London Still the Top FX Spot but Market Share Slides in Latest BoIS Survey

- Written by: James Skinner

- London the top FX spot but market share dips

- United States & Singapore market shares rise

- GBP & CAD gain increased share of FX trade

- EUR & JPY shares of FX market turnover slip

Image © Adobe Images

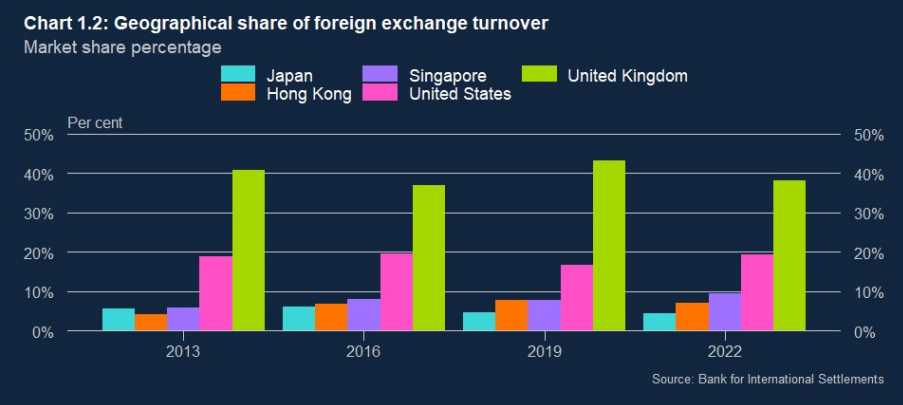

London remained the world's top foreign exchange spot and currency trading capital by a long shot in the triennial Bank for International Settlements survey for April 2022 but lost some of its market share to financial centres in the United States and Singapore along the way.

Daily turnover in the currency market rose from $3.57 trillion to $3.75 trillion between April 2019 and April 2022 while the lion's share of deals underlying this latest number continued to be booked through sales desks of banks and other financial firms operating out of London in the latest survey period.

But while the UK remained the top currency trading venue in the latest Bank for International Settlements settlements survey its market share did also fall by more than five percentage points from 43.2% to 38.1%, while the United States was the most notable beneficiary of this particular form of slippage.

The United States' market share rose to nearly 20% while Singapore's increased to almost 10% in a survey of interdealer trading activity at some 47 banks, brokers and other firms carried out over 19 days in April 2022.

"Turnover in foreign exchange spot activity decreased from $1,144 billion per day in April 2019 to $997 billion per day in April 2022, and now accounts for 26.6% of total turnover. Conversely, turnover in foreign exchange swaps increased from $1,646 billion per day in April 2019 to $1,945 billion per day," the Bank of England said in summary of the survey results late on Thursday.

More than half of trades related to business between dealer firms and were carried out between the top five market participants while some 82% of business was concentrated within a group encompassing the top 10 market participants.

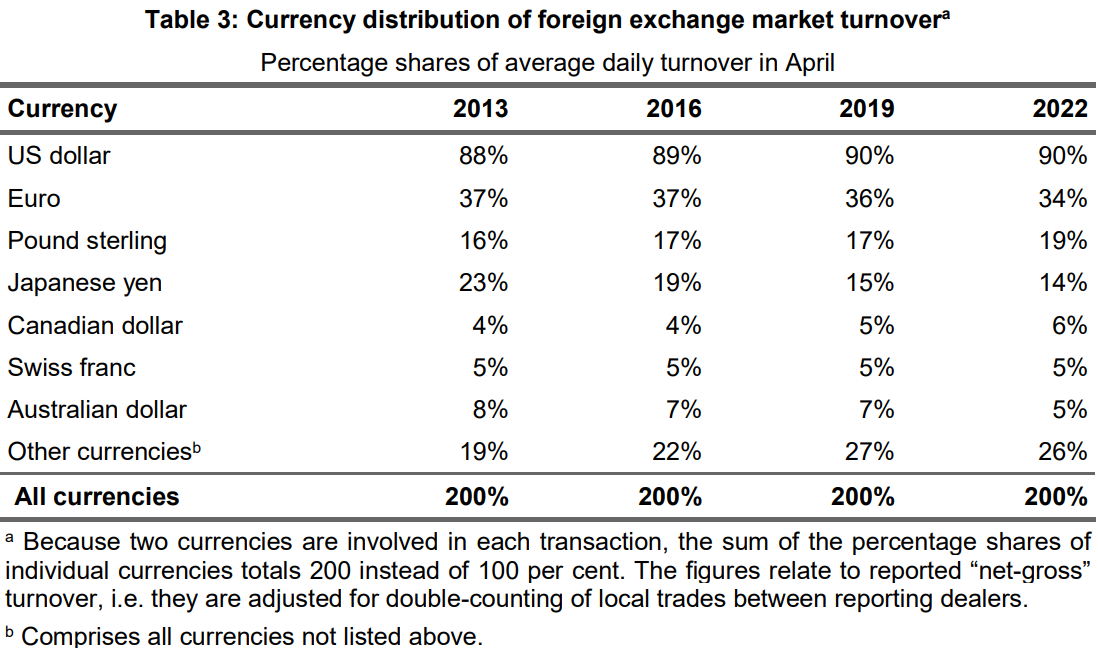

Meanwhile, at the individual currency level the U.S. Dollar remained dominant after featuring as one of two parts in trades accounting for 90% of daily turnover, a percentage that was unchanged from in the 2019 survey.

However, trades involving Euros ebbed from 36% to 34% of the total while those involving Japanese Yen slipped from 15% to 14% during a period in which the Canadian Dollar and Pound gained an increased share of turnover.

Canadian Dollars featured as one of two parts in trades accounting for 6% of daily turnover, up from 5% previously, while Pound Sterling's share of daily turnover rose from 17% to 19% in the April 2022 survey.

Turnover in Swiss Francs was unchanged at 5% and the Australian Dollar's share of trade dipped from 7% to 5% while the "other currencies" category saw its share fall from 27% to 26% in the latest period.