Pound vs. Australian Dollar Rate in the Week Ahead: Early Signs Pair Could Be Reversing Trend

Image © William W. Potter, Adobe Stock

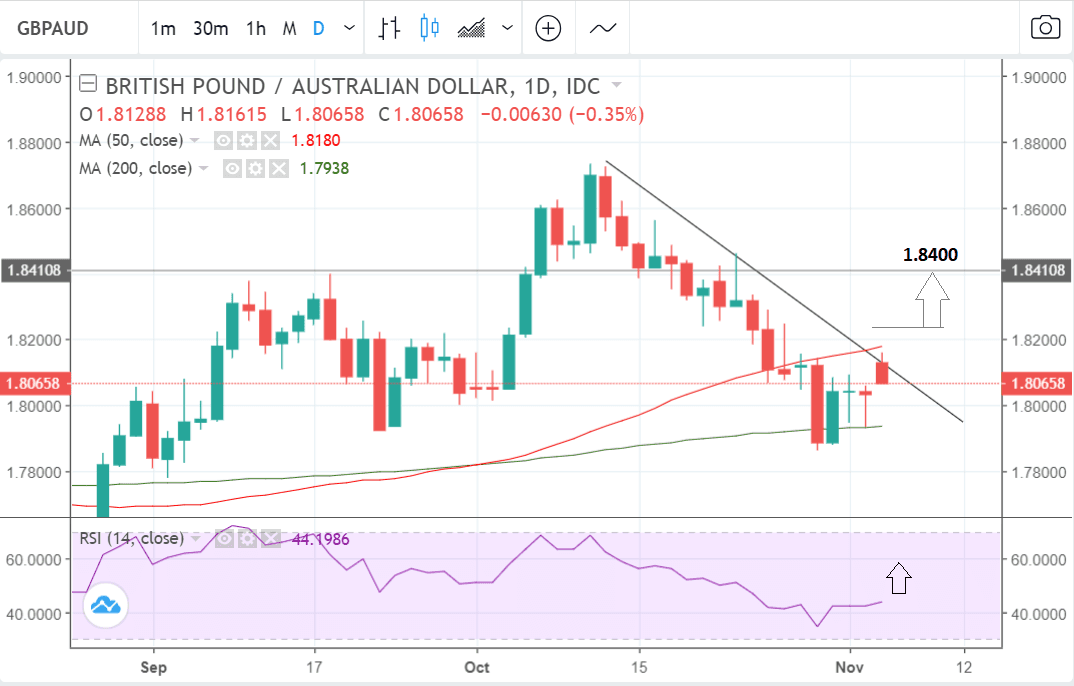

- GBP appears to have bottomed temporarily

- Bulls looking for a break above the 50-day MA

- The main release for the UK is GDP data

- Aussie eyes RBA meeting Tuesday

The Pound appeared to reach a bottom versus the Australian Dollar last week as Brexit prospects improved and studies bode optimistic for the GBP/AUD exchange rate in the week ahead.

Reports of a solution to the Irish backstop problem as well as rumours of a deal on continued access for financial services supported the UK currency which appeared to halt its decline after falling to the 200-day Moving Average which is a key technical 'line in the sand' for the exchange rate.

The improved sentiment is still with Sterling at the start of the new week with talk of a 'secret Brexit deal' in the offing supporting the Sterling-Australian Dollar exchange rate to 1.81 at the start of the week's session.

Overall, our technical studies suggest the pair is biased to more upside even though the trend is still neutral.

GBP/AUD looks like it is attempting to break above a trendline drawn from the October 10 highs. If it succeeds it will probably herald the birth of a new short-term uptrend.

It is also pushing up against the 50-day moving average - another major obstacle in the path of any potential recovery - and we would Ideally like to see the exchange rate break clearly above that too for confirmation of a continuation of the uptrend.

Momentum looks like it is picking up after basing in late October. RSI looks much more like it is about to rise than fall and this suggests a corresponding rise in the underlying asset.

Overall we see a move above the 1.8225 level as providing confirming of a continuation higher, with the next upside target situated at the 1.8400 October highs.

Advertisement

Bank-beating GBP-AUD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Australian Dollar: What to Watch

The main event for the Australian Dollar in the week ahead is the meeting of the Reserve Bank of Australia (RBA) on Tuesday at 3.30 GMT.

The RBA is not expected to change its policy at the meeting on Tuesday so there is unlikely to be a high degree of volatility for the Australian Dollar, nevertheless, the market will be interested in finding out about the RBA's forward guidance, which is where it expects interest rates evolving in the future, and this will be held in the accompanying statement.

Higher interest rates are supportive of the currencies as they attract greater inflows of foreign capital drawn by the promise of higher returns.

Third quarter inflation came in marginally lower at 1.9% from 2.1% in the previous quarter.

Lacklustre inflation suggests the RBA could delay putting up interest rates. The slip in inflation was mainly due to a slowdown in house price inflation because of its direct relationship to wealth, and people's access to credit.

Six-month inflation is now only up 1.5% which is rather low and further suggests a delay in expectations of higher rates. The market doesn't forecast a rate hike in Australia now until 2020. This is one of the slowest trajectories in the G10 and will probably weigh on the Aussie Dollar.

The meeting will be accompanied by a 'statement of monetary policy' (SOMP) which will include revised economic growth forecasts to 2020 and these may also impact the currency if radically revised.

Analysts appear divided on whether the current market outlook is too pessimistic or not as illustrated by a recent Bloomberg survey.

"In the latest Bloomberg survey of economists’ forecasts, only 10 of the 24 forecasters expect the cash rate to be on hold (one is calling cuts) by end 2019. In addition, 9 of those 13 forecasters expecting rates to be rising expect multiple hikes. Note that the other three major Australian banks expect rate hikes next year," say Wells Fargo in a client note.

Analysts at Wells Fargo themselves, however, do not see much chance of much higher rates going forward.

"As usual we will scour the Governor’s statement next Tuesday for any hints towards a firmer tightening bias, but there is unlikely to be much to encourage these efforts."

Another key theme for the Australian Dollar in the week ahead is likely to be the rhetoric around U.S.-China trade relations. Tensions eased recently amidst reports Donald Trump had asked officials to draw up plans for a proposed deal with Beijing and nods towards talks taking place on the margin of the G20 meeting later in November.

We note that the AUD is actually tracking the Chinese Yuan quite closely and therefore will be watching developments in the CNY over coming days and weeks.

The Australian Dollar rose quite strongly versus the U.S. Dollar last week on easing trade tensions and improved investor sentiment, and more news on this front could affect the Aussie in the week ahead.

The Pound: What to Watch this Week

For Sterling, Brexit remains central to the outlook with the swinging in sentiment on whether or not a deal will be agreed by year-end being the main driver of the currency.

"Headlines on Brexit will intensify, but short of a material sign that negotiations are progressing (or that we are heading towards a ‘no deal’), they are unlikely to trigger a decisive directional shift in Sterling," says Daniel Been, Head of FX Research with ANZ Bank.

Data releases have however moved Sterling over recent days, but the moves tend to be short-lived in nature and therefore tend to be faded.

Nevertheless, there are some important numbers to watch.

Services PMI for October is another important release for the Pound in the week ahead. It is released on Monday at 9.30. It is forecast to slow to 53.3 from 53.9 previously.

The PMI numbers already released this week have been mixed with manufacturing PMI released Thursday disappointing while construction on Friday beat expectations.

The key release for the Pound in the week ahead is GDP data, out on Friday, November 9 at 9.30 GMT.

Month-on-month GDP is forecast to have only grown 0.1% while third quarter GDP is forecast to show a 1.5% rise on an annualised basis (1.2% previously) and a 0.6% rise on a quarterly basis (quarter-on-quarter) compared to 0.4% previously.

If growth accelerates as much as expected it may boost the Pound - if it beats expectations it could rise even more strongly.

Industrial and manufacturing production for October are out on Friday at 9.30 and forecast to show -0.1% and 0.1% changes in October on a monthly basis. While the data will be important we feel that from a Sterling perspective it will be overshadowed by the more timely monthly statistic.

Also on Friday are trade data with the balance forecast to reveal a deficit of £11.40BN in September.

Apart from this, there are also several housing metrics out including Halifax house prices at 8.30 on Wednesday and the RICS house price balance at 0.01 on Thursday.

The British Retail Consortium's retail sales monitor is often a good leading indicator for retail sales in general and it is forecast to show a 0.6% rise in October when released at 0.01 on Tuesday.

Advertisement

Bank-beating GBP-AUD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here