The South African Rand: Light at the End of the Tunnel?

Morgan Stanley see a 'light at the end of the tunnel' for the South African currency in 2018.

The South Rand has weakened substantially following the recent budget statement which both forecast a wider budget deficit and lacked any policies to combat it; the moves have prompted analysts at global investment bank Morgan Stanley to lower their year-end forecasts for the currency.

"The 2017 Medium Term Budget Policy Statement (MTBPS) ended up being meaningfully more bearish than we had expected. It was not so much the 2017/18 projected deficit of 4.3% that troubled us (consensus -3.7%, MSe -4.0%), but rather the lack of any tangible plan to reduce the deficit over the forecast horizon," says Morgan Stanley Economist Andrea Masia.

The implications of the budget could very well weigh on the Rand in the months to come, and Morgan Stanley have raised their end of year forecast for USD/ZAR to 14.30 (current market level 14.05).

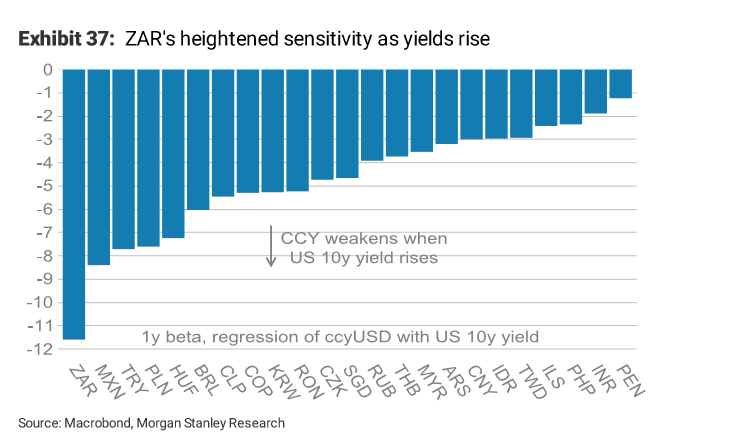

Another short-term negative factor is the Rand's sensitivity to US bond yields, to which it is highly inversely correlated, especially the 10-year yield.

Renewed expectations that the Trump administration may get tax reforms implemented could cause a surge in longer-dated bond yields such as the 10-year which will be very negative for ZAR.

However, longer-term, there is light at the end of the tunnel, according to Morgan Stanley's Strategist James Lord, and it is likely to come in the form of an alleviation of political risk.

The Rand will probably get a bump after the December ANC conference when the party will meet to elect a new leader and, ultimately, ordain the next President of the Republic.

Assuming Zuma's ex-wife Nkosazana Dlamini-Zuma - who is seen as representing a continuity of Zuma's rule - is not elected the outcome is likely to viewed as a positive fresh start for the country's economy and therefore for the Rand, since Zuma has always had a negative effect on the currency.

As such, Morgan Stanely's Lord cautions against getting overly bearish:

"We do not view this most recent development (the budget) as a reason for becoming more bearish and we caution against chasing the sell-off in ZAR given the longer-term prospect of political change with the ANC Conference in December," he said.

Yet recent reports that Dlamini-Zuma is garnering much grassroots support, especially amongst the ANC youth league, suggests she is no no-hoper and has a shot at winning.

Although Lord maintains a brighter outlook for the currency after the ANC conference in December, a win for the President's ex-wife could upturn Morgan Stanley's brighter 2018 outlook for ZAR.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.