South African Rand Plummets +2.0% as Lira Crises Explodes

Image © Rawpixel.com, Adobe Images

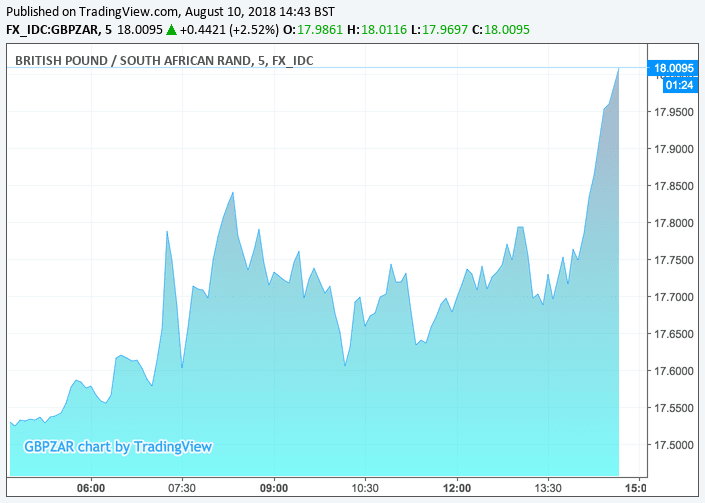

The Pound-to-Rand exchange rate has shot higher by over 2.0% to reach 18.00 ahead of the weekend while the Euro-Rand hit a high at 16.15 and the Dollar-Rand went as high as 14.14 - a new 2018 high.

The surge has taken markets by surprise as it represents one of the more aggressive moves in the FX market and looks to be a direct result of the unfolding crisis being suffered by the under-fire Turkish Lira.

The ZAR appears to have plummeted just as the Turkish Lira took another leg lower around about the time US markets opened for trade.

The Lira is some 17% lower against the Dollar and Pound today,

The Rand and Lira are often placed in the same emerging market currency bracket by investors and therefore risk sentiment impacting one can often spill over into the other.

"With EMEA a source of geopolitical risk, we think it will be difficult for the ZAR to also stabilise – in effect the Rand's source of market risk has shifted from a weaker CNY to a weaker TRY and RUB," says foreign exchange strategist Viraj Patel with ING Bank N.V.

For those looking to make GBP to ZAR payments, this is the best opportunity to do so since July 05; we are seeing retail rates as high as 17.87 with independent providers, while high-street banks are offering in the 17.30-17.40 region.

Whether or not further declines in the Rand occur now depend largely on the fate of the Lira.

"The TRY is in a full-blown currency crisis as the number of negative stories increases," says Morten Lund with Nordea Markets. "We think that Erdogan needs to act now if he does not want Turkey to develop into a mini-Venezuela (worst case scenario). Growth will take a significant hit no matter what, so the important thing now is to do some damage control and stabilise the Lira."

Unfortunately for the South African Rand, it appears that their own currency might now be in the hands of Turkish President Erdogan.

The Turkish Lira and Russian Ruble are struggling after both countries were recently hit by fresh US sanctions.

The added weakness in Turkish currency - that has seen it plunge a further 10% - comes as disappointment set in after talks between Turkish and US diplomats in Washington failed to result in a compromise that was likely to ease sanctions.

The Turkish delegation met with the State Department's No. 2 official, John Sullivan, on Wednesday to address friction between the NATO allies. There were no signs of a breakthrough after the hour-long talks.

There was widespread selling of Turkish financial assets and fears are growing the country might have to turn to the IMF for support or introduce capital controls - measures that prevent outflows - became a distinct possibility.

The Trump administration imposed financial sanctions against two ministers of President Recep Erdogan’s cabinet, a move that sent the Turkish lira plummeting.

Erdogan retaliated last weekend with sanctions of his own against the American counterparts of the sanctioned Turkish ministers.

"The near-term path for the TRY is more in the hands of Ankara. The Finance Ministry may provide some insights into its ‘New Economic Model’ later today – perhaps with reference to budget deficits to address fiscal imbalances," says Patel.

"We doubt Turkey is ready to limit its fiscal flexibility right now. And without measures to address its inflation problem, TRY will likely remain under pressure," adds Patel.

This could therefore well translate into the Euro staying under pressure.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here