Australian Dollar: Iron Ore & Coal Export Rebound Underpins the Outlook

- AUD outlook underpinned by strong terms of trade

- Iron ore exports hit six-month peak

- LNG exports provide a boost

- But JPMorgan forecasts drop in iron ore prices in 2021

Image © Adobe Stock

- GBP/AUD spot at publication: 1.7642

- Bank transfer rates, indicative guide: 1.7025-1.7148

- FX specialist transfer rates, indicative: 1.7217-1.7520

- Find out how to acccess specialist rates, here

A material increase in Australian iron ore exports combined with a strong rebound in coal and LNG exports have propelled the Australian Dollar higher over recent weeks, and further gains are likely according to some analysts.

The Australian Dollar is often classed as a 'commodity currency' in a nod to the value it derives from Australia's substantial export of raw commodities, such as iron ore, coal and Liquefied Natural Gas (LNG).

This basket of currencies have appreciated notably in value over the course of the past six months, but these price rises have not dented international demand which has allowed Australia to boost exports and improve its Terms of Trade.

"The AUD's rally is underpinned by a buoyant terms of trade as global growth prospects improve. In fact, the USD price of Australia's export basket of commodities appreciated by 9.9% in December 2020 alone while spot prices of iron ore, the country’s largest export, have more than doubled from their 2020 low," says Paul Mackel, Global Head of FX Research at HSBC.

In short, the country is generating strong revenues from the export of commodities and until fortunes change the Australian Dollar will likely retain a solid underpinning.

Even though the Aussie Dollar has pared back some of its recent gains at the time of writing, trends in the commodity market are positively aligned as we move towards February which hint at the possibility of further appreciation in coming weeks.

Modelling from Australian bank Westpac shows Australian December iron ore exports reached a six-month high while coal exports reached a one-year high.

Wetpac's bulk shipping activity models point to a noticeable increase in iron ore exports from Australia in December, with a forecast of 78.6mt.

The data analysis reveals the recovery in December was helped by a record 15mt of exports from Port Dampier and brings the total for the year to 883mt, that total is up 3.8% versus 2019 and 4% versus 2018.

Above: December Australian iron ore exports rise to 79mt, but -2%yy. Port Dampier saw record in Dec though total 2020 exports just +3.8% vs 2019 & 4% vs 2018. Image courtesy of Westpac.

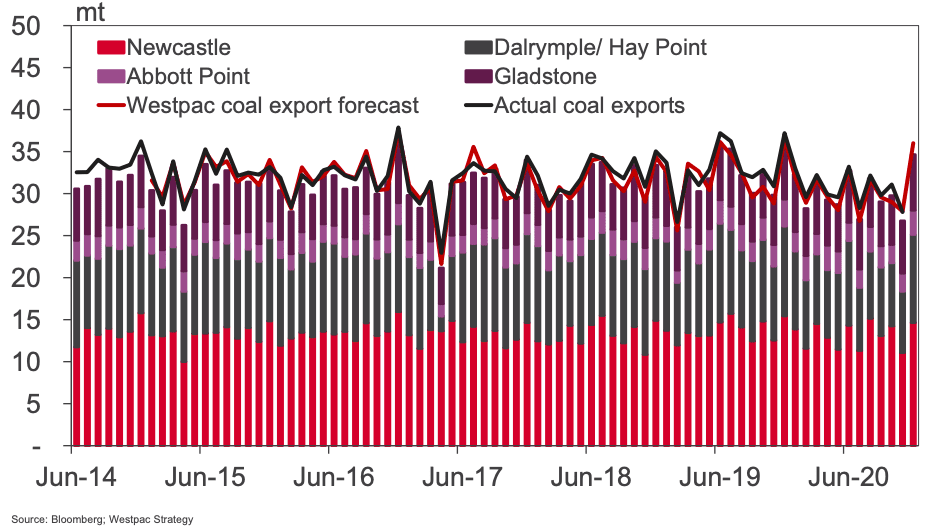

December also saw a sharp increase in coal exports with volumes from Newcastle at a 4-month high, Dalrymple/Hay Point at a six-month high and Gladstone at one-year high, according to Westpac economist Robert Rennie in a recent briefing to clients.

The improvement follows on from a generally poor 2019 for this commodity, with a Chinese ban on Australian coal cited as having impacted negatively on activity.

"The sharp improvement in December volumes is likely due to cold winter conditions in Asia; heavy rains in Kalimantan and rising demand out of Japan, South Korea and Taiwan. Closures in the Hebei region in China due to a Covid outbreak has also helped demand for thermal coal," says Rennie.

Above: December Australian coal exports rise to 36mt; trend still weak. Newcastle coal exports 4m high; Dalrymple 1yr high; but total for year at 364mt -5% vs 2019. Image courtesy of Westpac.

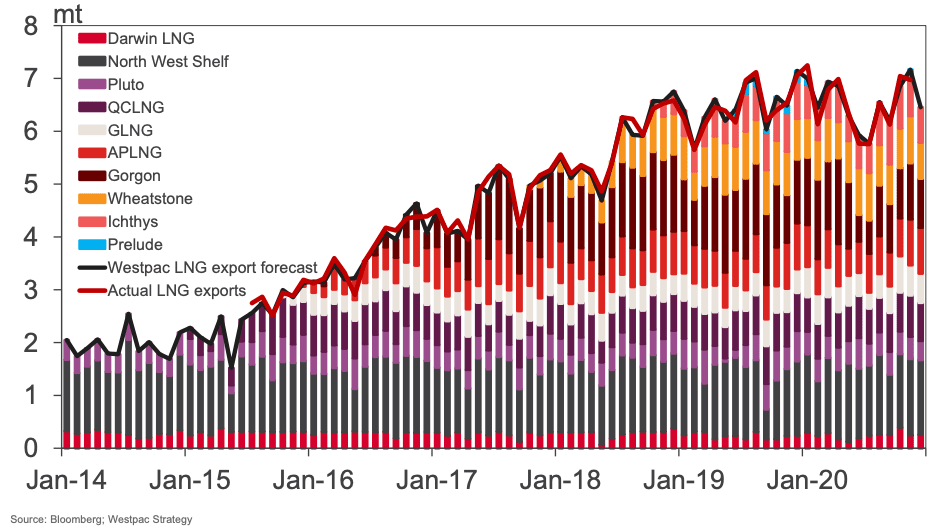

But recent Australian Dollar strength "is not only iron ore driven as LNG prices also support Terms of Trade gains," says Shahab Jalinoos, a foreign exchange strategist with Credit Suisse.

Australia's December LNG exports dropped from 7mt in November to 6.5mt, but that still leaves the total for the fourth quarter of 2020 up 1.0% versus the fourth quarter in 2019 and also sees a fresh record for the year at 78.5mt, up from 78mt in 2019.

Above: December Australian LNG exports 6.5mt, +1%3myy. Total LNG exports for 2020 of 78.44mt hit fresh record high, but up just 1% vs 2019. Image courtesy of Westpac.

Westpac says strength out of the three Queensland projects was noticeable in the fourth quarter with volumes at a record 6.5mt for the quarter, up 9% versus the same period in 2019.

"Record spot prices in Asia late last year will arguably have helped, with Chinese demand strong," says Rennie.

Consensus amongst foreign exchange analysts we follow is that the Australian Dollar should remain supported provided commodity markets see strong dynamics, however a clear risk to the outlook is that the trend in improvement cools or even reverses.

As such, the currency will remain highly geared to the global recovery and whether or not the world does in fact enter a strong phase of recovery from covid-19 in 2021.

Commodity analysts at Wall Street investment bank JP Morgan say iron ore prices are biased lower and are forecast to decline 30% by end-2021.

"Alongside potential USD tailwinds associated with the Democrats gaining control of Congress and the real yield compression story running out of steam, we continue to favor a lower AUD from current levels," says Ben K Jarman, analyst at JP Morgan.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}