Investors "A Lot Less Bearish", Shift Out of U.S. Stocks: Bank of America Global Fund Manager Survey

- Written by: Gary Howes

Above: January rotation into utilities, RoW and out of US, stocks, healthcare

A much-watched survey of fund managers shows a thawing in the gloom that characterised the final quarter of 2022 as recession fears subside and money is allocated to Emerging Markets and the European Union at the expense of cash and the U.S.

The Bank of America Fund Manager Survey reveals investors are still bearish but a lot less bearish than in the fourth quarter, amidst China reopening optimism and a belief the Federal Reserve is close to ending its interest rate hiking cycle.

The result is falling cash levels in their accounts as they allocated to Emerging Market and European Union assets with the UK also benefiting.

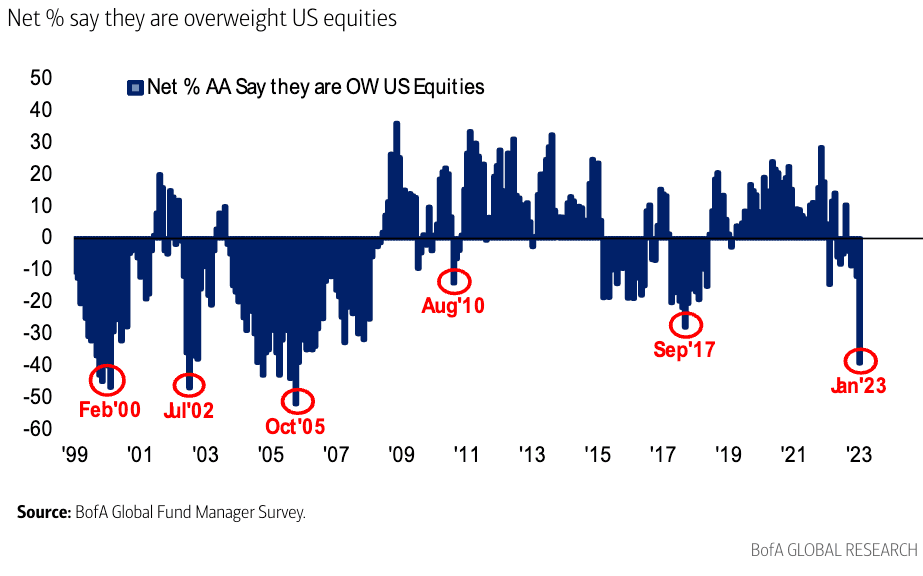

The U.S. is a loser with the survey revealing the biggest unwind of U.S. exposure since October 2005.

Above: January sees a collapse in US equity allocation.

Recession concerns fade as China reopens its economy: China growth expectations are at a 17-year high as 91% expect "full reopening" of the world's 2nd largest economy in 2023.

The survey also shows a six-month low in recession fears (51%) and a one-year high in global growth optimism (net -50%).

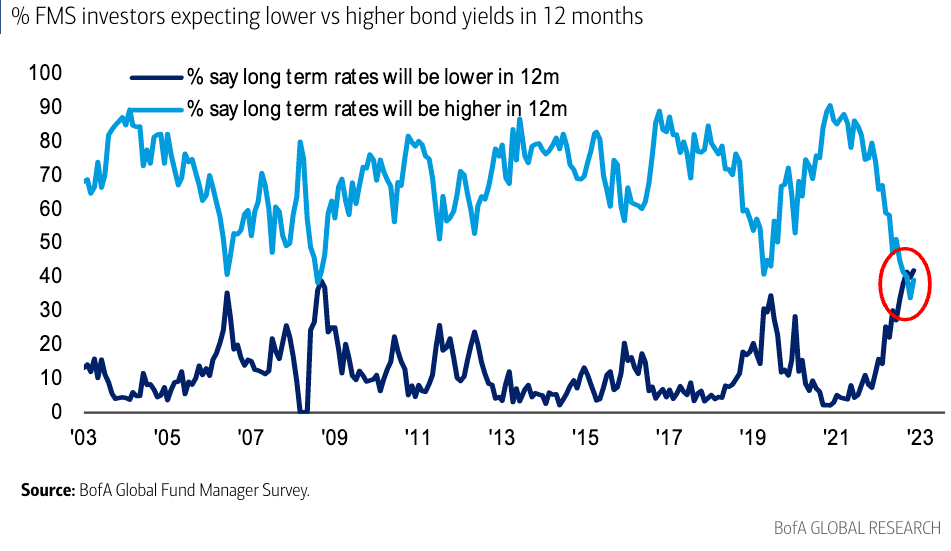

Survey data reveals a "rate shock" emanating from the Federal Reserve is ending as perceived liquidity conditions turn more benign.

Above: More investors think long-term rates lower, not higher, in 2023.

Investor perception of negative "liquidity conditions" were a headwind for risk assets for most of 2022 and were most negative in October 2022 when U.S. Treasury volatility peaked.

Interestingly, despite the talk of a decline in the Dollar over 2023, the "long Dollar" trade was still said to be the most crowded position (32% of responses), followed by long ESG assets (17%) and long China equities (12%).