Australian Dollar Outperformance Tied to Yuan Outlook, which Remains Decidedly Shaky

Image © Adobe Stock

- Australian Dollar enters new month on the front-foot

- Rising CNY has links to AUD strength

- Trump's rumoured deal the catalyst

- GBP/AUD downside to be limited

The Australian Dollar's strength continues into early November but whether or not this period of appreciation can continue might actually be closely tied to the fortunes of China's Yuan where the outlook remains shaky.

At present, a notable improvement in global investor sentiment has lifted Chinese stocks, the Yuan and the Australian Dollar.

President Donald Trump has signalled a potential ceasefire in the trade war with China, signalling he wants to reach an agreement on trade with Chinese President Xi Jinping at the Group of 20 nations summit in Argentina later this month

Signs of a thawing in the U.S.-China trade war immediately boosted China's Yuan (CNY) which in turn appears to have dragged up the AUD.

Above: Directional moves in AUD and CNY appear to be synched. Image (C) TradingView, Pound Sterling Live.

China is Australia's biggest export market and a stronger Renminbi increases Chinese corporate buying power and makes Australian exports more affordable, this in turn increases import demand in China, bidding up the Australian Dollar in the process.

AUD/USD is up a at 0.7211 at the time of writing, having been as low as 0.7065 earlier in the week while the GBP/AUD exchange rate is down at 1.8010.

Sterling has roared into the new month on the back of more sympathetic Brexit headlines, however against the Australian Dollar the currency's teeth certainly lack teeth.

But how long is this shift in fortunes for CNY and the AUD likely to last?

Not long, argues a Commerzbank analyst who proposes a volatile but non-directional forecast for the Renminbi.

Chinese Jitters to Remain, Could Weigh on Australian Dollar Sentiment

According to Hao Zhou, an analyst at Commerzbank, the Chinese currency could fall as quickly as it has risen, with an equally volatile impact expected on the Australian Dollar.

"At this point, only one thing is clear: the CNY will remain choppy, and the hedging cost will rise as a result," says Zhou.

CNY may be rising now but it will remain under pressure longer-term because of a negative outlook for the Chinese economy, says Zhou.

"In the longer term, the renminbi outlook will be largely dependent on China's economic performance. Recent activity indicators suggest that China's growth has slowed significantly, suggesting a gloomier economic outlook. In order to prevent a further economic slowdown, the Chinese authorities have initiated a new round of monetary and fiscal easing," says the analyst.

Slower growth is likely to bias the Peoples Bank of China (Pboc) to adopting more accommodative monetary policy measures, which in turn would be negative for the currency.

Trump's entreaty to Xi seems genuine, and a deal of some sort, now a strong possibility. This should limit Renminbi downside in the short-term, says Zhou.

Another risk to the CNY in the medium-term, however, is the US Treasury department's demands for more transparency from the Chinese authorities in relation to their 'management of reserves' and interventions in the FX market, says Zhou.

The Chinese have been intervening quite a bit to strengthen their currency, most recently via a plan to issue central bank bills in Hong Kong. These interventions have been to prop up the Renminbi which is actually positive from a US-trade perspective.

The demand for greater oversight and scrutiny from the US Treasury, however, is likely to restrict intervention in the future, that this would weaken CNY, would, ironically, be negative from a US perspective.

What of the GBP/AUD?

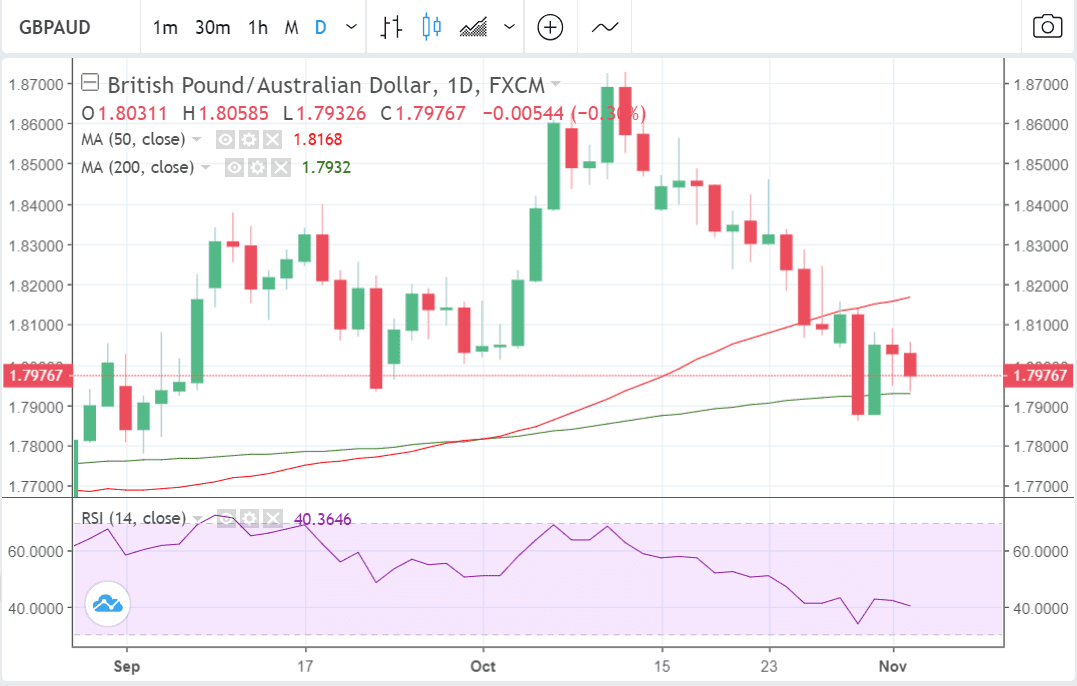

An analysis of the GBP/AUD chart further supports the view that the pair could trade in a volatile but non-directional ranged market.

The chart above shows the pair is currently trading between the 50 and 200-day moving averages (MA).

These are tough support and resistance levels which are likely to hem in price action.

Advertisement

Bank-beating GBP/AUD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the spreads charged by your bank when providing currency. Learn more here