Australian Dollar Falls to 3-week Low: Hurdle to RBA Hikes is High

- Written by: Gary Howes

Image © Newtown Grafitti, Reproduced under CC Licensing.

The Australian Dollar was the day's underperformer following a fall in Chinese equity markets and the release of minutes from the Reserve Bank of Australia (RBA), which revealed that the hurdle to further rate hikes is set high.

The Pound to Australian Dollar rallied for a second consecutive day to reach 1.9095, its highest level in three weeks, after the RBA's minutes of this month's policy decision revealed limited appetite for a further interest rate hike.

"Importantly, inflation expectations remained well anchored. Given this, and the higher-than-usual level of uncertainty about the economic outlook, members judged that it remained reasonable to look through short-term variation in inflation to avoid excessive fine-tuning," said the minutes.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The Australian Dollar has been one of the best-performing major currencies over the past month, helped by a supportive global investor backdrop and market expectations that the RBA will be amongst the last central banks to cut rates.

In fact, owing to a strong Q1 inflation print, market pricing over recent weeks has shown a non-negligible expectation that the RBA could raise interest rates again, further bolstering the AUD.

But the RBA's minutes showed it wants to avoid 'fine-tuning' policy by tinkering with another interest rate rise, and the removal of residual rate hike expectations in the market is considered an unsupportive development for the currency.

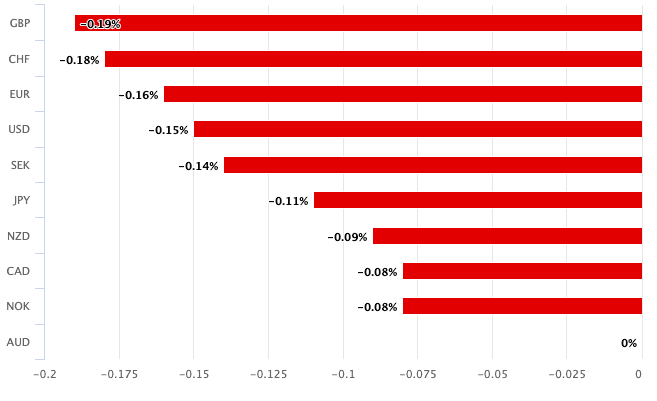

Above: AUD performance on May 21.

To be sure, the minutes revealed that the Bank did actively consider raising interest rates, but they also showed that the hurdle to further hikes was set high, which can limit AUD downside. "Members judged that the case to leave the cash rate unchanged at this meeting was the stronger one," said the minutes.

At the same time, the hurdle to cuts is also set high, particularly following the Australian government's federal budget announcement last week, which included numerous giveaways and tax cuts for every citizen. This risks maintaining strong demand in the economy, keeping inflation elevated for longer and requiring the RBA to remain vigilant.

"Last week's fiscal measures pose the risk that the cash rate will need to stay higher for longer," says Kristina Clifton, an analyst at Commonwealth Bank of Australia.

AUD underperformance also follows a soft couple of sessions for Asian equity markets, to which the currency has a high beta. "A 2% fall in Hang Seng was a headwind for both AUD/USD and NZD/USD," says Clifton.

According to Reuters, Chinese stocks edged down on Tuesday, led by cyclical shares, as Beijing's measures to lift the country's struggling property sector failed to boost sentiment. Hong Kong shares also fell as technology shares weighed.

The Australian Dollar rallied last week following news that Chinese authorities were preparing a significant set of measures to boost the country's flagging retail property market.

However, Fitch Ratings noted that the impact of recent policy moves, including local state-owned enterprises' home-buying plans and some higher-tier cities' removal of purchase curbs, on reviving national home sales remains uncertain.