Euro / Franc Headed Towards Parity: Analyst

- Written by: James Skinner

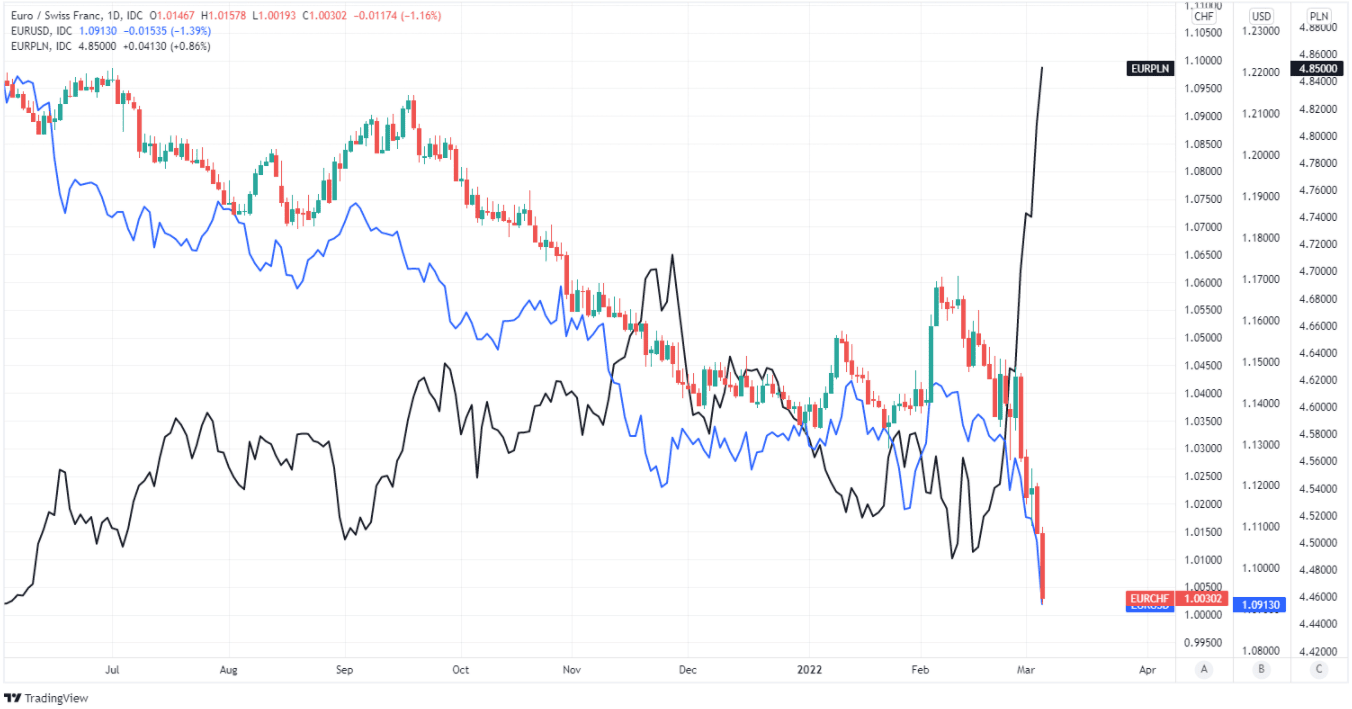

- EUR/CHF headed below parity; could see 0.9174

- Prompting CHF/EUR foray above 1.09 short-term

- Even if USD/CHF holds major support at 0.9149

- As Euro complex slips lower amid Ukraine fallout

Image © Adobe Images

The Swiss Franc traded up to its strongest level against the European single currency since the ‘Frankenshock’ of 2015 ahead of the weekend but could rise further over the coming days even if the USD/CHF exchange rate is able to hold above an important support level around 0.9150.

Switzerland’s Franc was among the top performing major currencies in the week to Friday having trailed behind only commodity-linked currencies such as the Australian and New Zealand Dollars during a period in which the Euro currency complex came under further significant pressure.

“This recent rise in the franc is the flip-side of weakness in the euro and the SNB seems pretty relaxed for now, as we argued that it would be last week,” says David Oxley, a senior Europe economist at Capital Economics.

Europe’s single currency was on Friday heading for its largest one week decline against the Dollar since the most acute stage of the coronavirus crisis in March 2020 as natural gas prices reached for the stars while Central and Eastern European (CEE) currencies tumbled further.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

All of this price action is ultimately the market response to the escalating financial, economic and humanitarian fallout from Russia’s attack on Ukraine.

“The krone was this year's best performer in G10 until last week, but has now been leapfrogged by the AUD and NZD. In EM, losses for CEE currencies continue to snowball for PLN, CZK and HUF. The RUB has lost 36% year-to-date,” says Kenneth Broux, a strategist at Societe Generale.

Reserve selling by central banks in the CEE region could well have added to the Euro’s declines, although the single currency’s weakness may be the most effective form of short-term relief for the smaller currencies of Europe in the short-term, given their economic linkages to the Eurozone.

It could also make for the most virtuous equilibrium when it comes to the impact that foriegn exchange rates have on inflation in Europe, the U.S. and elsewhere, albeit not necessarily in Switzerland where a strengthening currency has long kept inflation at too low levels for the Swiss National Bank.

“Data suggest that the Bank has not been active in the FX market in any large capacity so far. However, policymakers’ tolerance would surely be tested if the franc were to push through the psychological barrier of parity, which now seems likely,” says Capital Economics’ Oxley

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“A lot could depend on whether the ECB moves to shore up the euro, most likely through verbal interventions,” Oxley also said on Friday.

Some analysts have suggested the Euro to Dollar rate could be on course for a meaningful break beneath 1.10 while others are looking for a move toward the 1.08 handle, which has implications for EUR/CHF given the single currency’s influence on that exchange rate.

EUR/CHF tends to closely reflect the relative performance of EUR/USD and the Swiss Franc measured against the Dollar, although EUR/CHF would be likely to fall to 0.9174 and CHF/EUR lift to 1.09 in most market contexts where EUR/USD is trading around 1.08.

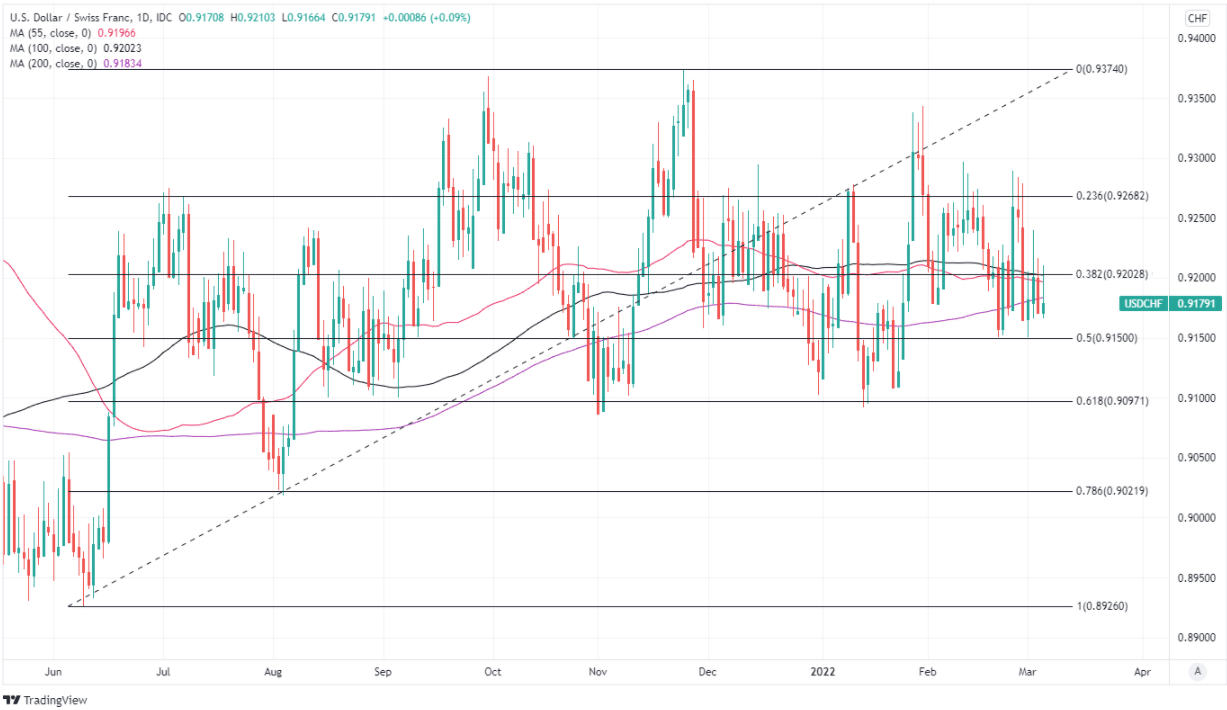

It would take a meaningful rebound by the USD/CHF exchange rate from a nearby technical support level around 0.9150 in order to prevent this.

“We think that USDCHF will rise as the USD is the more attractive safe haven due to attractive yields,” says Thomas Flury, a strategist at UBS Global Wealth Management.

Above: USD/CHF shown at daily intervals with Fibonacci retracements of June 2021 rally indicating possible areas of technical support for U.S. Dollar.