Pound to South African Rand Rate Steadies as Data and Macro Risks Abound

- Written by: James Skinner

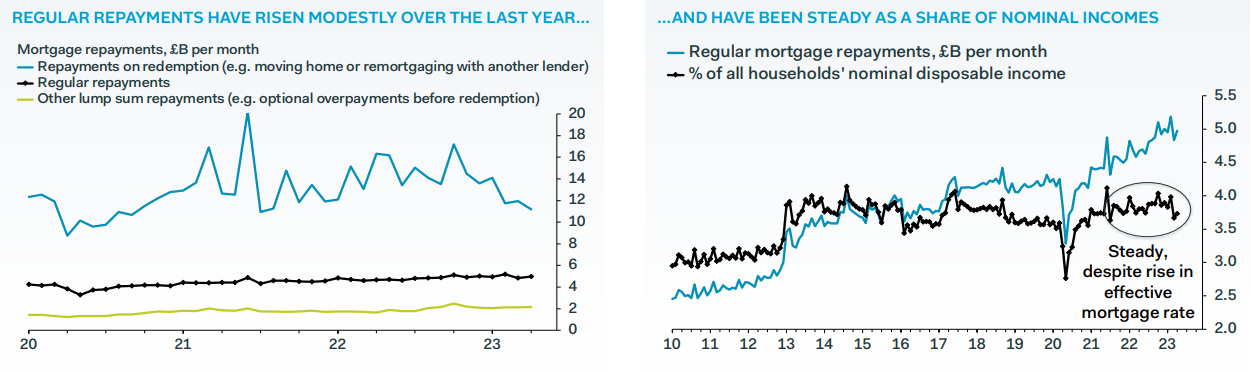

"Monthly regular repayments would have risen by £860M since December 2021, if households had simply rolled over their mortgages and accepted the higher repayments entailed by the rise in rates" - Pantheon Macroeconomics.

Image © Adobe Images

The Pound to Rand exchange rate steadied near some of its softest levels since the opening of May early in the new week but its path ahead is clouded by uncertainty about the outcome of inflation updates on both sides of the GBP/ZAR equation and the Bank of England (BoE) interest rate outlook.

South Africa's Rand outperformed all major or otherwise comparable currencies in the week to Tuesday and a global market rally that was said to have been encouraged by multiple macroeconomic drivers but local inflation figures and their implications for the South African Reserve Bank (SARB) are front and center this week.

"The recent bout of strength in the Rand can largely be attributed to a shift towards riskier assets following the resolution of the US Debt ceiling threat. Moreover, the decision by the US Federal Reserve to pause its hiking cycle during its latest meeting has added to the positive sentiment," writes Sebastian Steyne, an FX risk and hedging specialist at Sable International, in a Monday research briefing.

"This week, our focus will be the inflation print on Wednesday. Here we expect the inflation figures to improve, but it should be noted that the extremely undervalued ZAR of the past few weeks will start filtering into higher import prices. Overall, we look to see if the ZAR can hold onto the recent gains, or if it will give back a bit," he adds.

Above: Fibonacci retracements of January rally indicate possible areas of technical support for GBP/ZAR while selected moving averages denote prospective support and/or resistance for Sterling. Shown alongside EUR/ZAR and USD/ZAR pair.

Economist surveys suggest a consensus that looks for South African inflation to fall from 6.8% to 6.5% for the month of May on Wednesday in an outcome that would bring the South African Reserve Bank closer to the upper bound of its three-to-six percent target band and the finish line in its campaign to contain price pressures.

But last month's decline in the core inflation rate, which many take to be a better reflection of domestic inflation pressures due to its overlooking changes in prices of food, energy and some other items, is seen easing by less with the annual measure dipping from 5.3% to 5.2%.

"Food price inflation at the consumer level has proved sticky, despite a notable easing in global food prices," says Lara Hodes, an economist at Investec.

"Specifically, the weak rand has driven up prices of imported commodities, while domestic specific challenges, specifically load shedding have weighed heavily on costs. However, a deceleration in food inflation at the producer level was recorded in March and April," she adds in a Monday research briefing.

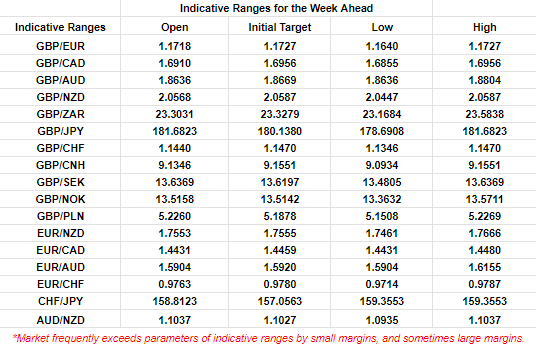

Above: Quantitative model estimates of ranges for this week. Source Pound Sterling Live.

Hodes and the Investec team say inflation should moderate as falling wholesale prices of food work their way into consumer prices and are looking for inflation to average 6% for the year overall, leaving it in line with the upper end of the SARB target range.

It remains to be seen whether this is also true of inflation in the UK this week but in any case, food and energy prices are less likely to be of concern to the Bank of England (BoE) than the recent increase in core inflation, which the consensus suggests will remain at 6.8% for the year to the end of May on Wednesday.

UK inflation fell from a peak of 11.1% in September 2022 to 8.7% in April 2023 but much of the decline, if not the entirety of it, has so far been driven by prices of wholesale energy and imported manufactured goods.

"We do think that CPI inflation will fall from 8.7% in April to the 2.0% target by the first half of 2024 and that core CPI inflation will decline from 6.8% to 2.0% by early 2025. But those falls will be slower than in the US and the euro-zone," says Paul Dales, chief UK economist at Capital Economics.

Above: GBP/ZAR shown at weekly intervals alongside EUR/ZAR and USD/ZAR. Click for closer inspection.

The still high rate of core inflation has been troublesome for the inflation-targeting Bank of England and grew more troublesome still in April when the core rate rose from 6.3% to 6.8% rather than continuing to fall as many economists had expected: This means inflation is now higher in the UK than in many other comparable economies.

Dales and colleagues attribute this to the lingering effects of the pandemic and so-called 'Brexit' but the latter is often cited for everything wrong or simply not right in the UK and in this context at least there is increasingly an alternative explanation.

"Monthly regular repayments would have risen by £860M since December 2021, if households had simply rolled over their mortgages and accepted the higher repayments entailed by the rise in rates," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

"The MLAR data also show that missed repayments have risen only marginally, with mortgages in arrears accounting for only 3.9% of total loan balances in Q1, up from 2.8% in Q4 2021," Tombs writes in a Tuesday research briefing.

Source: Pantheon Macroeconomics. Click for closer or more detailed inspection.

It transpires that increases in the Bank of England interest rate have been transmitted to the economy in a different way with mortgage borrowers and bank lenders having elected to extend the terms over which mortgage loans are taken in order to make increases in monthly repayments more affordable.

For many mortgage borrowers, it would appear as if these agreements have successfully minimised and in some cases entirely circumvented the increase in regular repayments stemming from the 440 basis point or 4.4% increase in the Bank of England Bank Rate announced since December 2021.

This would almost certainly be helping to sustain spending in the domestic economy and is potentially playing a role in keeping the core inflation rate elevated at too high levels.

It is one of many factors complicating this Thursday's interest rate decision, which economists and market-implied rates suggest will see the Bank Rate raised by a further 0.25% to 4.75%: How the actual decision compares with these expectations is likely to be one important influence on Sterling for a while to come.