Canadian Dollar Slides as Market Judges Inflation is the Wrong Kind of Hot

- Written by: James Skinner

“Inflation hasn't been this hot in Canada since Jennifer Lopez was topping the charts back in 2003” - CIBC Capital Markets.

Image © Adobe Stock

The Canadian Dollar slumped in the midweek session after investors appeared to baulk at the devil in the detail of October’s inflation data, which showed underlying inflation remaining below the 2% Bank of Canada (BoC) target.

Canada’s Dollar was vying with its Australian counterpart for bottom of the major currency bucket on Wednesday while the Pound-to-Canadian Dollar exchange rate lept back above the 1.69 handle for only the second time in November as investors recoiled at the latest inflation readings.

“Inflation hasn't been this hot in Canada since Jennifer Lopez was topping the charts back in 2003. The 0.7% not-seasonally adjusted month-over-month increase pushed the headline annual rate of consumer price inflation all the way up to 4.7%, both matching consensus expectations,” remarked Royce Mendes, an economist at CIBC Capital Markets.

“That being said, the latest Monetary Policy Report projected an average inflation rate of 4.8% in Q4, suggesting that today's reading won't do much to alter central bankers' thinking on the timing of rate hikes. With that in mind, and so much already priced in for rate increases by markets, short-end yields are falling and the Canadian dollar is selling off,” Mendes said in a note to clients following the release.

While Statistics Canada figures showed the main measure of consumer price growth rallying from 4.4% to 4.7% in October, the BoC’s three different measures of underlying inflation remained unchanged at comparatively tame levels for last month.

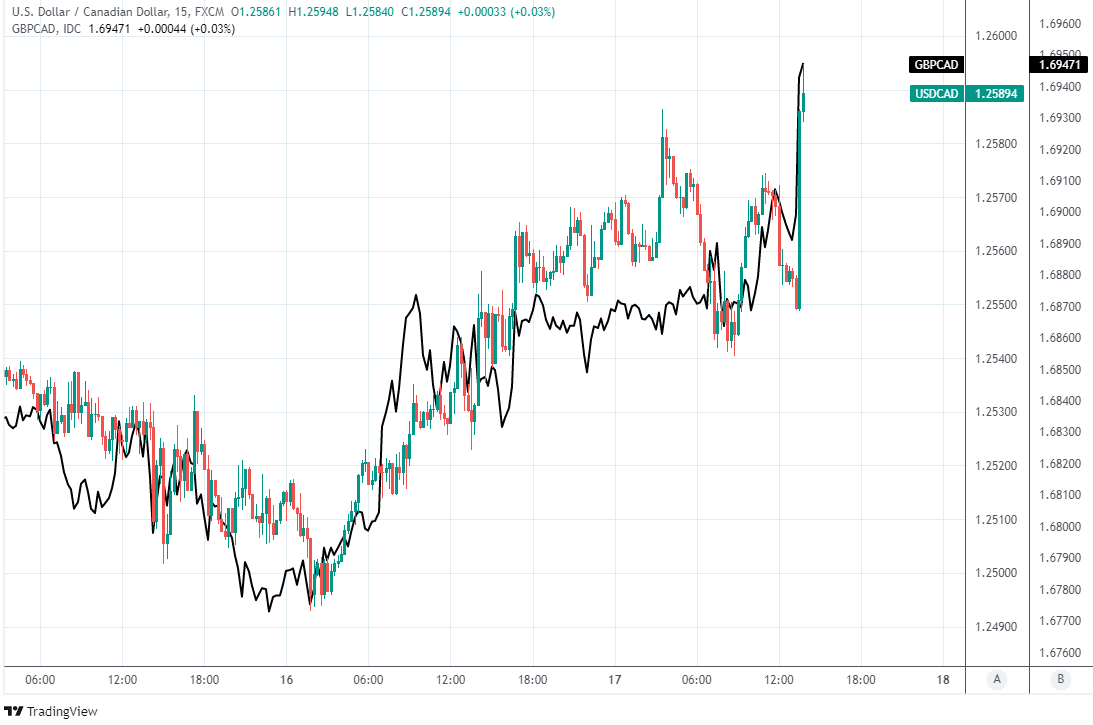

Above: USD/CAD shown at 15-minute intervals alongside Pound-to-Canadian Dollar rate.

- GBP/CAD reference rates at publication:

Spot: 1.6963 - High street bank rates (indicative band): 1.6369-1.6488

- Payment specialist rates (indicative band): 1.6810-1.6878

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

Common CPI was just 1.8% in October while median and trimmed-mean CPI held steady at 2.9% and 3.3% respectively, depriving the market of any vindication of encouragement in relation to its outlook for Canadian interest rates.

Meanwhile, and as noted by CIBC’s Mendes, even the headline rate of inflation was merely in line with Bank of Canada forecasts for the final quarter.

“A number above forecasts of 4.7% should see the loonie higher and will further encourage the view of an earlier lift-off in the rate hiking cycle and support the view of being long CAD on crosses,” said one trader on the London FX desk at J.P. Morgan in a Wednesday morning note.

“A lot is riding on this afternoon’s print, which if as hoped is a high one, should further encourage Real Money demand for CAD, who have bought with us for 8 out of the last 9 days,” the trader said, having flagged sales of EUR/CAD and EUR/JPY as preferred trades on the desk.

Investors and the market at large had wagered with increasing confidence that the BoC would lift its interest rate from 0.25% to 0.5% as soon as March next year in contravention of guidance given only just last month.

This in part due to a view that rising inflation pressures would prompt the Bank to become less confident about its perception that recent increases in price pressures are likely transitory.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“Faster underlying inflation would support the case for the Bank of Canada (BoC) to lift rates earlier than its “sometime in the middle quarters of 2022” guidance and bode well for CAD,” said Elias Haddad, a senior currency strategist at Commonwealth Bank of Australia, in a Wednesday afternoon note.

Governor Tiff Macklem had said in a press conference following October’s decision that the BoC’s cash rate could be lifted as soon as April next year, although financial markets have not only priced-in a lift-off that comes sooner than that they’ve also wagered heavily that rates would rise all the way to 1.5% by the end of next year if pricing in the overnight-indexed-swaps markets is a reliable guide.

Some of the investors behind those wagers were evidently encouraged to rethink them on Wednesday given the lack of upside in the underlying measures of inflation and limited increase in the headline numbers, which helped lift the Pound-to-Canadian Dollar exchange rate out of November’s rut.

The Canadian Dollar remained the best performing major currency of 2021 nonetheless, although on the day it was eclipsed by both Pound Sterling and the Swedish Krona which were both vying with each other for pole position in the intraday ranking among majors.

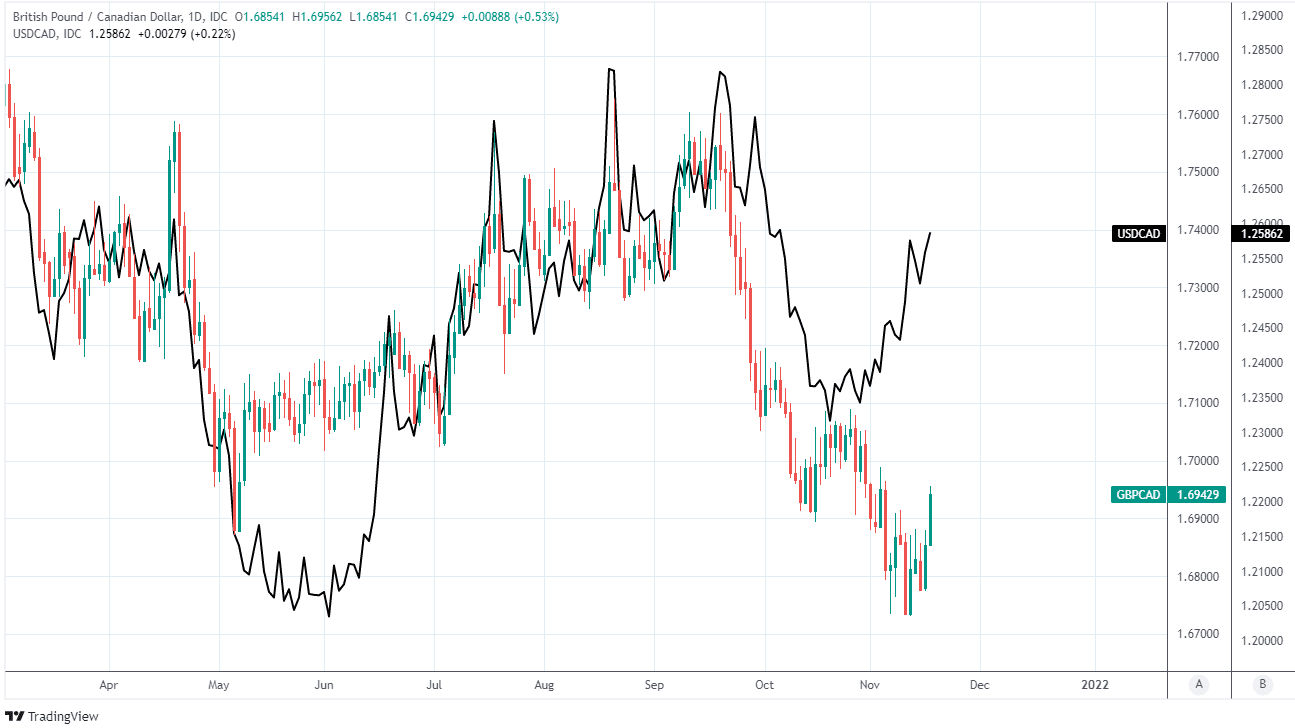

“Support at 1.6740 looks relatively firm and the two rebounds from that level have set up a potential double bottom (bullish above 1.6910 for a retest of the 1.7080/85 area). A clear move through 1.6840/45 trend resistance would serve as a “heads up” that the pound is making a run at 1.6910. We are neutral here for now,” said Jaun Manuel Herrera, a strategist at Scotiabank, in a Tuesday research note.

Above: Pound-to-Canadian Dollar rate shown at daily intervals alongside USD/CAD.