy of the FT.

The ONS said the primary drivers of Q4 business investment growth were the transport sector, which made the largest contribution, ICT equipment and other machinery and equipment, and other buildings and structures.

"This might support the thesis that supply has been more of a factor than demand in the weak business investment we have been seeing (though, again, much of this has now been revised away)," says Martins.

The S&P Global PMI report for February meanwhile confirmed the improvement in business investment is ongoing in the first quarter of 2023.

"Positive sentiment was often attributed to improving sales pipelines, the restart of delayed projects and signs of a recovery in business investment," said S&P Global.

But Jeremy Hunt will send Britain in a "drastically anti-investment direction" if he forges ahead with a planned increase in corporation tax, BT has warned on February 23.

The UK telecoms company said the country was approaching a "cliff edge deterioration in the tax environment for investment" ahead of an increase in the tax rate in April from 19% to 25%.

The first corporation tax since 1974 was announced by then-Chancellor Rishi Sunak in March 2021, a move that would see the headline rate of corporation tax rise to 25% for company profits over £250K from April 2023.

Nevertheless, there is some evidence that cuts to corporation taxes over the years had little to no impact on overall business investment.

The UK cut its headline rate of corporation tax rate from 30% in 2007 to 19% in 2017, but in 2020 private-sector investment was the lowest in the G7 at 9.8% of GDP. In fact, across 31 mostly wealthy nations in the OECD, Britain had the fourth-lowest business investment in 2020.

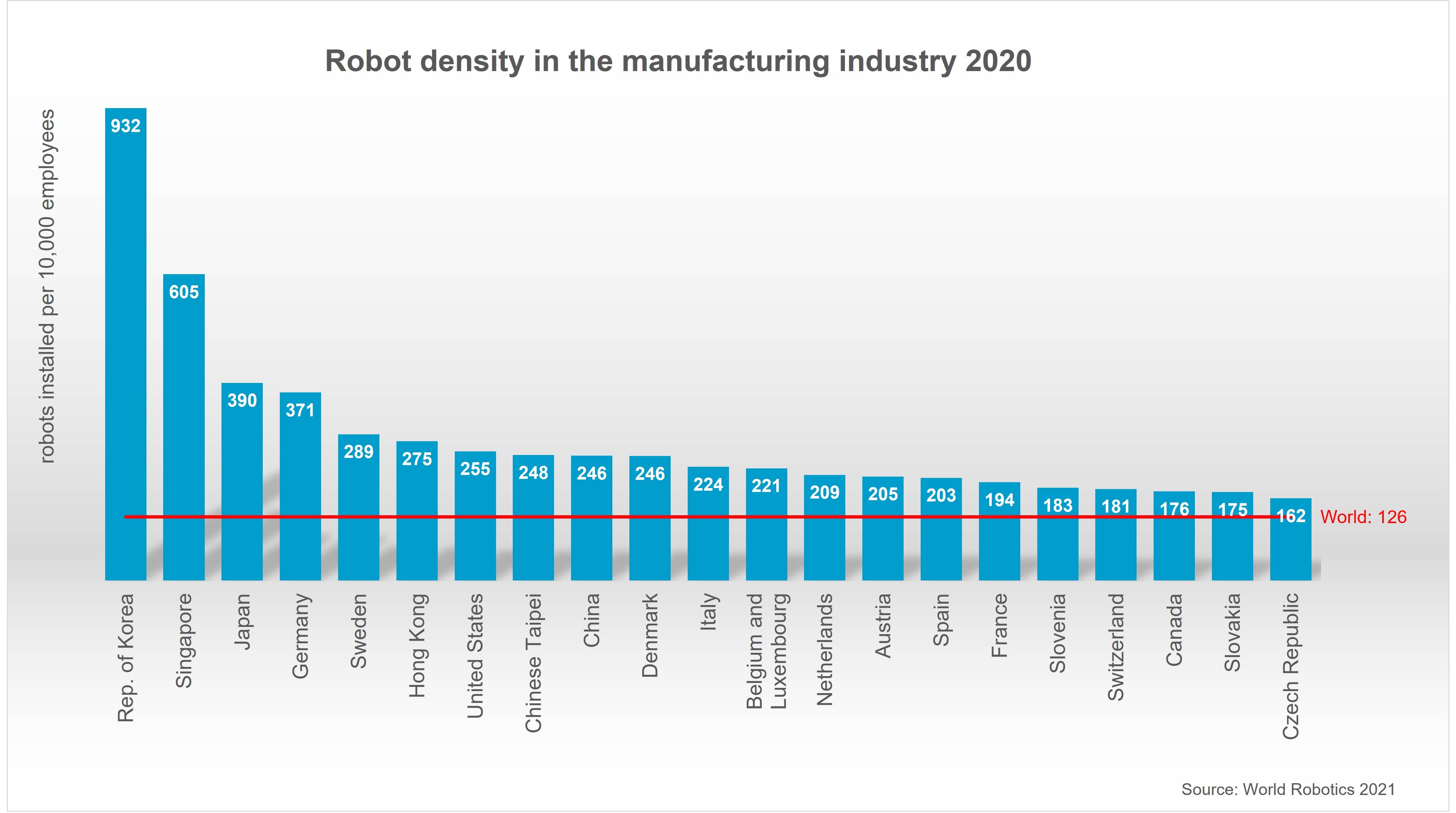

When faced with greater corporation tax on profits, some companies might in fact be incentivised to invest some of those profits to avoid the taxman. And here is some food for thought: the German corporate tax average is around 29.8%, yet the country is one of the most robot-intensive economies in the world owing to years of healthy business investment.

Above: The UK fails to rank meaningfully against peers when it comes to the investment in the machinery and technology required to 'tool-up' its labour force.

According to the CBI, the key to ensuring business investment growth continues will be the continuation of the super-deduction tax, in some form.

"All eyes are on the Chancellor’s March budget when businesses will be looking for a bolder approach to tackling labour and skills shortages and falling business investment. In particular, firms will be looking for a permanent replacement to the super-deduction," says Ben Jones, Lead Economist at the CBI.

UK businesses also now face a greater incentive to mechanise and invest in physical capital following the pandemic, leading to a shrinking labour force.

A phenomenon of "missing workers" that has emerged in the wake of the pandemic means robots and automated processes might be the only way companies can fill roles and boost output.

This will require an inevitable boost to business investment over the coming years, particularly given the UK's ageing population and Brexit rules which mean EU workers can no longer seamlessly slide into vacancies.

Why Business Investment Makes for a Richer Country

The more a business invests in physical capital, the greater the output produced by the humans that operate the capital.

An operator of a high-tech robot would therefore earn more than he would as a member of a team of employees that would have previously done the robot's job.

This leads to a higher GDP per capita outcome for a country (GDP per capita gives an indication of the share of a country's total wealth each person owns).

But according to a recent report by the International Federation of Robotics, the UK robot market is the world's fifteenth largest, but robot density per employee puts it twenty-fourth.

This is much lower than most other industrialised countries in Europe and the lowest of the G7 nations.

"This means businesses are missing out on the benefits that automation can bring, from increased productivity to reduced staff absence. If UK manufacturing is to compete on an international stage, this has to change," says PALpack, a high-tech UK manufacturer, in response to the report.