Bank of England's Pill Steers a Path Towards Rate Hikes

- Written by: Gary Howes

-

- Pill sees stubborn inflation

- And tightening labour market

- But says negative interest rates feasible

- Some economists fear Bank is heading for a policy mistake

Above: File image of Huw Pill. Image © Global Utmaning, Lasse Skog. Modified from original, reproduced under CC licensing, non-commercial.

Huw Pill, the Bank of England's new Chief Economist has given his first views on current UK economic and monetary conditions and whether current interest rate and quantitative settings are desirable.

Cutting through the fluff, all the market really wanted to know was whether he falls into the 'hawkish' or 'dovish' camp on the Bank's Monetary Policy Committee (MPC).

Where he lands on this spectrum could influence the direction of UK monetary policy, specifically whether an interest rate rise could come as early as late-2021 is delivered.

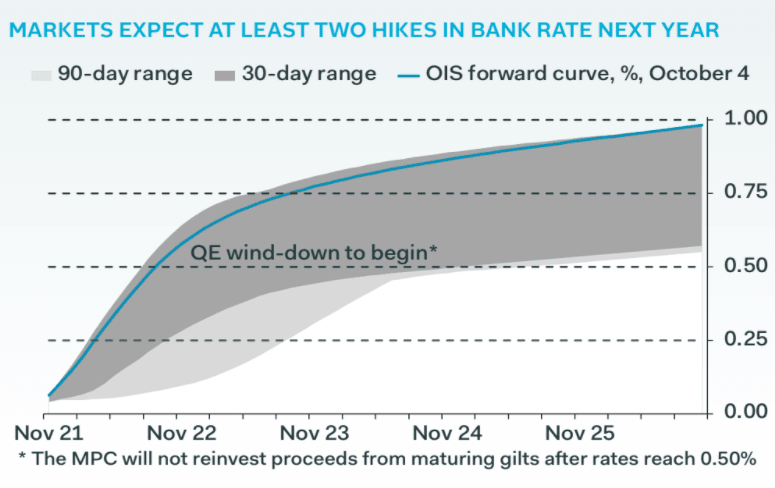

Huw's written evidence to Parliament's Treasury Select Committee comes as expectations for a rate rise remain relatively hefty, with investors pricing 57 basis points of increase to the Bank Rate by the end of next year.

"This implies that two increases in Bank Rate—first to 0.25%, then to 0.50%—are seen as a near-certainty, with a two-thirds probability attached to a further increase to 0.75% by the end of 2022," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

The initial market reaction - which was benign for Sterling - signals that Pill's testimony is consistent with the above pricing.

Above image courtesy of Pantheon Macroeconomics.

Getting to the answer of where Pill saw interest rates going required embarking on a round about journey, starting with his views on the current surge underway in UK inflation.

In written evidence to the Treasury Select Committee Pill said UK inflation "has surprised to the upside," adding that:

"The magnitude and duration of the transient inflation spike is proving greater than expected."

At the same time, economic activity has disappointed against expectations although the labour market "has tightened", a recognition that unemployment has fallen and job vacancies have risen.

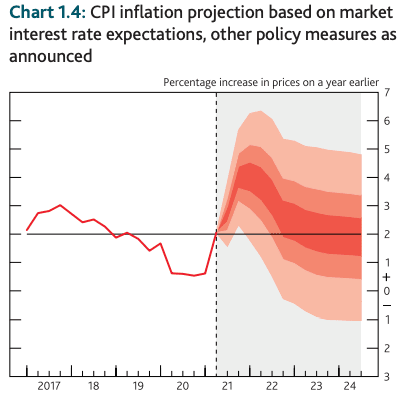

Pill says the current surge in inflation is down to global factors and should dissipate, but that there was evidence that it would leave a mark on the UK's longer-term inflationary trends.

"Framing these issues in a more general setting, the risks to inflation, growth and employment in coming quarters will reflect both the sustainability of the recovery in demand and the persistence and magnitude of supply constraints," said Pill.

"In my view, that balance of risks is currently shifting towards great concerns about the inflation outlook, as the current strength of inflation looks set to prove more long lasting than originally anticipated," he added.

Image courtesy of the Bank of England.

For markets, the important question is how Pill's view on the economic outlook will influence his vote on whether or not to raise interest rates in the near future.

"I would have judged the necessary condition embedded in the MPC’s forward guidance

to have been met at the August meeting," he said.

The forward guidance referenced by Pill states that, "there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably.”

On the face of this answer alone Pill would fall into the hawkish camp on the MPC, i.e. the group of thinkers who see fit to raise interest rates sooner rather than later.

But this haste leads some economists to worry the Bank is on course to make a mistake.

"We’re more worried about inflation than stagnation for now, but central banks are tempted to do what the ECB did in 2008 – hike when growth is slowing. That ended badly for Europe. The UK MPC seems to have itchier fingers than most despite also facing more growth hurdles than most," says Kit Juckes at Société Générale.

Juckes refers to what is widely considered a poor episode for monetary policy when the European Central Bank (ECB) hiked interest rates during a crisis.

The impact has scarred the ECB and informed their ultra-cautious approach ever since.

"The disastrous July 2008 hike will forever haunt them," says Brent Donnelly, President of Spectra Markets, "it could easily be the Bank of England in the lead this time, hiking into a crisis."

But, Pill also revealed that he believed cutting interest rates to below 0% was a viable option should it be required.

This will push back somewhat against fears the Bank's new Chief Economist is keen to run into what some perceive as a detrimental interest rate hike.

"Negative interest rates are now a live instrument of monetary policy in the UK," he said.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

This answer can be taken as a 'dovish' counter to his 'hawkish' view that conditions for tightening monetary policy had now been met.

But, Pill does indicate he is scepticism over the employment of negative interest rates, holding a view that the scope for interest rates to fall into negative territory in the current institutional setting remains limited

"I do expect interest rates to remain at relatively low levels for the coming years, even as the impact of the Covid-19 pandemic recedes," he added.

So while there are concerns amongst economists that the Bank of England could commit a mistake by raising interest rates too soon, Pill has yet to pick which side of the debate he stands.

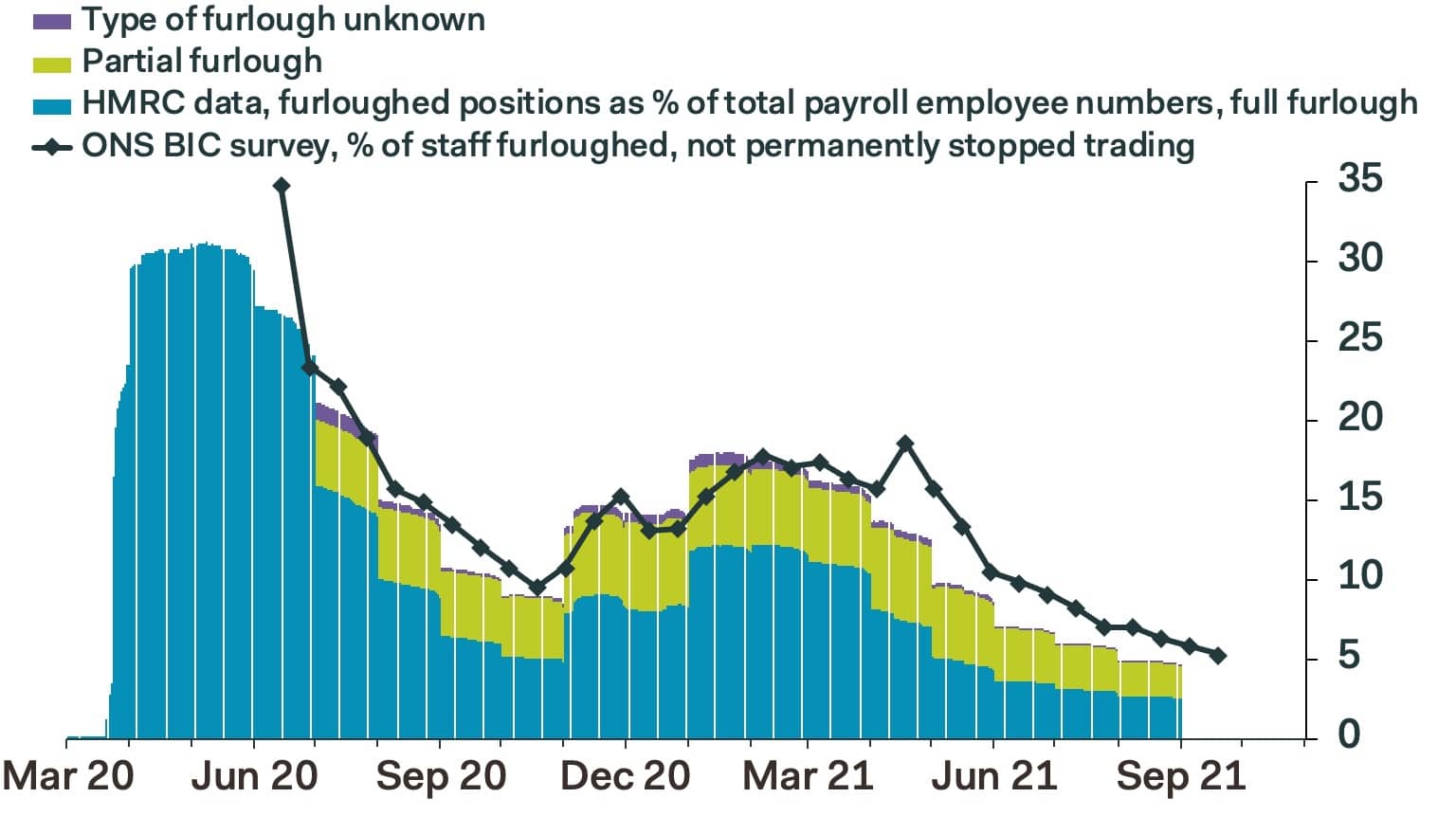

Like the majority of the MPC he indicated he would like to see how the labour market responds to the ending of the furlough scheme at the end of September, judging that a benign outcome would see him lean towards tightening.

Above: Official data showed 4.6% of all employees were still furloughed at the end of August. Image courtesy of Pantheon Macroeconomics.

As a result, the impact of incoming economic data that sheds light on labour market dynamics will be unusually important to the Pound and currency markets over coming weeks.

"With the recovery likely lacking momentum, we think that the MPC will be able to take its time and hike Bank Rate only to 0.25% next year, most likely in Q2," says Pantheon Macroeconomics' Tombs.