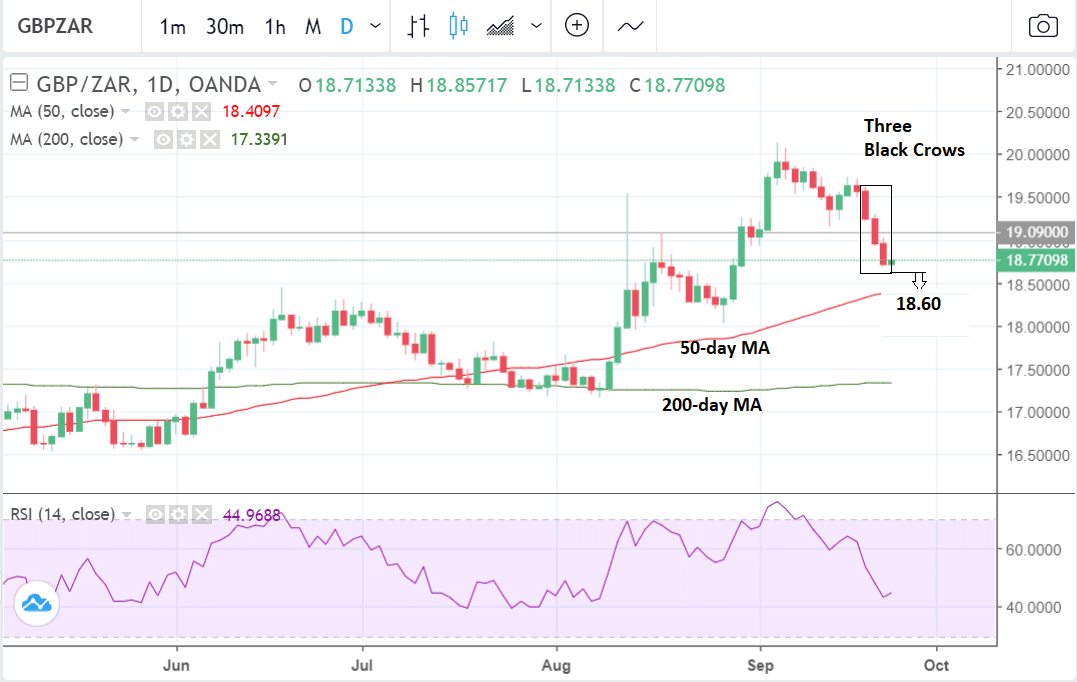

Pound vs. South African Rand Outlook: Three Black Crows Pattern Bodes ill

Image © Pound Sterling Live

- GBP/ZAR trend turns bearish short-term

- The pair will probably fall to a region of several major moving averages

- Rand performance to rest with developments in global sentiment

The Pound-to-Rand exchange rate trades at 18.66 at the start of the new week, a good half percent down on the previous week's close.

The improvement in the Rand's performance of late ensures GBP/ZAR fallen from the September 5 high of 20.1342, presenting a decline in purchasing power of 7.0%.

The fall has been driven by a combination of factors, including broad-based Sterling weakness over an impasse in Brexit negotiations.

The South African Rand strengthened from the announcement of a new economic stimulus package by the government as well as the probability of higher interest rates from the South African Reserve Bank (SARB) after they only narrowly voted not to raise interest rates at their meeting last week.

Furthermore, fading investor concerns over the U.S.-China trade spat over the previous week has helped the broader emerging market currency complex; and developments here remain key to the outlook.

From a technical perspective, the pair is now likely in a short-term down-trend now which is more likely to extend than not since traders tend to see trends are more likely to endure than reverse.

GBP/ZAR formed a 'three black crows' candlestick pattern at the end of last week which is a very bearish sign for the pair. Three black crows is composed of three long down-days in a row.

The RSI momentum indicator has fallen steeply and it is now at similar levels to where it was when the pair was at the 17.50 August lows, which is a bearish indicator.

The longer-term charts are showing that GBP/ZAR has broken below the October 2017 high at 19.0848, which is a bearish indication.

Downside is still curbed, however, by the location of the 200-week MA at 18.58, which is likely to prevent further declines, and we see the next target lying at 18.60, with a break below the 18.69 lows providing confirmation of more downside - albeit limited downside.

At the MA the pair is likely to encounter support and find further downside penetration more difficult. Short-term traders fading the dominant trend often buy at major MA's with the hope of riding a short-term bounce higher and this exacerbates the effect.

We think that a break below circa 18.00 would currently be required to confirm further downside.

The South African Rand: What to Watch

The GBP/ZAR pair is likely to be dominated by news on the U.K. side in the week ahead since data is quite thin from South Africa.

On the Rand's side of the equation, broader macro drivers linked to investor sentiment towards emerging markets and the broader strength of the U.S. Dollar will be key.

A stronger Dollar is negative for the S.A. currency since it pushes up the cost of servicing its relatively high proportion of US-Dollar denominated debts. The country's wide deficits must be financed from abroad which exposes the country to exchange rate risk.

Much will depend on developments in the China-U.S. trade war; we saw ZAR recover lost ground last week as investor senimtent towards the matter improved. There is certainly a sense that much of the negative news surrounding the issue has already been digested by markets.

However, with China this weekend reporting it would not attend U.S.-China talks to resolve the matter - a response to last week's news that the U.S. would be pursuing further tariffs - markets remain nervous. There is a sense that the issue might be a long-running affair that will cap global investor enthusiasm.

ZAR rose last week after the S.A. authorities successfully calmed markets by implementing a new fiscal stimulus programme to try to help the economy out of its recession.

The programme includes the creation of an infrastructure fund, increased spending on education, health, tourism, agriculture and municipal infrastructure as well as reforms to promote S.A. as a place for outsiders to do business and changes to the mining charter to give the sector a boost.

The SARB meanwhile came close to voting through a rate increase at their September meeting last week after three out of the seven officials in the monetary policy committee voted for a rise, although it was not quite enough to win the vote.

The fact the bank came close to increasing rates was enough to send ZAR higher.

Data in the week ahead includes consumer confidence in Q3 on Tuesday at 8.00 B.S.T; Producer Prices in August on Thursday at 10.30 and money supply and private sector credit on Friday at 7.00.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here