UK Economy: "Recession will Likely be Avoided this Year" says Credit Suisse

- Written by: Gary Howes

Image © Adobe Images

"Recession will likely be avoided this year," says Sonali Punhani, Chief UK Economist at Credit Suisse, as she delivers her team's latest forecasts for the UK economy.

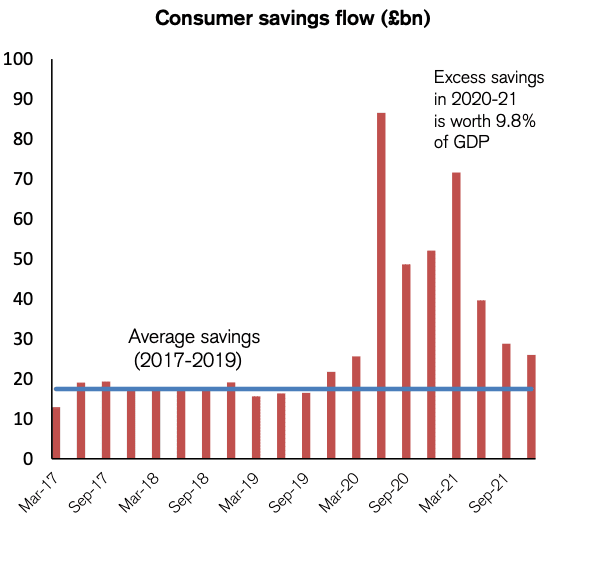

Punhani says the government's fiscal support of about 1.5% of GDP, consumer excess savings of 9.8% of GDP, and the tight labour market should drive a recovery of services spending that prevents a recession this year.

The call comes on the day it was revealed by the ONS the UK economy expanded 0.8% quarter-on-quarter in the first quarter of 2022, which was in line with economist expectations and takes the year-on-year growth rate to 8.7% for the first quarter.

However, surging inflation and cratering consumer confidence has lead economists right across the board to downgrade their forecasts for UK economic performance over the remainder of the year, with the Bank of England warning in May a recession could grip the UK by year-end.

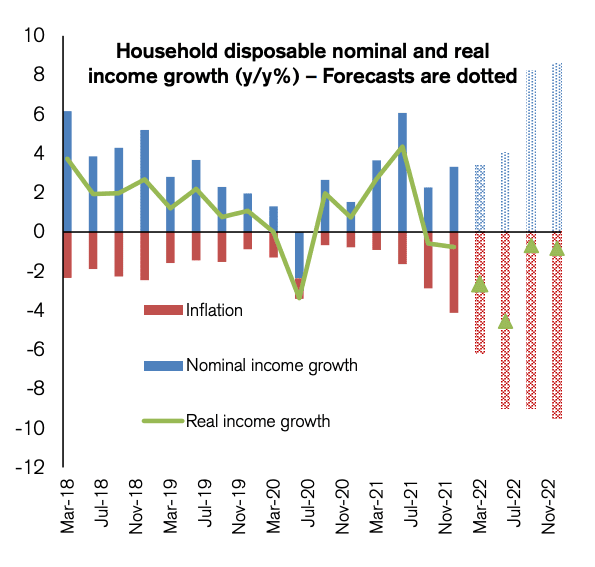

Source: ONS, Credit Suisse. Last data point: Q4 2021.

Indeed, Credit Suisse joins others in expecting a contraction in UK economic activity in the second quarter, seeing contraction of 0.4%.

But the third quarter should see a return to growth to the tune of 0.3% quarter-on-quarter as the bank holiday effect of the previous quarter is recovered.

An additional bank holiday was added to June to celebrate the Queen's Platinum Jubilee, which automatically delivers a lower growth profile.

Credit Suisse do see a smaller growth contraction in the fourth quarter of 0.1%.

Source: ONS, Credit Suisse. Last data point: Q4 2021.

A technical recession is recorded when an economy registers two consecutive quarters of negative growth, nevertheless it is clear the economy is expected to slow notably.

"As the temporary fiscal boost in H2 22 fades, the ongoing stagnation of real incomes should combine with BoE tightening and slower trading partner growth to cut GDP growth to 0.5% in 2023 after 3.4% in 2022," says Punhani.

"Given we are forecasting growth close to stagnation, risks of a recession in 2023 have increased," she adds.

Three risks that would make a recession likely would be

(1) more aggressive BoE hikes to above 3% by year-end

(2) any shock that pushes the Euro area into a recession

(3) if the UK PMIs drop to below 45

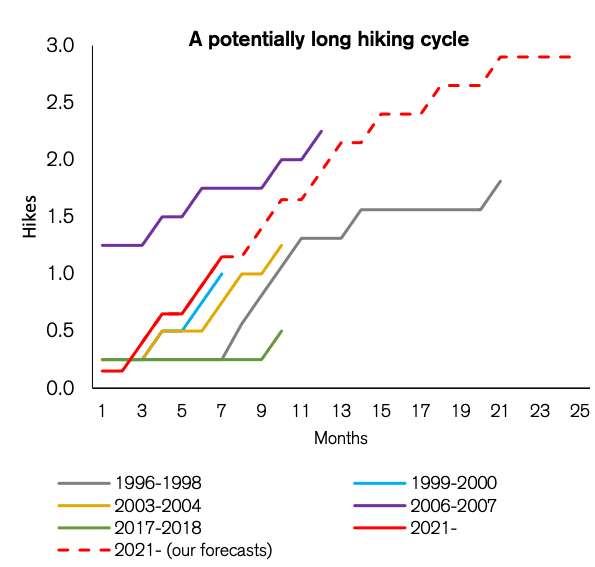

Credit Suisse expects the Bank of England to hike Bank Rate a further 100 basis points in 2022 to 2.25% by end-2022, which is less aggressive than market pricing which currently sees about 160 bps of hikes coming.

Source: Bloomberg, Credit Suisse. Last data point: Market pricing as of 22 June.

Nevertheless, "the slower pace of BoE hiking relative to fundamentals should mean that the BoE carries on with its hiking cycle for longer. We expect three more hikes in 2023," says Punhani.

Bank Rate is expected to reach 3.00% by end-2023.

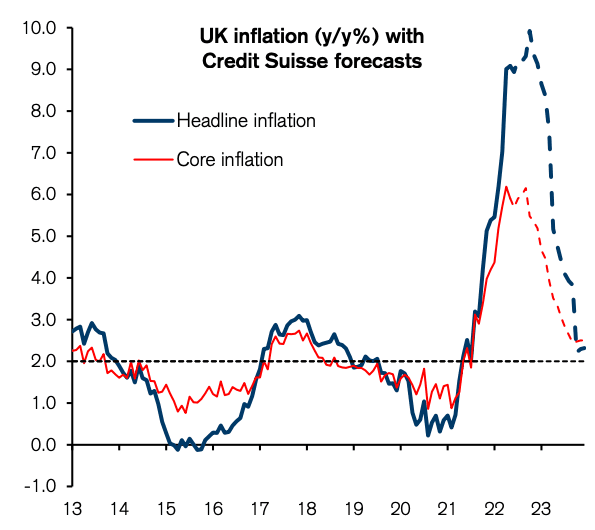

The Bank will be motivated to continue its pursuit of higher rates by an ongoing rise in inflation; Credit Suisse forecasts above-consensus inflation of 8.5% in 2022 and 4.8% in 2023.

Source: ONS, Credit Suisse. Last data point: May 2022. Dashed lines are CS forecasts.

Inflation is expected to remain between 9.0% and 10% in the second half of 2022, peaking at 9.9% in October, and begin falling meaningfully only in the second quarter of 2023.

"Although some signs of an easing in core goods inflation are emerging, higher energy and food prices, supply bottlenecks, and wage growth are likely to keep pushing up inflation," says Punhani.

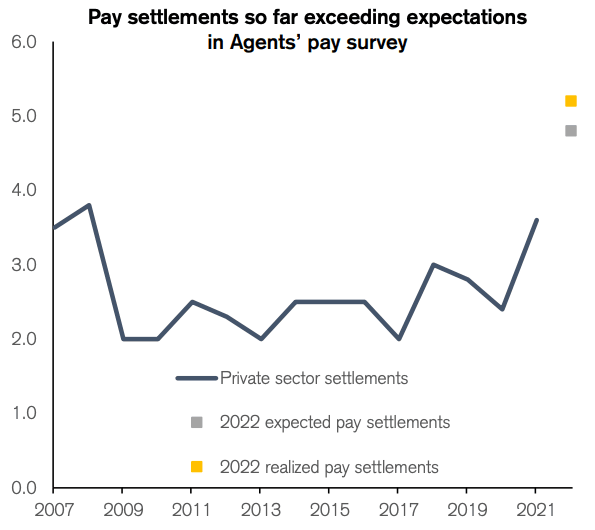

Also maintaining pressure on the UK's inflation rates will be a 'tight' labour market that should see wage growth remaining above 4% according to Credit Suisse's estimates.

"Robust labour demand is clashing with participation rates that are 1% below pre-pandemic levels, while Brexit-related reductions in foreign labor should keep the labour market tight," says Punhani.

Source: BoE, Credit Suisse. Latest data point: Q2 2022.