UK Recession Fears to Fade after Growth Accelerates in July, with Brexit Stockpilers in Driving Seat

- Written by: James Skinner

© Adobe Stock

- UK GDP rises by 0.3% in July as all sectors return to expansion.

- Manufacturing, services and construction industries all accelerate.

- Draws a line under earlier contraction, bodes well for the quarter.

- August tipped as another strong month as car plants to stay open.

The UK economy is on course to avoid a 'technical recession', forecasters said Monday, after Office for National Statistics (ONS) data revealed a sharp rebound in growth during July that bodes well for the third quarter outlook.

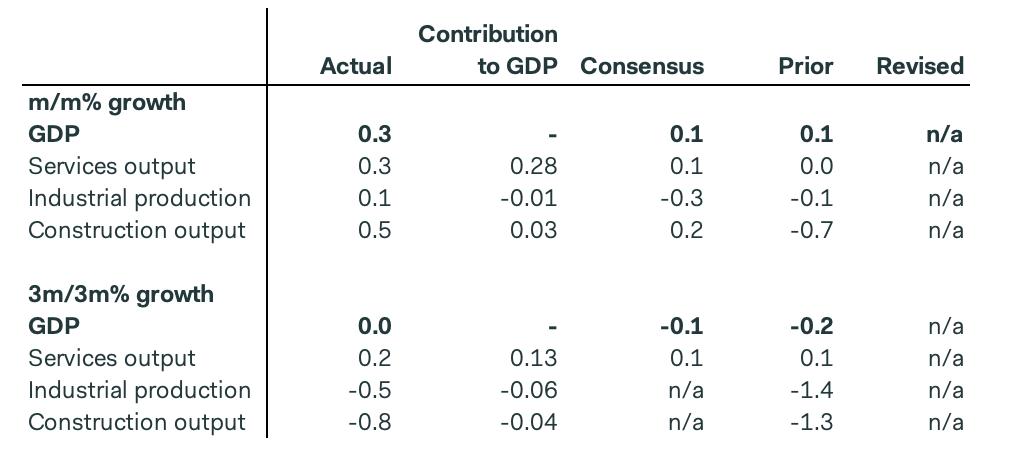

UK GDP growth was 0.3% in July, up from 0% previously, when markets had looked for an increase of just 0.1%. The result marks a strong start to the third quarter for an economy that shrank by 0.2% in the three months to the end of June, which had seen economists fret about the prospect of a technical recession, which is defined as two consecutive quarters of contraction.

All main industries expanded during the recent month, although most notable was the increase in output from the Brexit-transfixed manufacturing sector. Manufacturing output rose 0.3% in July after falling -0.2% in June, which some say is the result of renewed Brexit-related stockpiling that could continue to boost growth in the months ahead.

"Changes in GDP in July (consensus +0.1/-0.1%) provide more support to our view that the economy has not fallen into recession," says Paul Dales, chief UK economist at Capital Economics. "The 0.3% m/m rise in services GDP followed four months of no change and was partly due to a 1.1% m/m rise in transport and storage output. The latter is the first real sign that businesses could be bringing activity forward ahead of the possible 31st October Brexit deadline."

Above: ONS table detailing contributions to monthly GDP growth.

The ONS says pharmaceuticals companies were the most active in July, with output rising some 3.8% during that month alone. However, the weapons and ammunition industry also saw output rise notably, by 12.1%, which the ONS attributed to completion of some high value contracts. Rising manufacturing output was just one small part of the July story though, because output also expanded notably in the services and construction sectors.

"The pick-up in GDP in July is a reassuring sign that the economy is on course to grow at a solid—perhaps even above-trend—rate in Q3," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. "The 0.3% month-to-month rise in manufacturing might have been driven by firms once again stockpiling goods before the October Brexit deadline. But this pick-up contributed a mere 0.03pp to growth in overall GDP. "

Tombs has been tipping an increase in UK GDP growth for the months ahead because he expects firms to rebuild stockpiles of finished goods ahead of the October 31 Brexit deadline in order to insure themselves against any potential disruption at the ports. He says Monday's boost to growth from manufacturing was small and that it could pick up during the months ahead, an idea that July's trade balance data loaned support to.

Above: Pantheon Macroeconomics graph detailing quarterly and monthly contributions to growth.

Imports rose faster than exports during July, leading the trade in goods deficit to widen from £8.92 bn to £9.14 bn. However, if the second quarter decline in imports is to be reversed during the current period, as firms rebuild stockpiles, then they still have a long way to go. The ONS says total goods imports for the three months to the end of July were just £120.3 bn, down from £138 bn in the quarter to the end of June and a difference equal to nearly 1% of GDP.

"This improvement has been driven by a temporary decline in imports. British firms appear to be depleting the inventories they accumulated before the original Brexit deadline in March, rather than placing new orders with overseas suppliers. A rebuild of stocks before the October deadline likely will drive up both imports and the trade deficit again soon," Tombs says.

Markets care about GDP data because it reflects rising and falling demand in the economy, which has a direct bearing on consumer price inflation and is itself important for questions around interest rates. Trade balance data is important because it not only reflects real world supply and demand of a currency, but also provides clues on the likely pace of growth in a given period because imports are a subtraction in the calculation of GDP while exports are an addition.

"The British economy is surprisingly resisting the global slowdown for the time being. Nevertheless, I still expect the Bank of England to cut interest rates by the beginning of 2020 at the latest. The central bank won't be able to escape the global trend towards a looser monetary policy," says Marc-Andre Fongern, a strategist at MAF Global Forex.

Above: Pantheon Macroeconomics graph showing changes in manufacturer inventories.

"Manufacturing output should grow at a faster rate later in Q3, given that firms should add to their stockpiles at a faster rate as the Brexit deadline approaches, and given that most car plants didn’t shut as usual for maintenance in August," Tombs says. "July’s report leaves us feeling content with our above-consensus forecast for GDP to grow at a 0.4% quarter-on-quarter rate in Q3."

The economy contracted in the second quarter after the manufacturing sector ground to a standstill in April, as firms sold off stocks that were built up to abnormal levels ahead of the original March 29 Brexit day in order to insure against disruption at the ports. The halt in production drove a reversal in the broader economy, which shrank after growing 0.5% at the start of the year, but Pantheon and Capital Economics say another contraction should be avoided.

Monday's data comes amid heightened fears of both a general election as well as 'no deal' Brexit, after the opposition in the House of Commons and rebels within the governing Conservative Party hijacked the parliamentary agenda and passed a bill requiring Prime Minister Boris Johnson to seek another extension to the Article 50 negotiating period, contrary to the government's policy and opening a constitutional can of worms in the process.

Johnson, after staking his premiership on a pledge to take the UK out of the EU on October 31 regardless of whether formal arrangements have been agreed, is seeking to drum up support in parliament for an election in which the fate of Brexit will be decided. However, after having called for a new poll almost twice every week for more than a year now, the opposition now says it's reluctant to go back to go back to the ballot box until the UK's EU exit has been delayed for what will be a third time.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement