Australian Dollar G10 Laggard on Iron Ore Losses, GDP Partials

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar is the day's biggest loser on a combination of sliding stock markets, falling commodities and higher U.S. treasury yields. Domestically, partial GDP data and a blowout current account deficit raised eyebrows.

"AUD is underperforming and catching up to the recent plunge in iron ore prices. China’s ongoing property slump and poor manufacturing activity are weighing on iron ore prices," says Elias Haddad, Senior Markets Strategist at Brown Brothers Harriman.

Dalian iron ore futures logged their sharpest daily drop in almost two years on Tuesday amidst soft economic data from China, which clouded the demand outlook, and firm global supply also weighed on prices.

Iron ore is Australia's most important foreign exchange earner, meaning analysts watch iron ore prices for clues on the Aussie Dollar's performance. The Pound to Australian Dollar exchange rate (GBP/AUD) rose nearly half a per cent in London trade to quote at 1.9443. Against the U.S. Dollar the Aussie was 0.63% lower at 0.6748 AUD/USD. EUR/AUD was 0.45% higher at 1.6377.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The most-traded January iron ore contract on China's Dalian Commodity Exchange (DCE) ended daytime trade 4.74% lower at 703.5 yuan ($98.87) a metric ton, posting its steepest decline since Oct. 31, 2022.

The potential for lower earnings from iron ore exports comes on the day it was reported Australia's current account deficit unexpectedly ballooned to a six-year high at -A$10.7BN in the second quarter as the country spent more on goods and services than it earned.

The market was prepared for an outcome of half the figure at -5.9BN, down on Q1's -6.3BN.

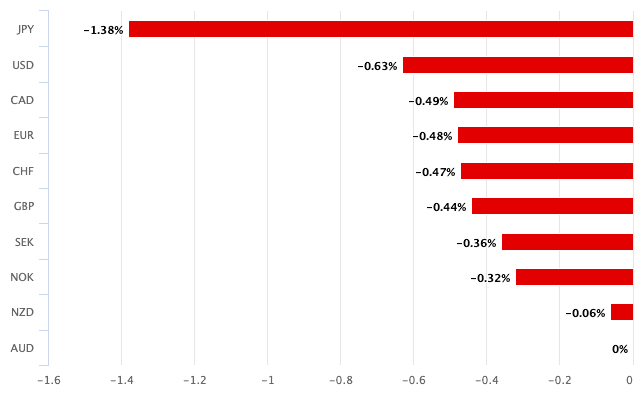

Above: AUD performance on Sept 03.

A persistent current account deficit is considered by economists to be a long-term headwind for a currency on the understanding that a country spends more than it earns and must compensate for this imbalance by attracting investor capital, which can dry up when investor sentiment slumps.

In other domestic developments, GDP input data was released and points to unimpressive underlying Australian economic growth in Q2. The Australian economy is expected to have grown 0.3% in the June quarter 2024. This would see annual growth ease to 1.0% in Q2 and make for the softest growth momentum since the early 1990s recession.

"There's nothing in the news flow that's Aussie specific that I would say is positive. There was nothing in the GDP parcels that we have had so far... the risks of an upside surprise in GDP tomorrow don't seem to be there," says Ray Attrill, Head of FX Strategy at National Australia Bank.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Signs of slowing growth could prompt the Reserve Bank of Australia (RBA) to consider whether it might soon be appropriate to lower interest rates. The RBA is expected to be the last G10 central bank to cut interest rates, which has underscored a period of AUD outperformance, and any signs of this advantage waning can weigh.

All eyes now turn to RBA Governor Michelle Bullock's reaction when she speaks on Thursday.

Softer global equity markets have also contributed to AUD weakness, with stocks falling ahead of an important week of U.S. data releases. Nerves ahead of the non-farm payroll release on Friday are reflected in rising U.S. Treasury yields, suggesting market participants are nervous of a softer-than-forecast outcome.

Ahead of the release, we will face survey data from ISM on Tuesday (manufacturing) and Thursday (services), both of which have the potential to move the market if they deviate from expectations in a material fashion.

The rule of thumb is that softer data can boost the risk-sensitive Aussie Dollar as it implies a greater pace of easing at the Federal Reserve lies ahead. Stronger data will have the opposite effect and exacerbate the current risk-off sentiment.