South African Rand Rises as Foreign Inflows Return to Local Bonds, China Pledges $14.7bn Investment

Image © Comugnero Silvana, Adobe Stock

- Rand outperforming other EM currencies as investment flows return

- China pledges $14.7bn at BRICS summit

- Ramaphosa's mission to raise $100bn in 5-years

The Rand has rebounded into the midweek period after foreign investors took a renewed interest in the country's bond market as China pledged 14.8bn of investment into South Africa at a BRICS conference on Tuesday.

Fuelling further gains is an apparent return to domestic debt markets by foreign investors with data showing inflows into South Africa's bond market are turning following months of hefty outflows.

The Rand rose on the Pound in line with the growind demand for South African debt assets, sending the GBP/ZAR exchange rate down to 17.44 after the news, whilst USD/ZAR fell to 13.26. GBP/ZAR is trading at 17.3892 at the time of writing, and USD/ZAR at 13.2143.

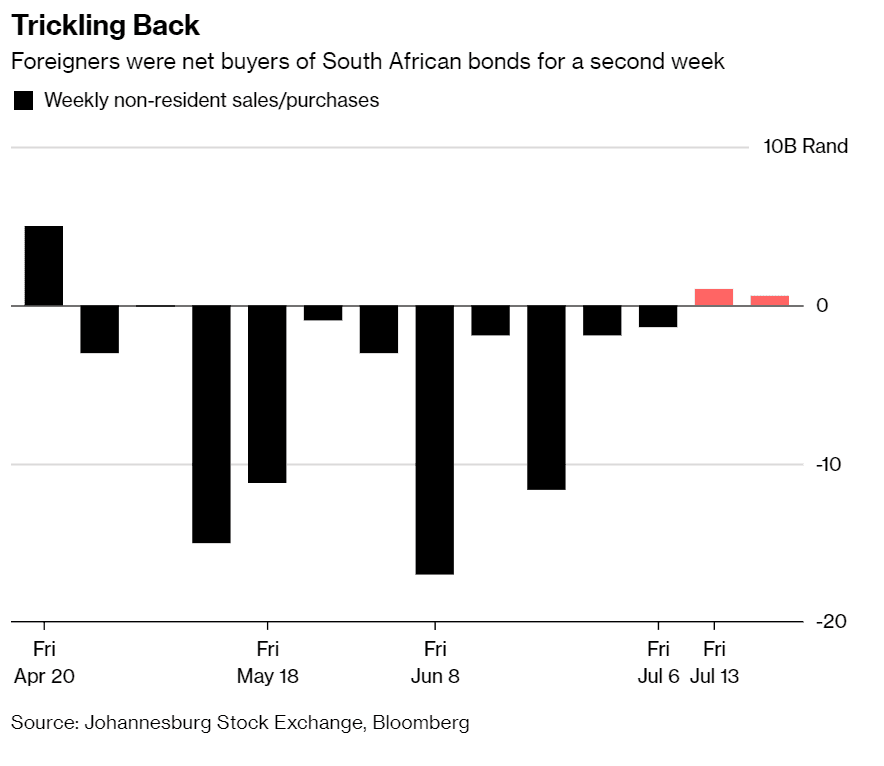

Foreign inflows have "trickled" back into SA bonds in recent days after a poor start to the year, which was characterised by investor flight says Colleen Goko, a reporter at Bloomberg News:

"The inflows have been small: about 1.6 billion rand ($119 million) since July 9, compared with almost 60 billion rand of outflows in the second quarter, according to Johannesburg Stock Exchange data. But the move marks a turnaround from 11 straight weeks of outflows sparked by a stronger dollar and rising U.S. Treasury rates."

The rebound came on the back of a general improvement in market sentiment for emerging markets (EM) and lower-than-expected inflation data out of South Africa, which saw CPI rise by 4.6% in June compared to the 4.8% forecast. The relatively benign inflation improves what investors call 'real yields' which is the return they can hope to get from bond interest payments above the rise in inflation.

"We still see real yields on SAGBs remaining attractive, stimulating foreign demand for SAGBs, especially as SA’s inflationary pressures are still benign," says Zaachirah Ismail, an analyst at Standard Bank.

South African bonds offer good returns compared to other similar emerging market debt; the only countries which offer as high returns are Turkey and Brazil, but both of these also carry higher risks as their credit ratings are below investment grade, whereas SA's rating remains one notch above, at Baa3.

This makes SA bonds more attractive in the eyes of investors they are more likely to get repaid.

"While the threat of more tariffs between two of the largest economies in the world still lingers, South Africa’s yields are high enough to compensate for the uncertainty in global markets," says Goko. SA bonds have earned a 3 percent return so far this quarter, "the best after Argentina, Brazil and Mexico among 19 emerging markets tracked by Bloomberg Barclays indexes."

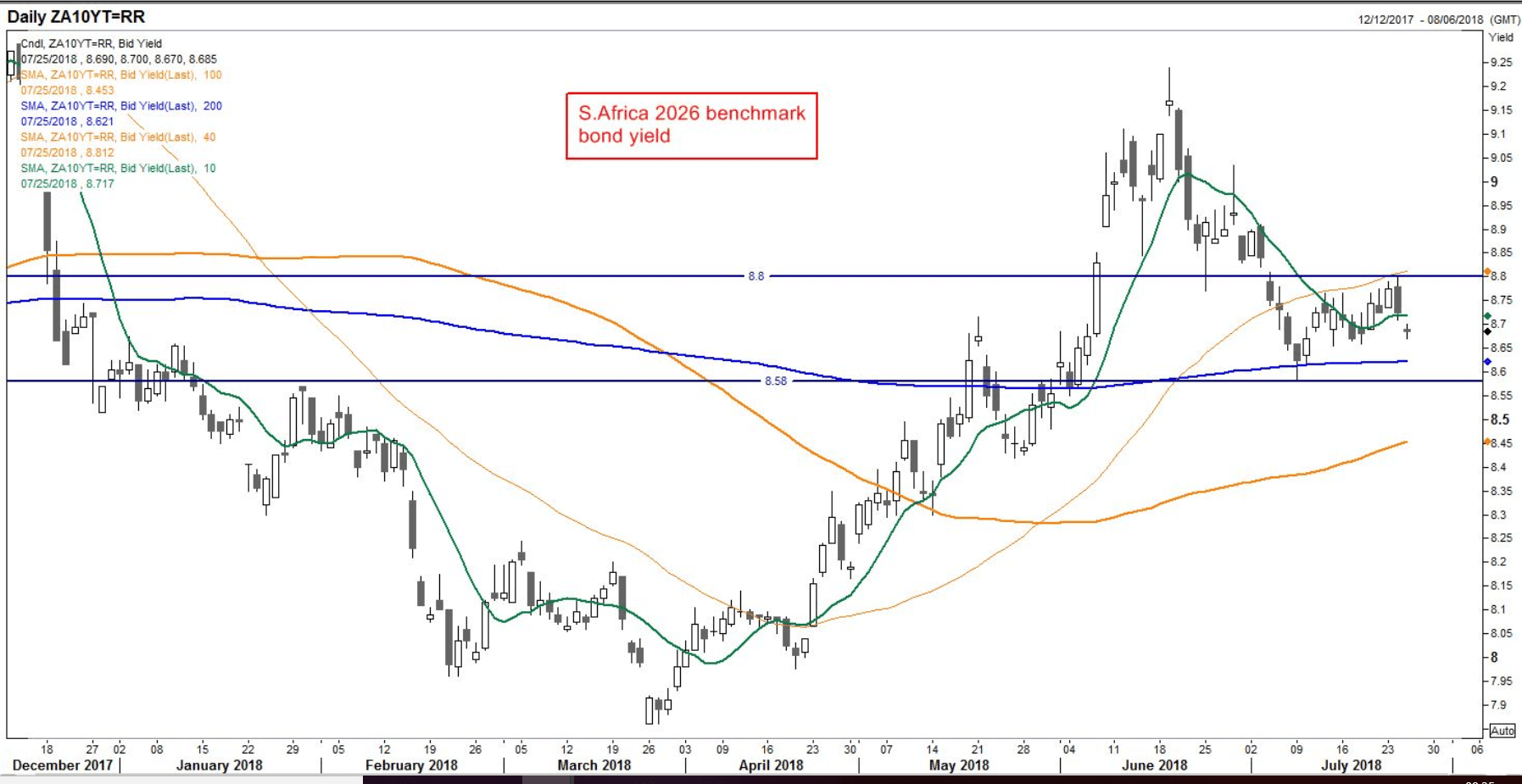

Those gains could accelerate in coming months, with Standard Bank forecasting the yield on benchmark 2026 bonds at 8.3% by year-end, from about 8.77%.

South African bonds rose on Wednesday morning as yields fell. Yield is the compensation bondholders receive for expected inflation erosion.

The "yield on the 2026 benchmark bond fell to 8.67% early Wed," says Peter Stoneham, a reporter at Thomson Reuters, who added that "chart watchers point to the 200DMA, 8.621%, and Jul 9 8.58% low as levels," to watch.

Image courtesy of Thomson Reuters

The 200 DMA (200-day moving average) normally presents a formidable obstacle on charts and prices, rates or yields often bounce, pivot or reverse after touching it. This suggests a possibility that the down-trending yield could halt, either temporarily or for longer, at 8.621%.

Over the medium-term, however, we are in agreement with Standard Bank, that the downtrend is likely to prevail and bring the yield down to circa 8.3%. Such a fall would represent a renewal of appetite in SA bonds which would probably be positive for the Rand given the relatively high foreign component of buyers.

A major driver of the rise in ZAR on Tuesday was China's promise to invest $14.7bn into SA.

"The rand firmed yesterday against a weaker dollar after news broke that China would invest $14.7bn in SA. SAGBs also traded firmer after these SA-China investment talks," says Standard Bank's Ismail.

China also pledged to give Eskom, South Africa's state owned utility company, a $2.5bn loan to help bail it out after it suffered full-year losses of around R2.3bn and also still has severe liquidity constraints.

"These positive developments locally allowed the Rand to shine, although the lira’s fall capped some of the Rand gains," says Ismail.

The China investment follows similar promises made by Saudi Arabia and UAE following a charm offensive launched by SA's new President Cyril Ramaphosa to reach a goal of attracting $100bn to SA in investment over the next 5-years.

Both Saudi Arabia and the Emirate's pledged $10bn each earlier on in July, and this is probably part of the reason why foreign investor sentiment has turned 180 degree's in relation to SA.

"The Rand is firming because our president is making it rain,” said Wichard Cilliers, a trader at Pretoria-based Treasuryone Ltd, quoted by Bloomberg.

“He has just secured another big investment, this time from China. That means new FDI inflows,” added Cilliers.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here