Bank of England's Bank Rate will Peak at 1.25% to Take the Sting Out of Mortgage Repayments says NatWest

- Written by: Gary Howes

Image © Adobe Stock

A squeeze on home owners from rising interest rates will become apparent by the second half of 2023 says NatWest Markets, an expectation that will prompt the Bank of England to rein in rate hikes.

The UK lender says homeowners are currently largely shielded from near-term Bank of England interest rate hikes as fixed rate mortgages now make up the vast majority of the market, but with most having a lifespan of 1-3 years this protection will inevitably fade.

The Bank of England said in a recent paper "the housing market is closely linked to consumer spending. When house prices go up, homeowners become better off and feel more confident."

Any prospect of house price growth reversing in 2023 as mortgage rate rises hit could therefore contribute to an anti-inflationary slowdown in economic growth.

Above image courtesy of Pantheon Macroeconomics.

The Bank of England will therefore be wary of pushing interest rates as high as money market pricing currently suggests, for fear of squeezing the economy.

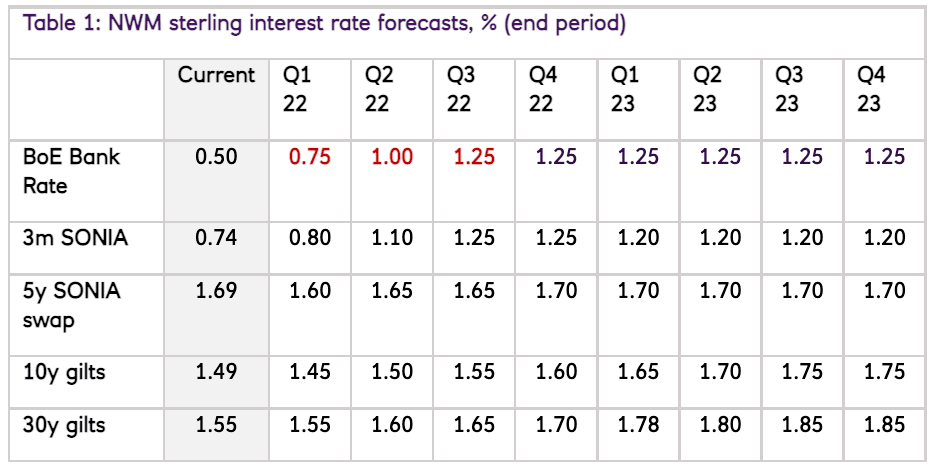

Market pricing currently anticipates a third rate hike to come in March and Bank Rate to be at 1.75% by year-end, with further hikes pencilled in for 2023.

But NatWest Market's calculations suggest this kind of pricing would place Bank Rate far above where the Bank of England will establish the so-called terminal rate of this hiking cycle.

"The most powerful monetary policy transmission channel in the UK is via the mortgage market given its size and sensitivity to Bank Rate changes," says Ross Walker, Chief UK Economist at NatWest Markets.

"Part of the rationale for pricing materially higher rates than BoE policymakers are signalling may rest on the view that the high proportion of fixed-rate mortgages (~80% of the stock) has removed much of the potency of monetary policy," he adds.

But Walker argues this assessment is wrong.

"One way of gauging how far Bank Rate will need to rise is to model its impact on household debt-servicing cost," says Walker.

Above image courtesy of Pantheon Macroeconomics.

Economists anticipated a delayed pass-through from the hiking of Bank rate to mortgage rates with NatWest estimating that Bank Rate rising to around 1.25% by August 2022 would be sufficient to raise households' (mortgage) debt-servicing costs to longer-run averages by the second half of 2023.

"We therefore regard these levels of Bank Rate as a proxy for a ‘neutral’ policy rate," says Walker.

The neutral rate is the rate at which monetary policy is neither stimulatory (as it is now) or restrictive.

It therefore presents a theoretical interest rate target for central banks that are trying to recalibrate policy settings following a stimulatory period.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, says rising mortgage rates will ultimately in turn limit house price growth, which will have far-reaching economic impacts.

"Households have protection from rising rates in the near term," says Tombs, "rising mortgage rates, however, will slow house price growth."

Data show mortgage debt now accounts for around 90% of all UK household debt, which is substantial in size according to Walker.

The FCA says the UK's mortgage stock stood at £1.6 trillion by the end of the third quarter 2021 and NatWest finds this to be equivalent to around 100% of household after-tax income.

Image source: NatWest Markets, Bloomberg.

The Bank of England will therefore account for the delayed impact of rate hikes on mortgage repayments in assessing policy settings.

Walker notes most fixed-rate mortgage products are typically set for a relatively short periods of time of 1-3 years.

"So frequent re-setting means that reports of the death of monetary policy tightening are greatly exaggerated," says Walker.