In Wake of Ratings Downgrade, Rand Vulnerable to Further Losses Against the Pound

Following recent rating agency action the Rand looks vulnerable to furher losses against the British Pound.

The South African Rand is trading steady versus the Pound following Friday's rating agency news which saw the world's largest credit rating agency - Moody's - maintain South Africa's (SA) rating one notch above junk status.

But, Standard & Poors downgrade its local currency credit rating into sub-investment territory.

After opening the day at about 18.47 to a Pound the Rand did weaken following the news to a low of 18.73 before recovering and closing the week back down near where it started at 18.52.

As I write, however, the Rand has bounced back with force and is actually strengthening against the Pound; the Pound-to-Rand exchange rate is down at 18.36.

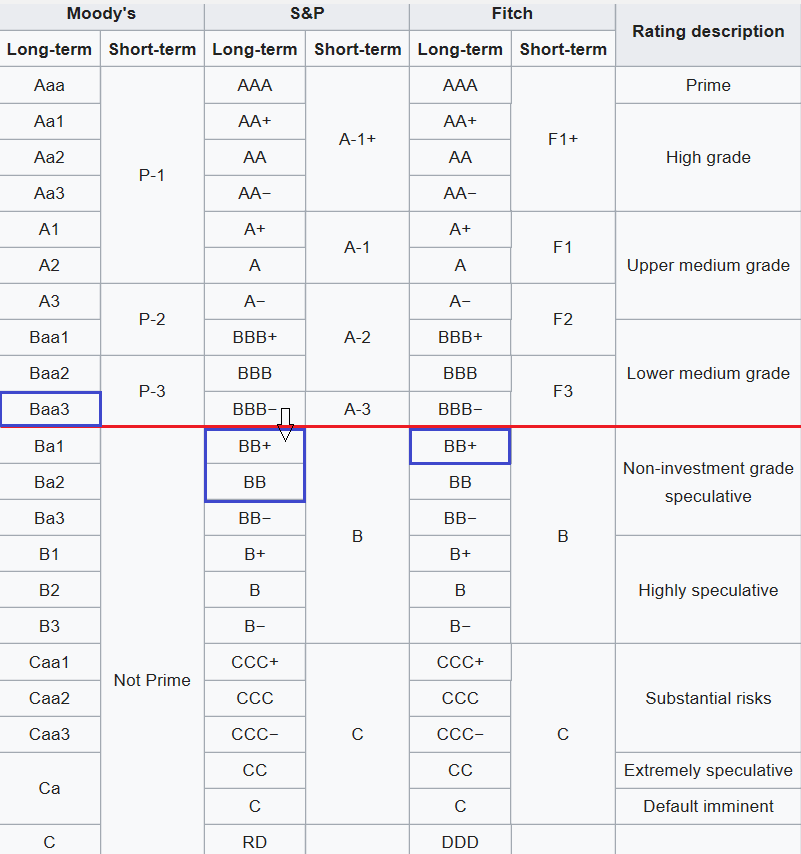

Whilst not actually downgrading South Africa's credit rating, Moody's placed the country's Baa3 rating (the lowest investment grade rating; see chart below) on review for a downgrade, which means it will investigate further and give the country a chance to balance its books before making a final decision after the February 2018 budget.

Rating agencies have become increasingly concerned about SA's ability to pay its debts due to an acid combination of falling growth, lower tax revenues, higher borrowing and increased public spending; political instability adds to the mix, with a key uncertainty on the horizon in the form of who will be the next leader of the ANC and President of South Africa.

"Moody's review will allow the rating agency to assess the South African authorities’ willingness and ability to respond to these rising pressures through growth-supportive fiscal adjustments that raise revenues and contain expenditures; structural economic reforms that ease domestic bottlenecks to growth; and improvements to SOE governance that contain contingent liabilities," says Moodys.

Although the review makes a downgrade probable next year, the fact Moody's maintained an investment grade rating for SA is still quite positive as it means major funds can still own South African government bonds - if they had been downgraded to junk that would no longer be the case.

This has major consequences for the Rand as foreign investors buying SA government bonds is a major source of demand for the currency.

It also means SA government bonds remain in the Citibank WGBI (World Global Bond Index), the standard international league table for sovereign bonds.

The downgrade from S&P, however, means SA bonds will now be excluded from the Barclays Global Bond Index, although Rand Merchant Bank (RMB) Analyst John Cairns does not see this as a major problem.

"The one-notch local-currency downgrade to sub-investment grade by S&P implies that SA bonds will fall out of the Barclays Global Bond Index, with estimated outflows of up to US$2bn. This is not hugely problematic for the rand market," says Cairns.

To clarify the three major rating's agencies positions, we have included a table below which shows SA's rating highlighted in blue.

As can be seen in the supplied graphic, the only rating which is not now sub-investment grade is Moodys.

Standard and Poors are the only agency currently making a distinction between local and foreign currency denominated bond ratings, with local currency now at BB+ after the downgrade.

RMB's Cairns expects the market to fully price in a further downgrade from Moodys, which will weigh on the Rand considerably.

"However, the market’s pricing of a full downgrade by Moody's, and so the exclusion from the WGBI, will grow and become a key constraint to any push stronger in the rand," says Cairns.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Leadership Elections

One thing which is likely to have a major influence on whether Moody's decides to downgrade SA debt next year is who the next leader of the ANC, and therefore President of SA is.

Of the three main candidates for the job the most supportive for the Rand would be the election of the 'reformist' Cyril Ramaphosa, neutral would be the compromise candidate Mkhize and weakest the election of Dlamini-Zuma, Jacob Zuma's ex-wife, who is expected to maintain the current status quo.

"The betting markets also believe a Ramaphosa lead: odds on Ramaphosa winning are currently at 48%, while Dlamini-Zuma is at 26% and Mkhize is at 13%," says Cairns.

It is possible that optimism over the success of Ramaphosa may have offset weakness from the downgrade.

The Rand is sensitive to the Dollar to which it is highly negatively correlated - which means it goes in the opposite direction to the Dollar - and the key event in the US is Federal Reserve chair Janet Yellen's address to Congress on Wednesday.

A major obstacle for the Dollar is the view gaining currency that inflation may stay lower longer, and investors will want to hear what Yellen's says about that.

Given it was her who raised the issue in a speech not long ago, she will probably reiterate her concerns which could weigh on the Dollar, particularly if there is no traction in the passage of tax reform, which is beginning to look like the Dollar's lifeline.

"Betting odds that a deal will be reached before year-end have surged to 29%," says Cairns.

Pound Remains in Technical Uptrend

From a technical perspective, the charts are showing that the Pound-to-Rand remains in a fairly strong short-term uptrend, which will probably extend.

A break above the highs would confirm a continuation up to our existing upside target at 19.50.

The one proviso to our constructive view is the rather negative-looking bearish topping pattern which may be what is called a head-and-shoulders, which could be in the process of forming at the highs.

But it is not clear enough yet to suggest a break lower is on the horizon, and we reserve judgment for now.

The 50-day moving average, situated at 18.28, also guards the way down and will make it difficult for any new bear trend to make downside progress.

Moving averages are dynamic areas of support and resistance on charts which can often act as obstacles to trending prices since they attract more supply or demand as they are targeted by traders, precisely because of these properties which offer unique touchpoints where profit potential is available.

Data and Events to Watch for the Pound in the Coming Week

Whether the Pound can ultimately break higher against the Euro will depend on progress over Brexit negotiations; it appears this issue will increasingly dominate sentiment on Sterling into year-end with a key EU summit on the matter in mid-December being a highlight.

It is at this summit that EU leaders will decide whether or not to greenlight or redlight the progression of negotiations onto the all-important issue of trade and the future relationship.

Businesses and Sterling will need this process to begin as soon as possible.

Much like the many-headed Hydra, a mythical creature that Hercules fought, which regrew two new heads for every one he cut off, so the Brexit negotiations keep growing new problems for Prime Minister Theresa May just as she has seemingly dealt with one.

Just after appearing to agree on a divorce bill that will help propel Brexit negotiations onto the issue of trade, a new problem has presented itself in the form of the border between Northern Ireland and the Republic of Ireland.

Irish Prime Minister Leo Varadka has threatened to veto any EU agreement to progress Brexit negotiations if he feels progress on the Irish border is inadequate; this is quite an interesting stance considering such a veto could push the EU and UK to a hard-Brexit and no European country has more to lose on a hard-Brexit than Ireland considering the UK is easily their largest trading partner.

A senior Irish diplomat in the EU has said it would really be better all round if the UK remained in the trade and customs union - or at least the customs union as then there would be no border issue.

He warned the UK people not to put too much faith in future free trade agreements as even the best of these, would "fall far short of being in the single market."

One solution would be to essentially keep Northern Ireland in the EU (exempting it from Brexit) so that the border could be left open, however, this idea has been met with firm resistance from the DUP, Theresa May's partners in government, and her only key to a parliamentary majority.

With no clear solution, the Irish border issue is now likely to further delay the onset of the next stage of Brexit talks, and Theresa May has only got until December 4 to come up with a solution.

Clearly, how the Ireland issue evolves in the coming week, will probable be a factor impacting on Sterling with any substantial break-down suggesting the Brexit process will be slowed down.

"The bigger hurdle to clear in order to reach “sufficient progress” is agreement on the Irish Border. The Irish Government’s position is that an “electronic border” is not viable. As a result, it won’t settle for anything less than a UK commitment to regulatory equivalence between Northern Ireland and the Republic in line with EU standards," says Andrew Wishart, UK Economist with Capital Economics.

Wishart notes the UK’s current intention is to leave the Single Market and the Customs Union and regulatory equivalence across the Irish border would require a customs border between Northern Ireland and the rest of the UK, which David Davis has ruled out.

But Mr. Barnier pointed out in a speech on Monday that contrary to arguments this would come at the cost of the integrity of the UK single market, many rules in Northern Ireland already differ from that in the rest of the UK.

From a hard-data perspective, the main release in the coming week will be Manufacturing PMI on Friday, December 1, at 9.00 GMT, which is forecast to show an uptick to 56.5 from 56.3 previously.

Investment bank TD Securities expect the result to be even higher as Eurozone growth spills-over into the UK:

"While strength in its euro-area counterparts is being driven by broad-based growth there, spillovers to UK businesses should nevertheless give the measure a lift, and November's CBI indicators seem to suggest continued healthy growth by firms," they said in a week ahead round robin.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.