Pound-Australian Dollar Rate Supported Above 1.88 but Struggling Near 1.90 in Week Ahead

- Written by: James Skinner

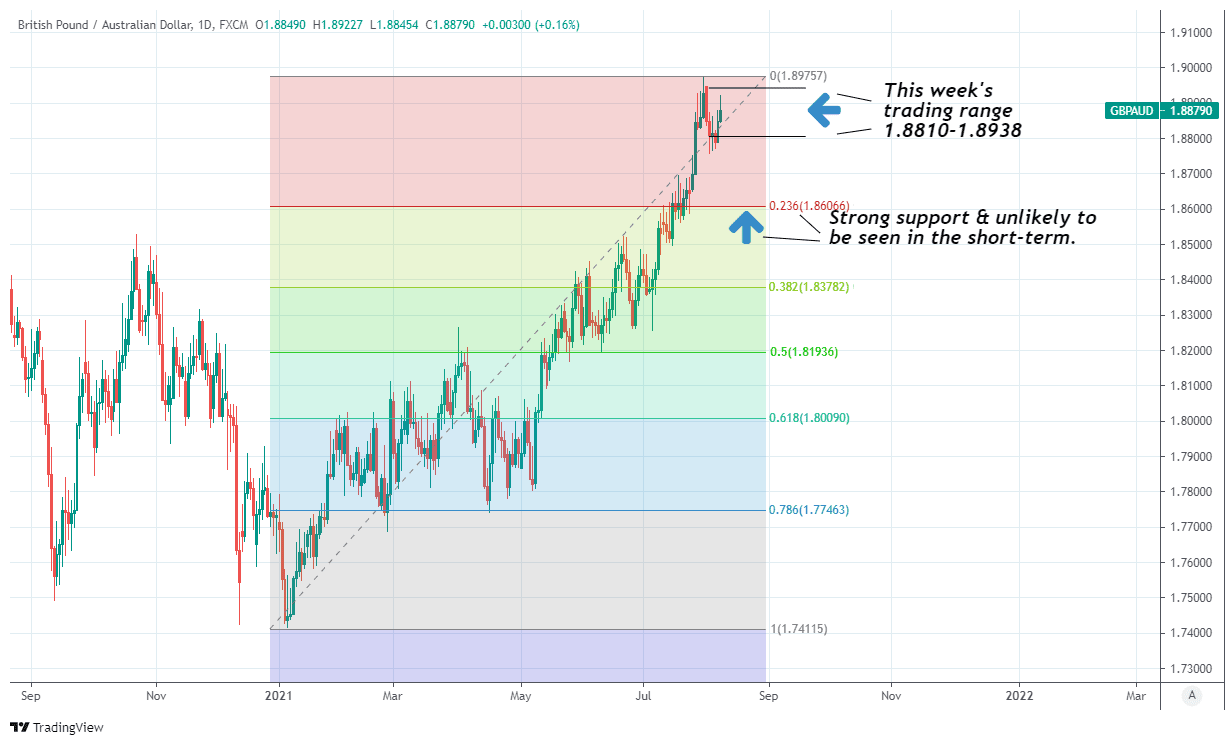

- GBP/AUD trading rough 1.8810 to 1.8938 range this week

- As broader consolidation between 1.8640 & 1.8938 looms

- Lethargic AUD & buoyant GBP keeping GBP/AUD elevated

- AUD ailed by virus toll on job market; GBP eyes GDP data

Image © Adobe Images

- GBP/AUD reference rates at publication:

- Spot: 1.8785

- Bank transfer rates (indicative guide): 1.8128-1.8259

- Money transfer specialist rates (indicative): 1.8616-1.8654

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Australian Dollar rate was levitating near to one-year highs early in the new week but could struggle to sustain a move above the nearby 1.8938 level over the coming days without a further breakdown in the AUD/USD exchange rate or a strong upside surprise in Thursday’s UK GDP data.

Pound Sterling entered the new week levitating comfortably above the 1.88 handle against the Australian Dollar, a level around which the British could find any declines arrested over the coming days, leaving GBP/AUD’s more-than six percent 2021 gain intact.

But the Pound-Australian Dollar rate’s upward momentum has ebbed in tandem with the Australian Dollar’s downward correction over the last week and much now remains to be determined by the outcome of Thursday’s UK GDP data and developments in AUD/USD.

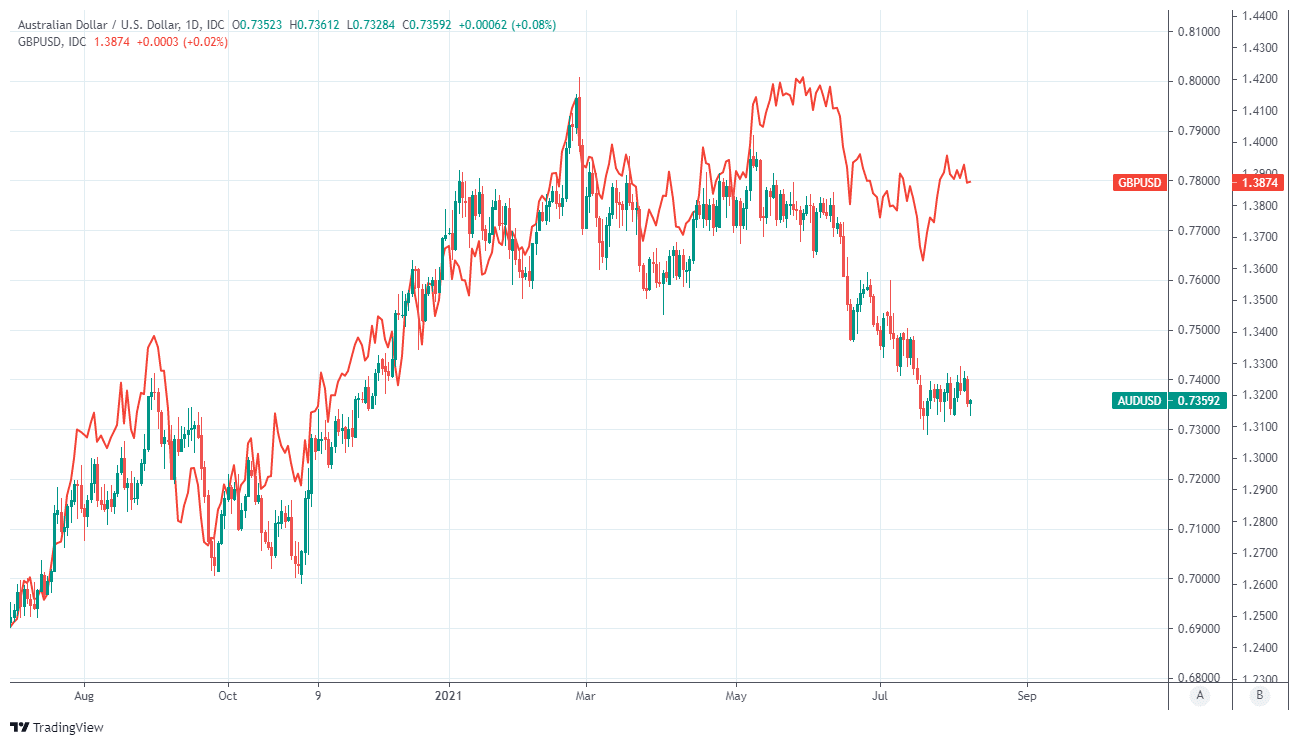

The Pound-to-Australian Dollar rate always closely reflects relative price moves in GBP/USD and AUD/USD, and would likely be curbed into a wide 1.8640-to-1.8990 range if AUD/USD steadies above 0.73 over the coming weeks and if GBP/USD is confined to its recent 1.38-to-1.40 trading band.

But for this week specifically the Pound-to-Australian Dollar rate may be likely to trade in the upper half of that wide range, roughly between 1.8810 and around 1.8938, given the Aussie’s coronavirus-inspired lethargy and Sterling’s buoyancy near the middle of its own band against the U.S. Dollar.

“Last week we saw the ABS’s tally of payrolls jobs, with Sydney payrolls already -5% in just 2 weeks and further weakness elsewhere in the nation. Then there’s Victoria’s return to lockdown for the 6th time and restrictions in south-east Queensland,” says Sean Callow, a strategist at Westpac.

“The impact of these developments could be clear in Australia’s data highlights this week – July NAB business confidence and August Westpac consumer sentiments,” Callow writes in a Monday note to clients.

Above: Pound-to-Australian Dollar exchange rate shown at daily intervals with Fibonacci retracements of 2021 uptrend indicating possible areas of support, alongside editorial annotations.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The main Australian exchange rate AUD/USD was unable to recover above 0.7350 in Monday trade despite a softer U.S. Dollar, having been pulled lower from a fraction above 0.74 on Friday and toward the round number of 0.73 in the wake of July’s blockbuster U.S. payrolls report.

But with the U.S. job market firing on all cylinders last month and potentially placing the Federal Reserve (Fed) on course to announce plans in September for a subsequent end to its quantitative easing programme, while fresh coronavirus-containment measures steadily undo an earlier repair of the Australian labour market, the Aussie’s prospect of getting the better of the U.S. Dollar in a meaningful way this week is doubtful to say the least.

“The subdued near term economic outlook in Australia suggests that the Australia‑US 10 year bond spread can remain negative for some time. At ‑9bp currently, our fixed income analysts expect further decreases in the bond spread to ‑25bp. Falling iron ore prices might also weigh on AUD,” says Kevin Xie, a senior Asia economist at Commonwealth Bank of Australia.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Many Asian countries have recently succumbed to renewed waves of coronavirus infections, with economies accordingly clobbered by new restrictions.

The coronavirus is resurgent right across the Asia Pacific including in China where provinces accounting for some 18% of GDP are the subjects of various containment measures in what is a further headwind for the overall regional economy and a dampener for the global economy.

Asia’s coronavirus troubles could make for a continued lethargic performance from AUD/USD which, when combined with a plucky main Sterling exchange rate GBP/USD, makes a supportive environment for the Pound-to-Australian Dollar rate.

Above: AUD/USD shown at daily intervals alongside GBP/USD.

Whether or not Sterling is itself able to lift GBP/AUD further could now depend more than anything else on the outcome of Thursday’s GDP data, which is expected to show the UK growing by 4.8% last quarter in what would be the fastest expansion seen in the G10 contingent of major economies.

But for the Pound to benefit from Thursday’s numbers in a sustained way the data may need to overshoot by some distance the even more upbeat forecast announced by the Bank of England (BoE) last week, which is looking for a 5% increase.

The BoE formally acknowledged in last week’s policy decision that based upon the currently available information, some “modest tightening” of monetary policy may be necessary in the coming 24 months or so in order to return inflation back toward its 2% target, and any strong upside surprise on Thursday would leave currency traders with little choice other than to take the BoE at its word.

"For now, I'm focusing on short EUR/GBP and short AUD/NZD. Neither trade is very original. The euro's best defence (which will limit the downside in EUR/USD) is that the market's net long is shrinking, but that's even more true of sterling,” says Kit Juckes, chief FX strategist at Societe Generale.

"AUD/NZD meanwhile, is heading towards parity. Pressure for RBNZ tightening will remain in place, while the RBA's dovish bias isn't even being questioned given the renewed lockdowns. At 36 deaths per million people, Australia's Covid death toll is less than 2% of the UK's, but the economic impact will drag on as long as vaccination rates remain low and lockdowns remain the main tool to limit transmission," Juckes writes in a Monday note.

Above: Pound-to-Australian Dollar exchange rate shown at weekly intervals with spreads, or gaps, between GB and AU government bond yields for 2-year and 10-year segments of the yield curve. Shows GBP bonds offering higher yields than once ‘high yield’ AUD bonds.