German Industrial Downturn Shallower than Previously Thought but Economy Still in Retreat

- Written by: James Skinner

Image © Adobe Images

Image © Adobe Images

- German slowdown shallower than thought but outlook is still tepid.

- Industrial output was unchanged in two months to end of January.

- Capital Economics says economy will struggle to grow by 1% in 2019.

The industrial slowdown that drove Germany's economy to a standstill late last year was shallower than previously thought, according to official data released on Monday, although economists say growth is still likely to slow again this year.

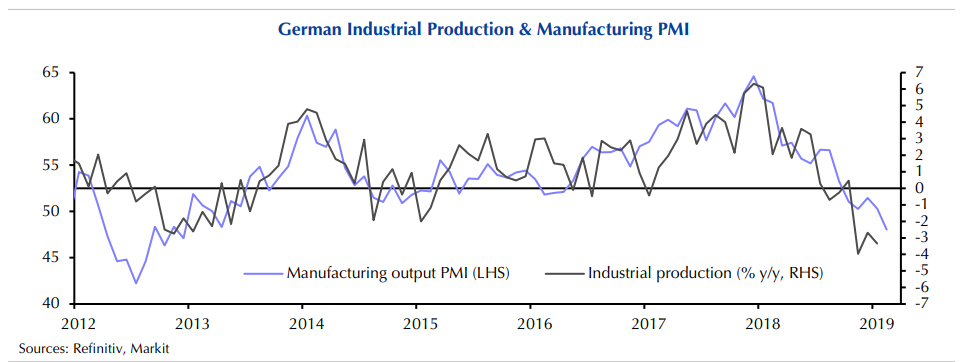

German industrial production contracted by -0.8% in January, unwinding an upwardly-revised 0.8% gain from December, when markets had anticipated an increase of 0.5%. Previously, Destatis said output was -0.4% in December.

The main number for January is ugly and just the latest to have emerged from Germany's mighty industrial sector however, the revision to December's figure means output from the factory space was unchanged in the last two months.

In other words, production stabilised in the New Year rather than contracting any further. But economists are warning that growth could still slow even further during the quarters ahead.

"The upshot is that the German economy is likely to return to growth in Q1, but only just, after performing very poorly in the second half of last year," says Jack Allen, an economist at Capital Economics.

Above: German industrial output and IHS Markit manufacturing PMI. Source: Capital Economics.

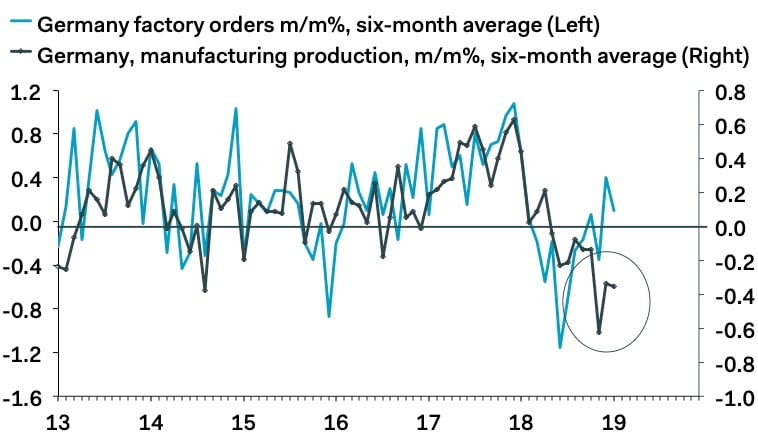

Monday's data mimics the pattern observed in factory orders figures covering the same month that were released on Friday. Those showed new orders falling -2.6% in January, but this obscured a large revision to December's number, which was revised from -1.6% to 0.9%.

Germany's industrial sector has been been buffeted by a number of headwinds in recent months including President Donald Trump's trade war with China, uncertainty about the outcome of the Brexit process and the implementation of new EU rules governing the emissions testing process for new cars.

Economists had initially expected the impact on output stemming from those headwinds to be temporary although many now say the slowdown could be longer-lived and that the economy has seen its best days for the current cycle.

"Even after the upward revisions to the Q4 numbers, the data still show that industrial production fell a cumulative 2.7% in the second half of 2018, providing a low base for the quarter-on-quarter numbers in Q1 and Q2. That said, today’s headlines suggest that the Q1 number will merely be less negative rather than outright positive," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

Markets care about the industrial output figures because they provide insight into the likely pace of growth in a given period and momentum within an economy is an important determinant of inflation. It's consumer price pressures that central banks are attempting to manipulate when they change interest rates, and it's those decisions that impact most on currency exchange rates.

Changes in interest rates are normally only made in response to movements in inflation but impact currencies because of the push and pull influence they have over capital flows, and their allure for short-term speculators.

Above: German factory orders and industrial production. Source: Pantheon Macroeconomics.

"Together with other national data published last week, the German data suggest that euro-zone industrial production rose by about 1.5% in January. (Data released on Wednesday.) But that still would still leave output below its level in October," says Capital Economics' Allen. "We still think that growth will pick up later in the year, but our forecast that GDP increases by 1.0% this year is now beginning to look optimistic."

Eurozone GDP growth was just 0.2% in the final quarter of 2018, Eurostat confirmed last week, which means the economy expanded by only 1.8% for 2018. That's down from 2.4% back in 2017.

German GDP growth was 0% in the final quarter of 2018, after contracting -0.2% in the third quarter, which means the economy expanded by just 1.5% for 2018. That's down from the 2.2% seen in 2017 but in line with the pattern for the broader Euro area.

Changes in inventory investment among companies was the main driver of the downturn in the second half of 2018. Inventories are goods that have been produced by companies but not yet sold.

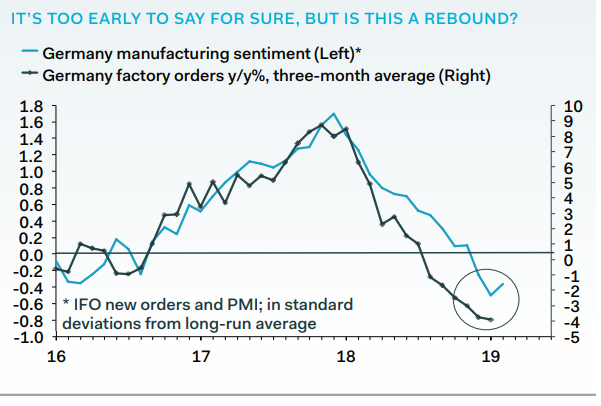

"Looking further ahead, the cold winds from China are blowing strong as ever," says Pantheon's Vistesen. "The economy stayed weak at the start of the year, though the Chinese first quarter data are notoriously difficult to interpret, thanks to the shifts in the timing of the New Year celebrations."

Above: German manufacturing sentiment and output. Source: Pantheon Macroeconomics.

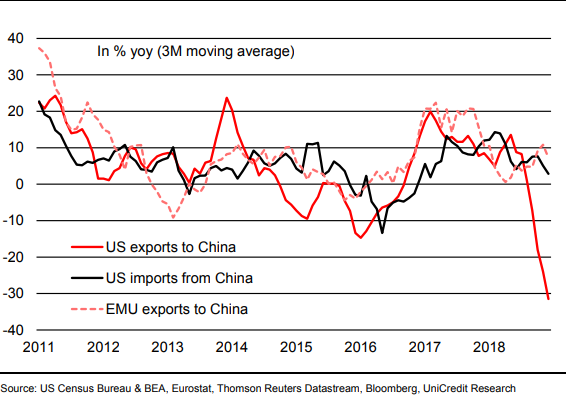

The U.S.-China trade war has also hurt demand for Eurozone factory goods and driven confidence among companies into the ground during recent months given the interdependence of the European and Chinese manufacturing sectors.

However, the White House has said it is close to reaching a deal that will end China's "unfair trading practices", raising hopes of an imminent end to the tariff fight between the world's two largest economies.

Nonetheless, China's economy has been damaged by the trade war and there are now events appearing on the European horizon that could serve to further undermine confidence and activity among German manufacturers.

The shape of the UK's exit from the EU remains far from certain and in May voters from across the bloc will elect a new set of representatives for the European parliament in a ballot that is expected to see an even larger contingent of anti-establishment MPs dispatched to Brussels.

That means the economic shock that would follow a disorderly "no deal Brexit" cannot yet be ruled out, and also that efforts aimed at enhancing integration within the EU could be stymied if the grouping of European MPs in the parliament opposed to such a thing grows larger after the May election.

Above: Eurozone and U.S. trade with China. Source UniCredit Bank.

"We continue to expect that risks for German industrial production throughout 2019 have become skewed to the downside. Aside from the technicalities that have weighed on German export-dependent manufacturers, we think that slowing global trade is continuing to take its toll. Both the latest hard and soft data coming from the industrial sector (see PMI and Ifo) have been weak. Possible factors weighing on business sentiment could be the ongoing trade tensions between the US and China, uncertainty about Brexit and the slowdown of China’s economy," says Dr Thomas Strobel, an economist at UniCredit Bank.

The European Central Bank (ECB) has already announced a new programme of cheap loans for the continent's banks in the hope that activity generated by that form of subsidised lending will be enough to prevent the Eurozone economic slowdown from getting any worse.

It also told markets last week that its interest rate will not rise until "at least through the end of 2019" when at its previous meeting the bank had said a hiked could come by the end of summer. The ECB left is refinancing rate, marginal lending rate and deposit facility rate at at 0.00%, 0.25% and -0.40% respectively this month.

The bank needs faster economic growth that is "close to potential" in order to get inflation sustainably back to its target level. ECB officials will struggle to justify raising interest rates in the absence of an outlook that underwrites a steady and sustainable return of inflation toward the 2% level.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement