Eurozone Inflation to "Settle Well Below Target": BofA

- Written by: Gary Howes

Image © European Union.

The European Central Bank (ECB) is up on Thursday and while investors see no chance of a policy change it will be the central bank's inflation projections that tell a story of when interest rates might rise.

Markets presently anticipate a rate hike at the end of 2022/very early 2023: how these expectations shift following Thursday's meeting will have some potential implications for the Eurozone rates market and the Euro.

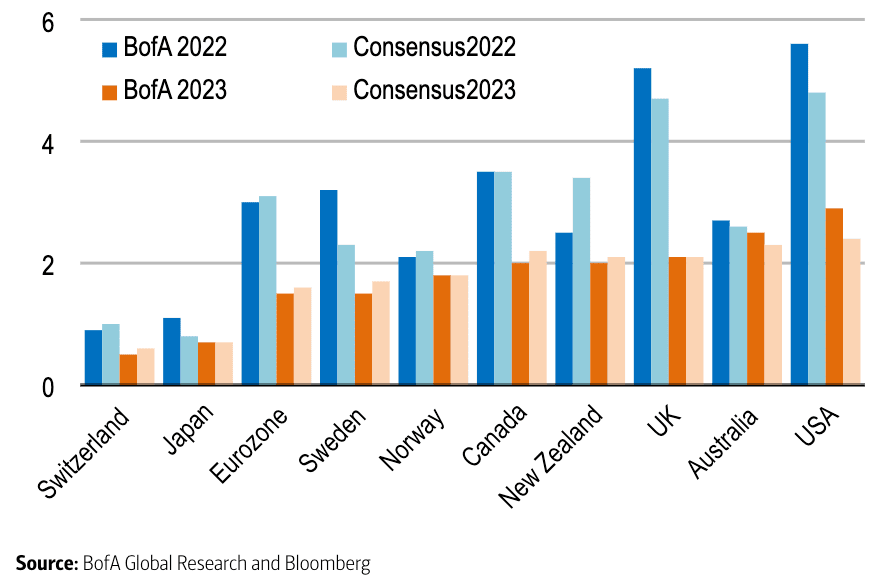

Economists at Bank of America warn in an ECB preview note that inflation in the Eurozone will fall fast and settle lower than it will elsewhere, a view that if correct implies little reasons for the ECB to move on rates in 2022.

"EZ inflation to settle well below target and one of the lowest in G10 once base effects fade," says Ralf Preusser, an economist at a Bank of America.

Above: "G10 inflation forecasts, 2022-23" - BofA. "EZ inflation to settle well below target and one of the lowest in G10 once base effects fade".

Preliminary January inflation data from Germany showed annual inflation edging lower from 5.3% to 4.9% amidst signs the peak could already be in for the Eurozone's largest economy.

Bank of America expects Lagarde to say inflation will come down eventually and there are no signs of second-round effects on wages.

The impact of the current round of high inflation on wages is important given the ECB's Chief Economist Philip Lane last month effectively tied the prospect of future rate hikes to the performance of wages.

Lane said wage increases would need to reach 3.0% for longer-term inflation rates to rise above 2.0% on a more consistent basis.

Given Eurozone wage settlements are 2.5% this target remains some way off.

"So far, we do not see a big response of wages. We do expect a response of wages but what is critical is how big," said Lane in an interview.

Bank of America anticipates Lagarde to tell markets inflation expectations are not "unanchoring to the upside" and market-implied expectations have actually weakened a little again as of late.

"Most end-point forecasts for Euro area inflation remain below ECB target, and haven't really moved over time, another dichotomy vs the US. She will probably mention upside risks - that's normal, they exist, but in our view need labelling as exactly that: a risk, not a base case," says Preusser.

Bank of America expects ECB President Christine Lagarde to signal 2022 rate hikes are unlikely, while remaining non-committal on 2023 in a development that could unsettle Euro bulls.

But, "for the ECB to successfully push back on market pricing, we may have to wait until lower inflation can re-embolden the doves," says Preusser.