UK Economy Keeps One Foot in Grave as Rebound Marred by New Lockdown

- Written by: James Skinner

Image © Adobe Stock

The UK economy kept one foot in a proverbial grave last quarter when a record rebound proved unable to backfill the hole dug by the government in its coronavirus containment efforts, although even that tepid recovery now faces going into reverse due to the current quarter's lockdown.

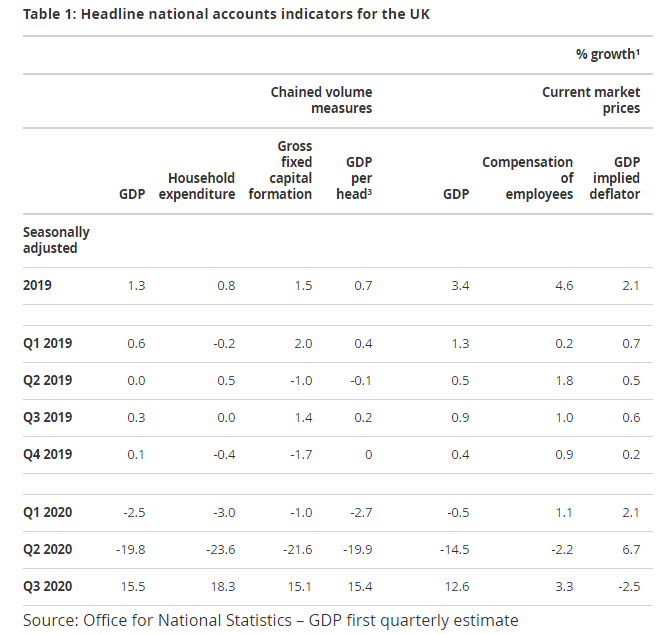

GDP rose by a record 15.5% in the third-quarter as the economy reopened from the shutdown imposed between March and July, partly reversing the upwardly-revised 19.8% fall seen in the prior period, with accomodation and food services featuring as the stars of the show after being closed in the prior quarter.

Retail and housebuilding trades also picked up notably, while professional, scientific, technical and legal services led the recovery in September, with all included as part of the services sector recovery.

Production and construction sectors also both saw record increases in output, although growth in all sectors slowed quickly throughout the quarter. Monthly GDP growth was +6.3% in July but fell to just +1.1% in September and still left output nearly a tenth below its pre-coronavirus level.

"We now know that the record breaking fall in GDP of 19.8% q/q in Q2 was followed by a record breaking rise of 15.5% q/q (consensus 15.8%, CE 15.6%) in Q3. But growth of just 1.1% m/m (consensus 1.5%, CE 1.0%) in September shows that the recovery was rapidly running out of steam at the end of Q3 even before tighter restrictions and the second lockdown were imposed," says Thomas Pugh at Capital Economics.

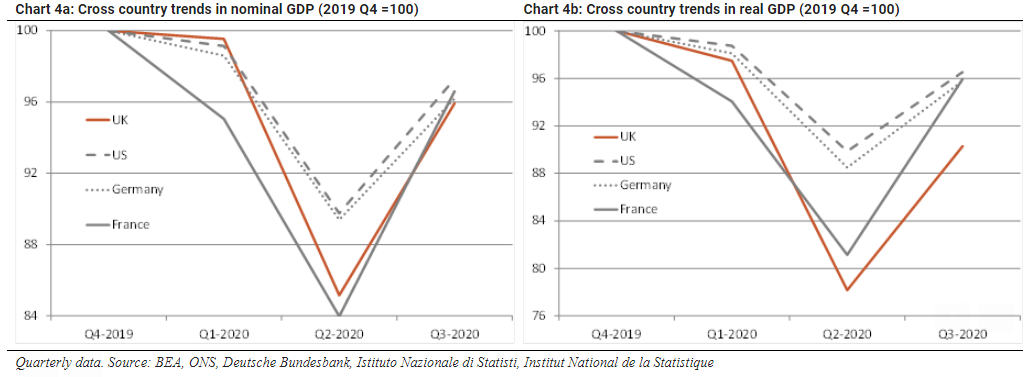

For the 12 months to the end of September, GDP was still 9.6% lower than at the same time one year ago and -9.7% beneath the level observed in February 2020. British output fell at more than twice the pace of that in Italy, Germany and France while declining at nearly three times the pace of the U.S. economy.

Larger numbers of coronavirus infections and deaths combined with an economy that's built mostly on services that were disproportionately impacted by the earlier shutdown all in part explain why the UK's GDP declines are thought to have been larger than in other countries and its recovery slower.

"Once the UK statistical office estimates that government output has returned to normal levels, it will be possible to better judge the shape of the UK recovery versus other economies on the basis of headline real GDP estimates. Until then, nominal comparisons may provide a better guide," says Kallum Pickering, a senior economist at Berenberg. "Nominal aggregate spending was at a similar point in Q3 relative to pre-pandemic levels across all four economies."

Source: Berenberg.

Britain's economic recovery was bolstered in August by a Eat Out to Help Out scheme from HM Treasury and the ongoing government furlough scheme that pays 80% of wages to workers affected by the pandemic.

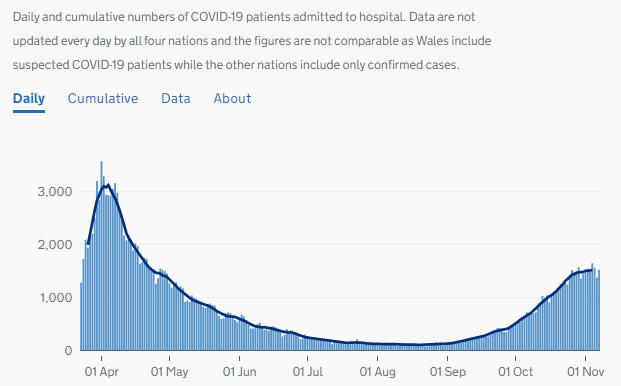

But it's also likely to have been extinguished in the final quarter after a November shutdown was announced in response to a second wave of infections that has grown to be larger than the first.

The current lockdown is less stringent, with workplaces and schools both still open while only hospitality businesses and supposedly non-essential retailers having been required to close. Nonetheless, economists still anticipate a fresh contraction that will further delay the complete recovery of lost output.

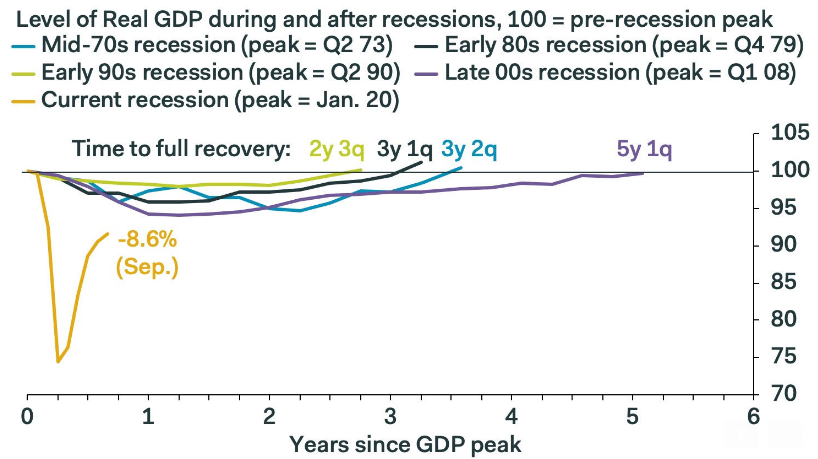

"Looking ahead, GDP probably was no higher in October than in September," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. "Thereafter, the second lockdown has prompted us to pencil-in a 6% month-to-month drop in GDP in November, followed by a 5% rise in December; the rebound will be incomplete as we doubt the government will choose to return fully to the loose Covid-19 restrictions that were in place in October."

Source: UK Government.

Government says the shutdown will run until December 02, but also indicated at the beginning of the initial lockdown that it would only be for a number of weeks rather than months. It's possible that restrictions could be prolonged through year-end and, in some form at least, potentially for as long as it takes authorities to have a vaccine ready for distribution.

This is part of why economists are anticipating that it could take years for economic output to return to its pre-pandemic levels, despite it taking less than one quarter for it to shrink by a fifth. However, hopes of a return to normality were boosted this week when Pfizer said that its coronavirus vaccine candidate had proven highly effective in preventing infections among those with no history of having suffered from the disease.

"It’s a bit of a cliche to say that GDP data is ‘old news’ on arrival, but this has arguably never been more true than in the case of the UK’s third-quarter figures," says James Smith, a developed markets economist at ING. "We are likely to see a modest fall in GDP during October, reflecting the introduction of ‘tiered restrictions’ in England (which will have acted as a further drag on hospitality) and a local lockdown in Wales. However, the decline will be amplified in November, where we estimate we’re likely to see a 6-7% slide in monthly GDP on the month-long English lockdown. This will also result in a negative figure for Q4 as a whole."

Source: Pantheon Macroeconomics.